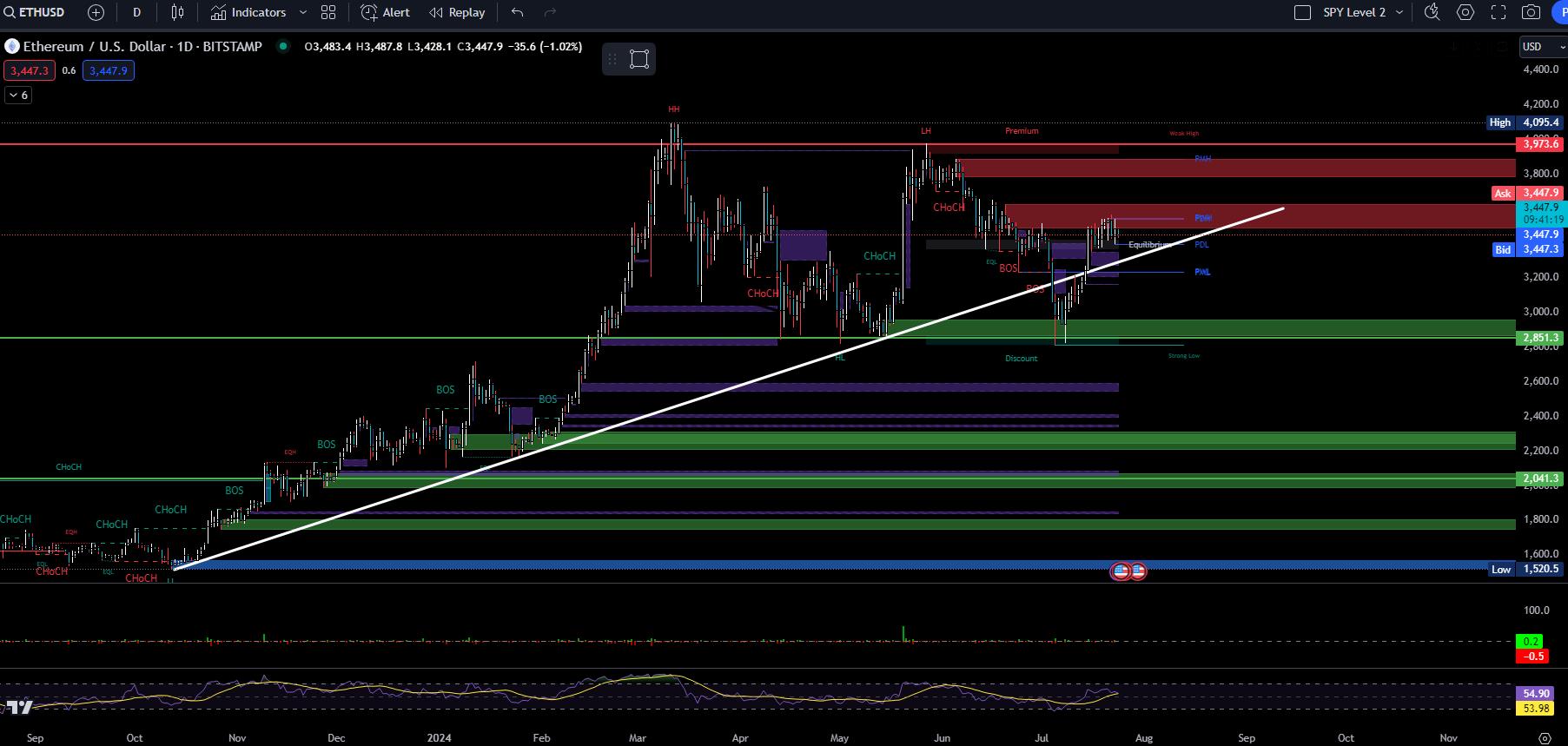

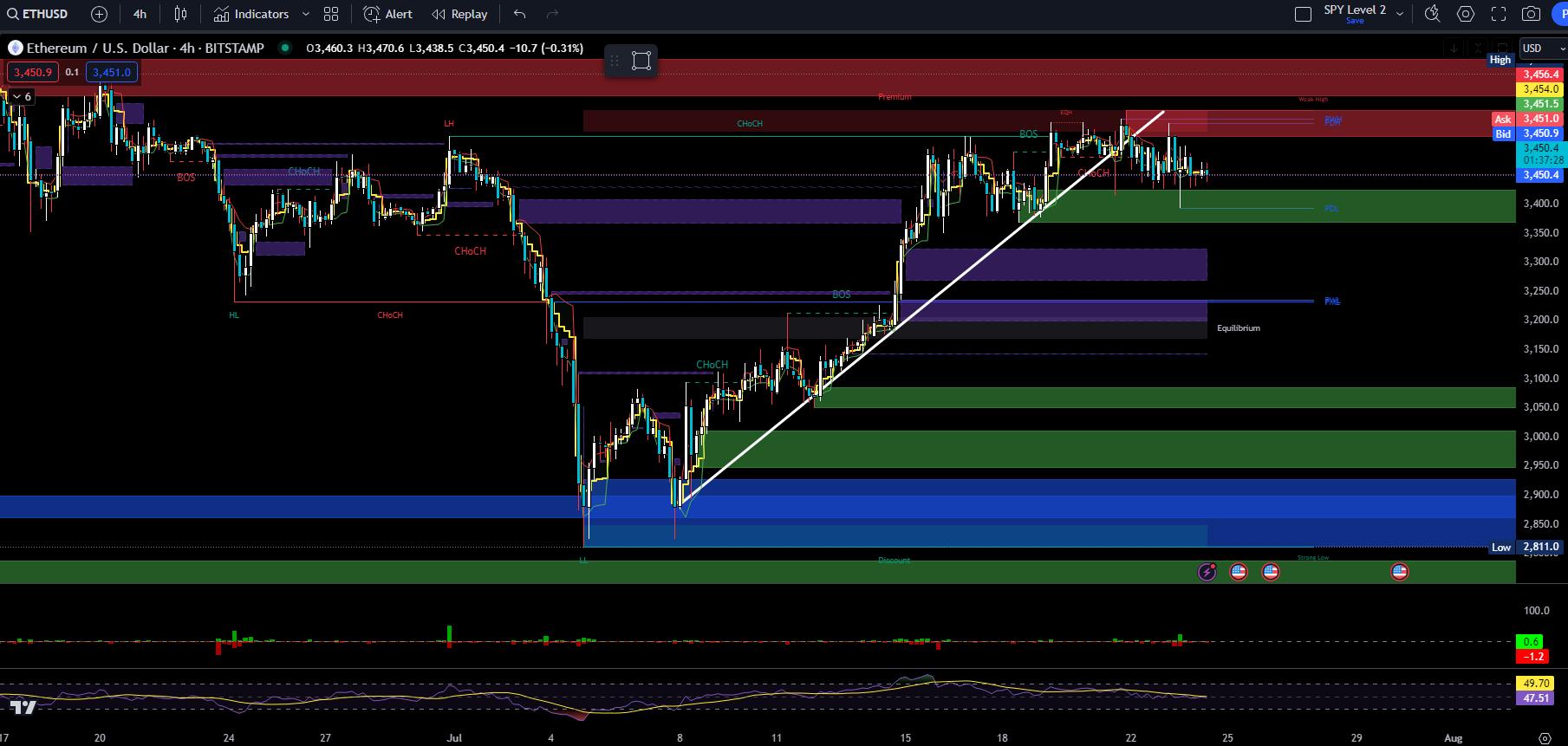

There is a ton of liquidity everywhere on the 4 hour as the price travels lower to the closest area at the $3,369.80 - $3,424.90 range. Other than that, there are no notable structures or price action here at the level. There was a previous imbalance move to the downside, met with buyers back to the upside. However, a larger move has yet to be realized.

Drew Manns : How long have you been investing ?