The Market

Good morning everyone! I hope you all have had a great week so far in the market.

I apologize for the lack of posts, I am still incredibly busy day to day and have not had much time to make quality work. However, today is the day! FOMC is later on and Jerome Powell will speak at 2:30PM NYC and we need to take a moment to prepare for it.

Before we begin, I would like to mention I have sold most of my stock positions. There were a mixed bag of large profits and loses. I did so because I am more focused on trading futures at the moment and cannot be monitoring my stock positions at the same time as day trading. The positions I still have are long term stocks, no options.

As of right now, futures are green.

Maybe I should explain what futures are to those who follow me and constantly see me post "Futures" and not many posts on stocks or options anymore.

Long story short, farmers wanted an accurate way to effeciently price their crops, and thus futures were born. Futures are derivative financial contracts that obligate the buyer to purchase or seller to sell an underlying asset at the set price. They are used to day trade by most in order to avoid the PDT rule which the SEC requires $25,000 in your portfolio.

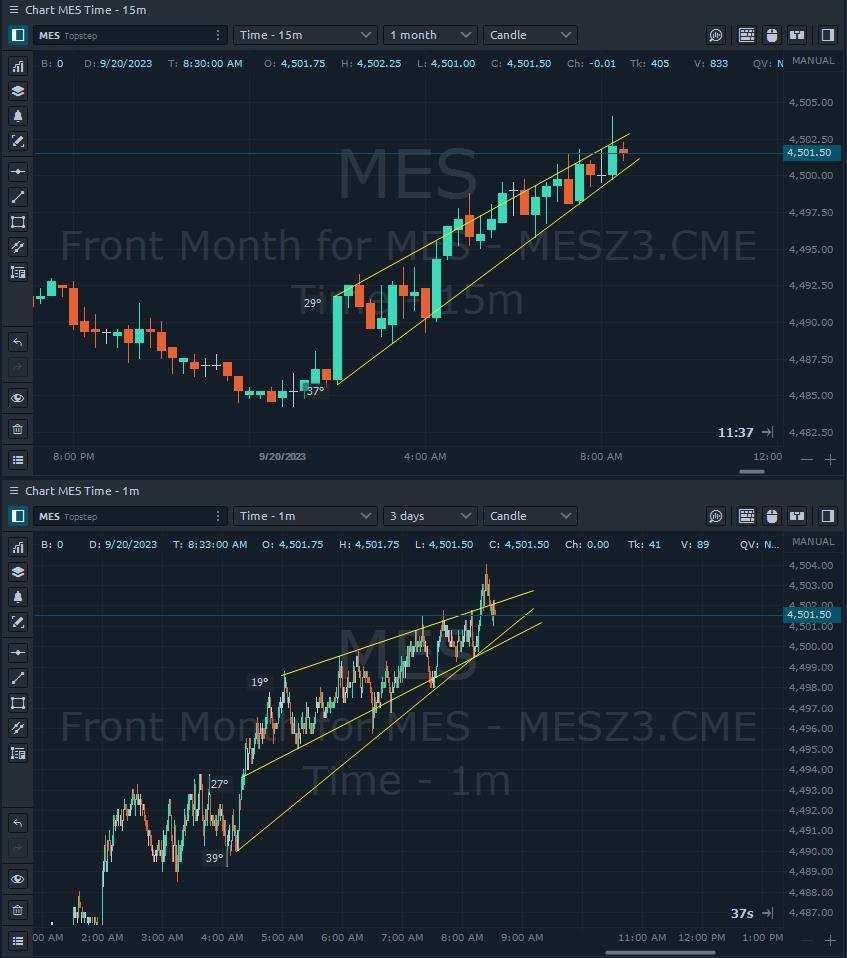

The futures I trade are the ES and MES which track the S&P (The difference is that ES contracts cost more per contract to trade and offers greater profits per tick, or losses. The MES is the Micro ES which is a smaller contract size that I trade if I am up in profits because it means I will lose more money than I would trading the ES. It also means I will make less money if correct with my trade). I also trade NG from time to time, which is the futures contract for Henry Hub Natrual Gas. I do not recommend trading NG unless you are experienced.

Alright, lets move on to FOMC!

Investors are expecting Jerome Powell to keep rates the same with minimal revisions to their policy of higher for longer among their views of inflation not going down any time soon and will make adjustments based on economic data.

Any change to the current rate hike, whether raises or lowers rates, will be seen as a suprise and we may see the market move considerably.

Probably not true: If Jerome wears a purple tie we might see the market initially dip, although I am peronally anticipating a first move dip.

Pay attention to: How long it takes Jerome Powell to reach the podium, any mention of "pausing", any revision of his plan to cut rates in the first half of 2024 (which he kind of mentioned they would wait until 2025 at a previous summit with other financial leaders from different countries), Jerome Powells physical appearance. Does he look stressed? Does he speak faster or slower than normal? Jerome Powell is expected to answer questions in a vague manner, so investors are looking for changes in any answer he provides. I am going to be listening for any questions about unemployment and the rising credit card debt / plans to cut or raise rates. I will absolutely be listening to any remark about a recession. If Jerome DOES raise rates, we might see instability in the financial / banking sector. I also am going to be listening to any remark about consumer spending despite the feds efforts to stop spending. Specifically entertainment spending.

The FED wants people to stop spending, but as we can see that is not the case. Credit card debt is rising at an alarming rate, people are buying movie tickets, concert tickets (taylor swift is literally carrying the economy) and what impact other entertainment spending might have such as (US) Football tickets, Hockey and others.

News:

The month of August in the US was the hottest ever recorded stretching back 174 years

The US housing market falls to lowest level since 2020

Single-family housing starts drop 4.3% in August, Single-Family building permits increase 2%, where overall housing starts plunge 11.3%, permits up 6.9%

Nvidia CEO keeps selling shares

Nick Timiraos says, "that today is likely the first FOMC meeting of the current hiking cycle where the Fed neither raises rates nor revises up its forecast for the peak rate" and mentions to watch for how many officials pensil in a Q4 hike / if they see fewer cuts in 2024

Investors think that if the FED does raise rates it could be bullish for the bonds

Putin is set to visit China in October

Elon Musks SpaceX is suing the US Government

Average monthly paument on a $400,000 mortgage in the US 2 years ago was $1,600 now at $2,700

India x Canada tensions are rising

The US government debt reaches $33 trillion

Citigroup has launched a digital token and private blockchain system

Harvard researchers estimate that an annual income of $117,100 is now needed to afford a median-priced house in the US

Germany enters a recession

Crude Oil prices rise to $94, the highest in ten months

CNBC says that the stock market has entered its worst 10-day stretch of the year historically

Rate hike decision is at 2PM NYC and Jerome Powell speaks at 2:30PM NYC

Good luck trading today! I hope your portfolios are in the money with thick cheese ready to hit your bank accounts

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $Carnival (CCL.US)$ $Alphabet-C (GOOG.US)$ $NVIDIA (NVDA.US)$ $E-mini S&P 500 Futures(SEP4) (ESmain.US)$ $E-mini NASDAQ 100 Futures(SEP4) (NQmain.US)$ $Henry Hub Natural Gas Futures(SEP4) (NGmain.US)$ $Genius Group (GNS.US)$ $Bluejay Diagnostics (BJDX.US)$ $Histogen (HSTO.US)$ $S&P 500 Index (.SPX.US)$ $Micro E-mini S&P 500 Index Futures(SEP4) (MESmain.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Bitcoin (BTC.CC)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment