The Holiday Shopping Season Outlook Is Sluggish as Consumer Spending Faces Headwinds

The U.S. economy has displayed remarkable resilience throughout the first three quarters of 2023, driven by strong consumer spending which comprises about 70% of U.S. GDP.

However, as the holiday shopping season is near, there are concerns about whether consumers can maintain their robust spending levels.

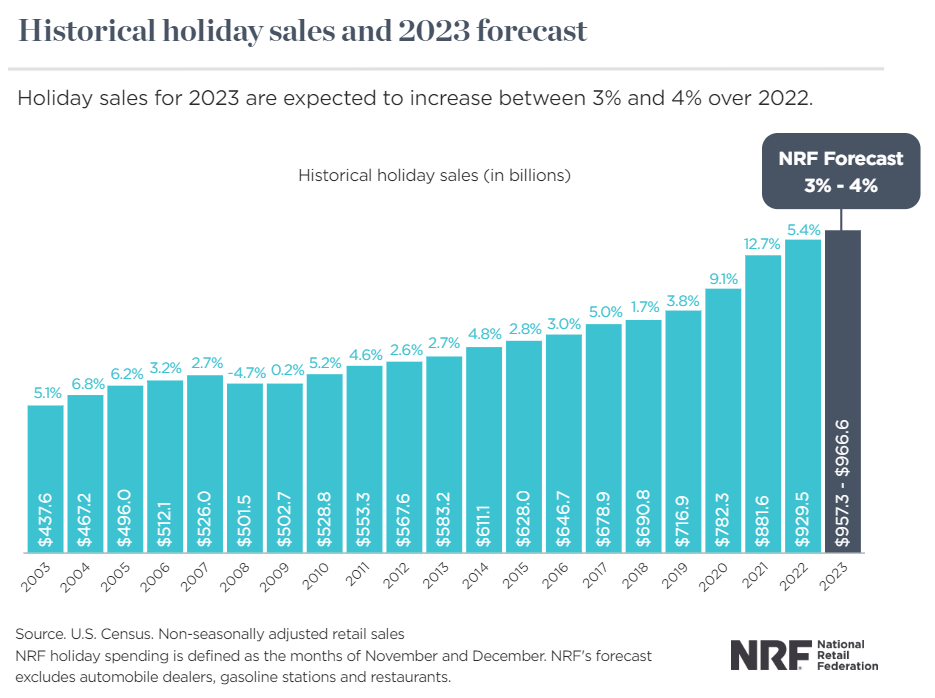

U.S. holiday sales in 2023 are expected to rise at the slowest pace in five years, data from the National Retail Federation (NRF) showed. NRF said holiday sales would rise between 3% and 4% during November and December. This compares with a 5.4% rise last year and a 12.7% jump in 2021.

Moreover, the declining savings rate, rising credit card balances, and tight bank lending standards indicate some potential slowing in consumption ahead.

1. Savings rates have declined

The chart below highlights that household saving rates have decreased to near post-pandemic lows, indicating that many consumers are spending more instead of saving. Though there is no indication of a significant reduction in consumer spending yet, a return to a pre-pandemic average savings rate of around 6% (versus the current 3.4%) could naturally lead to moderation in consumption.

2. Average credit card balances reach a 10-year high

As personal savings rates have decreased, credit card debt is mounting. Americans now owe $1.08 trillion on their credit cards, the Federal Reserve Bank of New York reported.

Balances jumped 15% from a year ago, according to a separate quarterly credit industry insights report from TransUnion, while the average balance per consumer hit $6,088, the highest in 10 years.

As household credit card balances have risen, delinquency rates on credit cards, and in areas like auto loans, have also ticked higher. Households may have to adjust spending plans in the months ahead to meet debt obligations, which could mean lower consumption overall.

3. Bank lending standards remain tight

Consumers are still confronted with elevated rates and stricter bank lending standards. The recent quarterly Senior Loan Officer's Survey conducted by the Fed revealed that banks are making borrowing difficult for both individuals and businesses. Such circumstances exert pressure on consumption as those consumers and small businesses unable to secure loans will not be able to pursue their intended purchases, repairs, projects, etc.

Although a potential decrease in consumer spending could potentially impede economic growth, there are some optimistic aspects to consider. For instance, inflation and the possibility of further Fed rate hikes might be restrained.

As consumption and the broader US economy decelerate, companies may adapt to a less dynamic demand environment, thus lowering prices. Furthermore, a balance between worker supply and demand could result in moderation in wage gains. These trends could lead to reduced inflation and a Fed that might not require any further rate increases this cycle.

Source: CNBC, Edward Jones, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

intuitive Jackal_354 : so it's obvious you know nothing about consumers