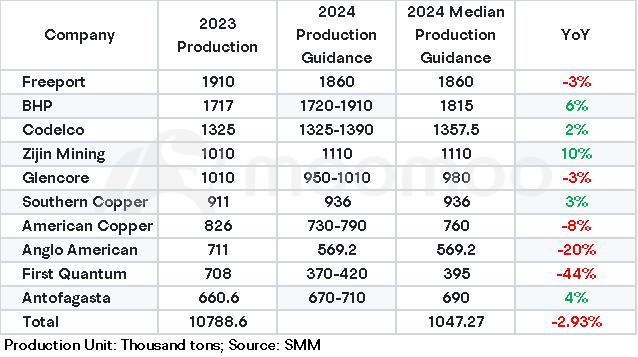

Currently, global copper mine production is concentrated in Chile, the Democratic Republic of the Congo, and Peru. According to data released by the USGS, these three countries account for production shares of 23%, 11%, and 12% in 2023, respectively. Following them are China and the United States, which contribute 8% and 5% of the global output, respectively.

WUDI CAI :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

WUDI CAI : No update?