The Mediterranean-Style Catering Company CAVA Has Soared 180% This Year. What's Next?

$CAVA Group (CAVA.US)$ , a Mediterranean catering brand that has rarely attracted market attention, is making a fortune in the consumer field. In the past 20 days, CAVA has soared by more than 50%, and its stock price has repeatedly hit record highs. During the year, it surpassed Nvidia's 155% with a growth rate of more than 190%. Some analysts compare it to Chipotle Mexican Grill.

Its strong performance last Friday was mainly due to robust Q2 results. However, the company faced a sell-off by shareholders, which was disclosed in after-hours trading on Monday.

■ Q2 performance exceeded expectations

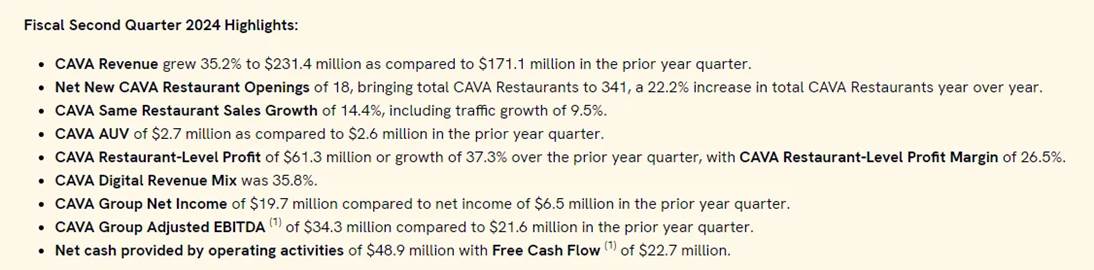

The strong performance of CAVA's stock price is inseparable from its strong earnings. After the US stock market closed on August 22, CAVA announced its latest quarterly results for fiscal year 2024.

The company's Q2 revenue increased by 35% year-on-year to US$231.4 million, exceeding market expectations of US$220 million. Net profit was US$19.7 million, a year-on-year increase of 203%; Adjusted EPS was 17 cents, beating market expectations of 13 cents.

Notably, Cava Group has beaten expectations in each of its five quarterly reports since going public.

CAVA has been leveraging its growing brand recognition, effective social and digital marketing strategies. The company has also managed to stay positive for free cash flow for two consecutive quarters. According to Citi, the factors driving CAVA's performance include a loyalty program relaunch set for October, which is anticipated to be another discrete driver for the business.

CAVA explained that revenue growth was mainly driven by the opening of 78 new restaurants in Q2 of fiscal 2023. In addition, CAVA's same-store sales increased by 14.4% year-on-year in the second quarter, exceeding market expectations of 7.45%. The same-store sales were driven by increased customer traffic (contributing 9.5%), higher menu prices, new stores and the newly launched grilled steak category (contributing 4.9%) in early June this year.

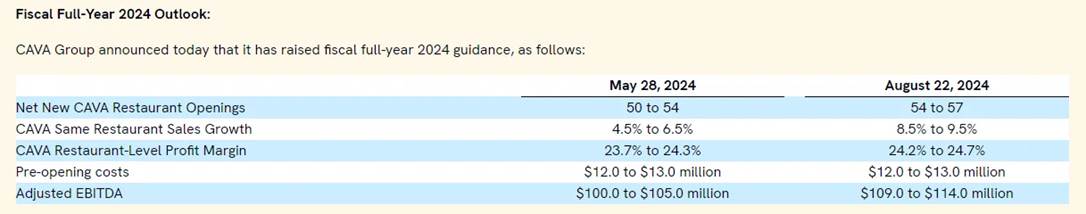

For fiscal 2024, CAVA expects same-store sales to grow by 8.5% to 9.5%, up from its previous forecast of 4.5% to 6.5%. The company also expects to open 54 to 57 new stores this year, up from its previous forecast of 50 to 54 stores.

■ Many major Wall Street banks are calling CAVA long

CAVA Group's robust performance led TD Cowen to increase the stock price target on CAVA Group's shares to $115 from the previous $95, maintaining a Buy rating for the stock.

JPMorgan Chase raised CAVA's target price from $77 to $90, with analysts pointing out that CAVA's success in multiple regions bodes well for achieving national scale.

Wedbush analyst Nick Setyan continues to be optimistic about the new steak products' boost to the company's prospects, predicting that "the company will still have room for growth within two years."

■ Will CAVA become the second Chipotle Mexican Grill?

Cava has become very popular in the United States in recent years, offering self-service ordering and customizable ingredient options. Its grilled steak menu, which was developed over two years, has been widely welcomed by customers.

CAVA is increasingly being referred to as "the next Chipotle Mexican Grill (CMG.US)," with its popularity growing by the day, making it one of the fastest-developing restaurants in the United States. Although there are some key differences between the two restaurants (i.e., Chipotle focuses on Mexican flavors, while CAVA leans towards Mediterranean flavors), the numerous similarities in their format and business models make them easy to compare.

Jefferies believes that CAVA may approach the size of Mexican Grill’s more than 7,000 stores in North America in the future.

CAVA's CEO, Brett Schulman, believes that Mediterranean cuisine is "the next major cultural food category," on par with Mexican, Asian, and Italian cuisines. Younger customers prefer bold flavors and lighter dishes.

■ The company faced a massive sell-off by shareholders

Following positive news, a massive sell-off by shareholders of CAVA disclosed after Monday's close provided an opportunity for short sellers. According to the latest SEC filings, CAVA CEO Brett Schulman sold 210,504 shares, cashing out $24.87 million. CAVA co-founder and Chief Concept Officer Ted Xenohristos sold 98,490 shares, cashing out $12.39 million. Chief Financial Officer Patricia Tolivar sold 5,000 shares, cashing out $628,175.

Following the disclosure of the sell-off, CAVA's stock fell over 8% in mid-market trading today.

The Citi analyst pointed out the challenge in identifying weaknesses in CAVA's fundamental narrative, noting that the current valuation adequately captures the company's strong fundamentals. This situation offers minimal room for mistakes as the company moves forward into what could be a more turbulent market in the near future.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Bullish Law : good

54088 FROM MBS : wow