The Risk-Free Options Strategy You Need to Know About!

Strategy: Mergers & Acquisitions (M&A) Arbitrage with Options

Trade Direction: Short Acquiring Company & Long Target Company

Mergers and acquisitions (M&A) are pretty common among publicly traded companies. What you might not know is that these M&A events can create a unique, almost risk-free opportunity for options traders.

Here's how you can take advantage of the price discrepancy between the acquiring company and the target company during the M&A process.

Key Concept: When a company announces it's being acquired, there's often a price gap between the acquiring company (the acquirer) and the target company (the target).

Initially, the acquirer's stock price is usually higher than the target's. This price gap will often narrow as the merger process moves forward and ultimately closes. As an options trader, you can exploit this gap for a profit. Let me walk you through how this works with an example.

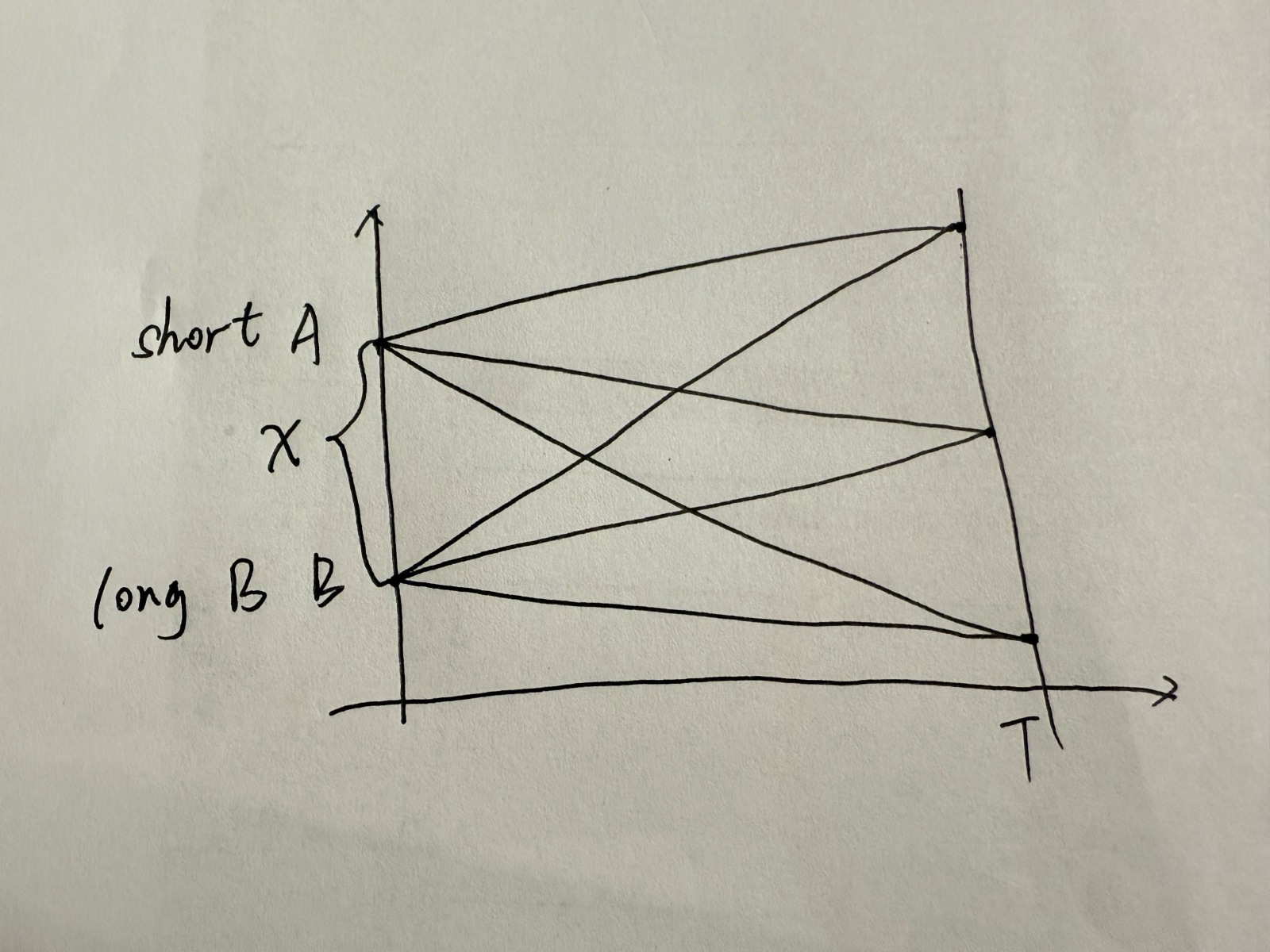

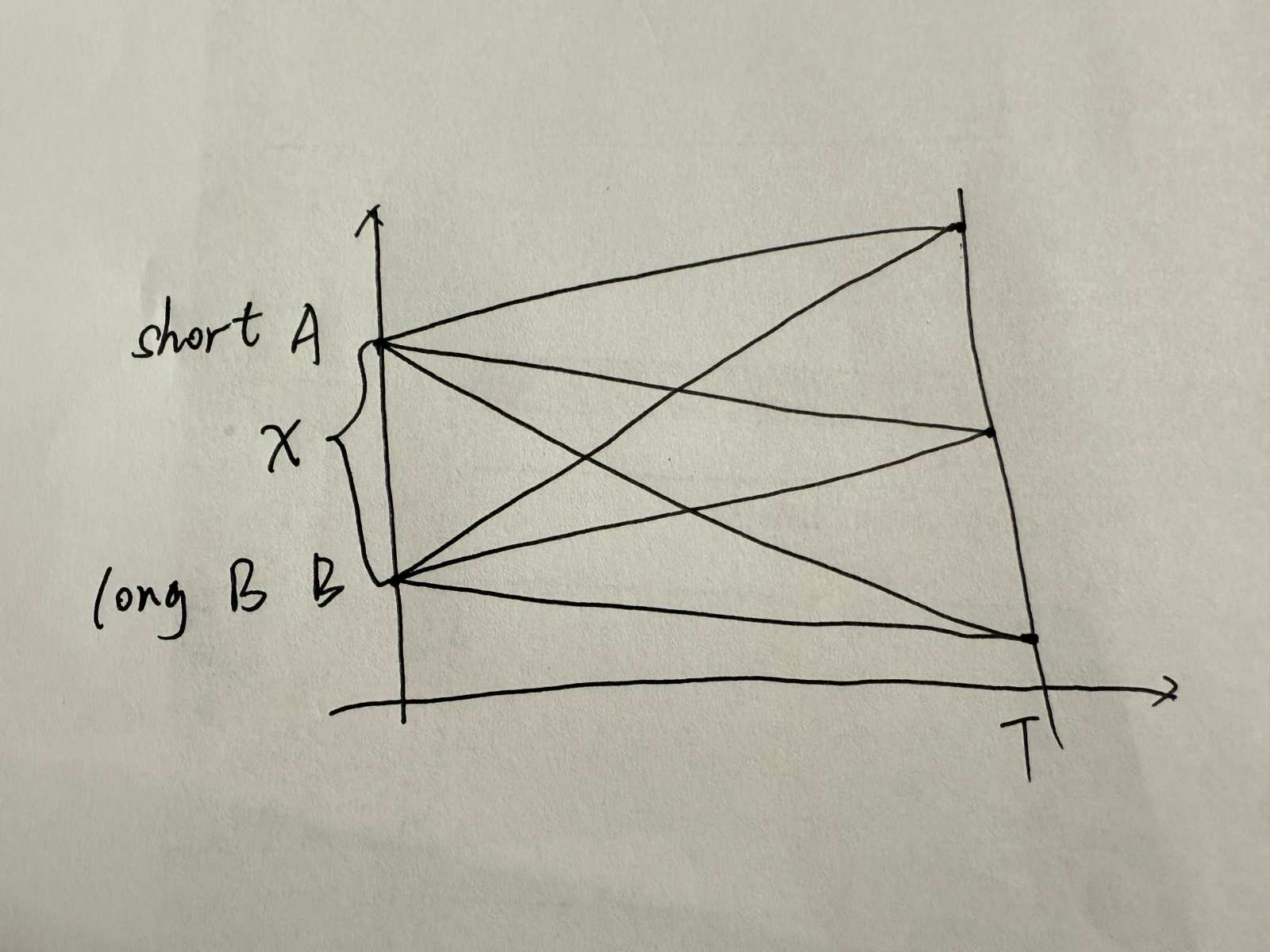

Example: Let's assume Company A is the acquirer, and Company B is the target. At the start of the deal (time zero), A's stock price is above B's stock price. In this case, we can take advantage of this gap by shorting A and going long on B (meaning buying call options on B).

Here's the beauty of it: Regardless of where the prices end up at the merger's completion (T), you'll make money. Whether Company A ends up above or below Company B at the closing, your profit will be the initial price difference between A and B, which I'll refer to as "X."

Option Play: You could also approach this trade by buying a put option on A and a call option on B. Here's how it could play out at the merger's close (T):

If Company A ends up above Company B at the end of the merger, your put option on A won't be exercised, but your call option on B will make a profit, equal to the price difference (X1). The only loss here is the cost of the option premium. Alternatively, if Company B ends up above Company A at the merger's close, your call option on B won't be exercised, but your put option on A will make a profit (X2). Again, your only loss is the premium paid for the options. In both cases, you're making a profit based on the difference in the initial prices of A and B—so you’re not just betting on the merger to close, but you’re also leveraging that price gap.

If the stock prices end up somewhere between A and B at the close, you'll likely end up executing both options, maximizing your gain.

Risks: The only real risk here is if the merger deal is abandoned or fails to go through, which would nullify the price movements and leave you with losses tied to the option premiums.

In short, this is a solid options strategy around M&A, where you can earn a guaranteed profit from the initial price gap between the acquirer and the target company—assuming the merger goes through.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

103916021 : k

All Also Taken : People can be strange though, seen options being assigned at prices way OTM, no idea why. For this to be risk-free both options have to be covered.