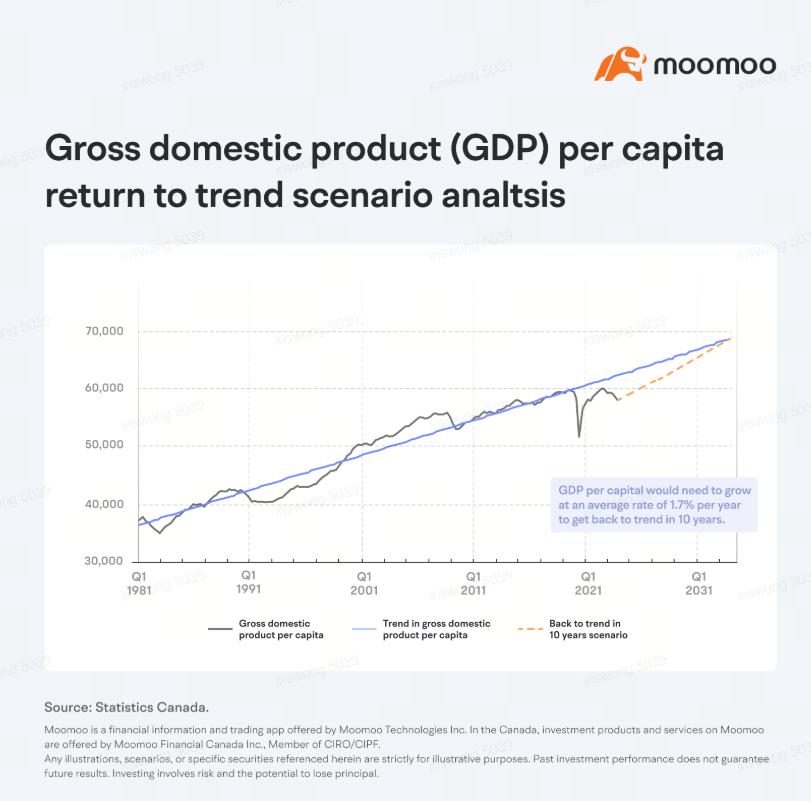

Canada's economy is losing momentum as high interest rates take their toll, with the national economy growing at an annualized rate of 2.5% in the first quarter, exhibiting a consistent monthly slowdown. Canada's real GDP per capita has deviated from its long-term trend. Since 1981, real GDP per capita has experienced an average annual growth rate of 1.1%. The shock of the COVID-19 pandemic, combined with recent quarters' declines in per capita output, has left real GDP per capita 7% below its long-term trend.

In the face of a declining economy, the Bank of Canada (BOC) is expected to lower interest rates to stimulate economic activity. Markets currently anticipate a 75% likelihood of the BOC initiating rate cuts in June, with a projected reduction of 25 basis points.

poem_view : If you consider inflation, you can't widen interest spreads.