The Gold-Silver Ratio Surpasses 80, Does This Signal an Investment Opportunity in Silver?

Gold prices have risen more than 15.6% this year. For investors who missed gold, silver is likely an alternative investment with the potential to catch up for the gains.

Although gold is considered a better safe-haven asset, silver offers several compelling reasons for consideration. The silver market is smaller and more volatile than gold, which means it has the potential for higher percentage gains.

Moreover, silver has a unique dual nature; it is both a precious metal and an industrial one. The industrial demand for silver can create a strong foundation for its value, independent of its status as an investment asset.

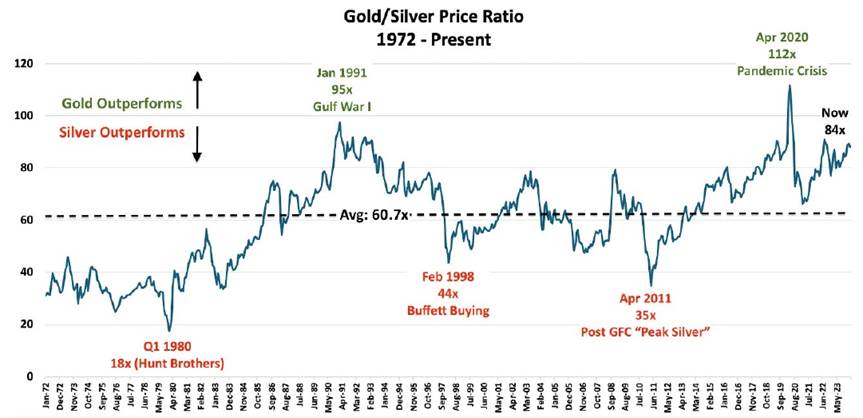

The gold-to-silver ratio, which measures how many ounces of silver it takes to buy one ounce of gold, is historically high, suggesting that silver is undervalued compared to gold. This ratio is often used by investors to determine the right time to swap gold holdings for silver or vice versa. When the gold-silver ratio exceeds 90, historical data shows that it is best to go long on silver and short on gold for Mean Reversion trading.

■ Photovoltaic demand may cause silver shortage

Silver is not only an investment asset, but also an important industrial metal, widely used in electronic products, solar panels, medical equipment, etc.

Silver's unique properties, including its exceptional electrical conductivity, thermal efficiency and optical reflectivity, play a vital role in enhancing the efficiency and performance of solar cells. Solar panels rely on silver for several critical components, including the front contact fingers, busbars and soldering of solar cells. These components ensure the electricity generated by the solar cells flows efficiently and maximizes energy conversion efficiencies.

Copper and aluminum are seen as alternatives to silver in the solar energy market, but they have shortcomings that reduce their viability.

“Silver has the lowest electrical resistance among all metals at standard temperatures, meaning its substitutes cannot match it in terms of energy output per panel; the savings made in substitution may therefore be offset by the increased number of panels needed to match capacity,” the Silver Institute indicates.

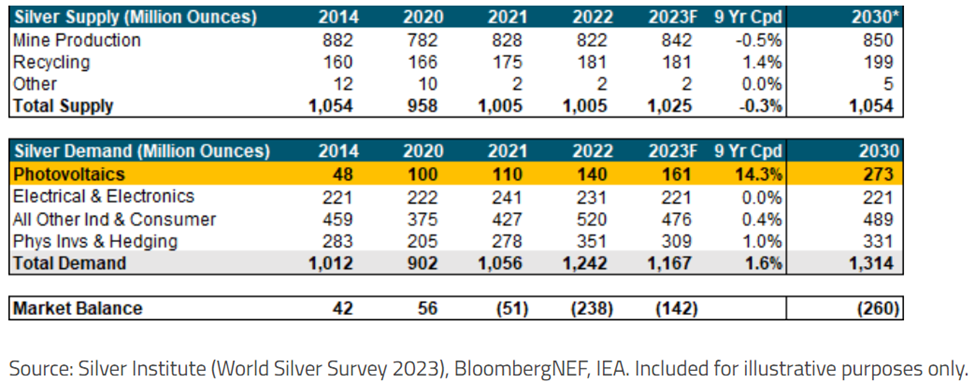

The solar industry's demand for silver is tied to advancements in solar panel technology. In the past, silver paste served as a conductive layer on the front and back of silicon solar cells. However, evolving cell designs now use larger amounts of silver. Solar silver demand as a percent of total silver demand is forecast to rise from 5% in 2014 to approximately 14% in 2023. Using BloombergNEF's estimate of 12 tons of silver demand per gigawatt of solar capacity, silver demand for solar panels could increase by almost 169% by 2030 to roughly 273 million ounces.

A paper from the University of New South Wales in Australia points out that by 2027, photovoltaic equipment manufacturers will consume more than 20% of the annual silver supply, and by 2050, photovoltaic panels will consume about 85-98% of the current global silver reserves.

■ Meanwhile, global production is declining

There is currently a shortage of silver, with silver inventories in New York and London exchanges declining significantly, even more significantly than gold inventories.

Randy Smallwood, president of precious metals mining company Wheaton Precious Metals, said that silver production has been declining globally: “We hit peak silver supply about five or six years ago, and silver production has actually been declining globally since then, and mines just can't produce as much silver.”

Data from the American Silver Institute shows that mine-produced silver supply was 843.2 million ounces in 2022, down from a peak of 900 million ounces in 2016.

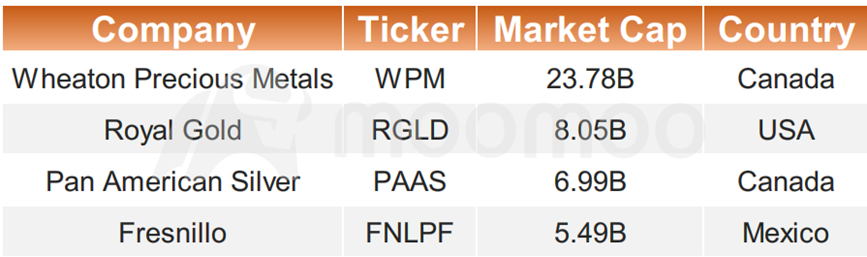

■ Which companies are the major silver producers?

Silver production is concentrated in a few countries around the world, mostly in Latin American countries like Peru, Chile, and Bolivia. Mexico has consistently been the world's largest silver producer, with significant production coming from the Fresnillo and Peñasquito mines, among others.

Meanwhile, in the US and Canada, $Hecla Mining (HL.US)$ 's Greens Creek Mine in Alaska is considered one of the largest and lowest-cost primary silver mines in the world.

$Pan American Silver (PAAS.US)$ / $Pan American Silver Corp (PAAS.CA)$ operates several mines in the Timmins region of Ontario, which produce silver along with gold.

$Wheaton Precious Metals Corp (WPM.CA)$ / $Wheaton Precious Metals (WPM.US)$' 777 Mine - located in Manitoba and operated by Hudbay Minerals, is a significant producer of copper, zinc, gold, and silver.

In addition to silver stocks, there are also ETFs like iShares Silver Trust that track the price of physical silver in the market.

■ Wall Street raises silver price target

Citi research analysts said in the latest research report that, driven by investment demand, silver prices may rise to around $32 per ounce in the second half of the year. Analysts pointed out that the rise in silver prices from mid-February to mid-April was not only due to short-covering activities, but also to new long positions established by investors. In addition, silver ETF inflows in March and April were the strongest since the first quarter of 2021, and silver derivatives traders tended to be bullish as the volatility of call options in the options market was relatively high compared to put options. Analysts also added that the demand for silver from passenger cars and electric vehicles seems to support silver prices structurally.

Growth in mine production is largely beholden to other metals projects for which silver is a by-product. The analyst from ANZ Banking Group said in a note "We estimate the silver market is entering a period of tightness unseen for decades."

"Once the peak of Fed tightening is confidently in place, silver should become attractive again," said Ed Moya, senior market analyst at brokerage OANDA.

Risk Disclosure: Silver volatility is greater; industrial demand may be less than expected.

Moomoo North America Team Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Seventhen : Litecoin

White_Shadow : start hoarding spoons![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

OneManBand : Silver Institute numbers are off and Silver Demand way higher than demand and China and India are driving large “exchange for physical” shipments !

Please watch to get the truth:

SILVER ALERT! "Historical" Data Changes in New 2024 Silver Survey are Off the Charts!! (Bix Weir)

White_Shadow OneManBand : that video is some dumptruck conspiracy theorist..