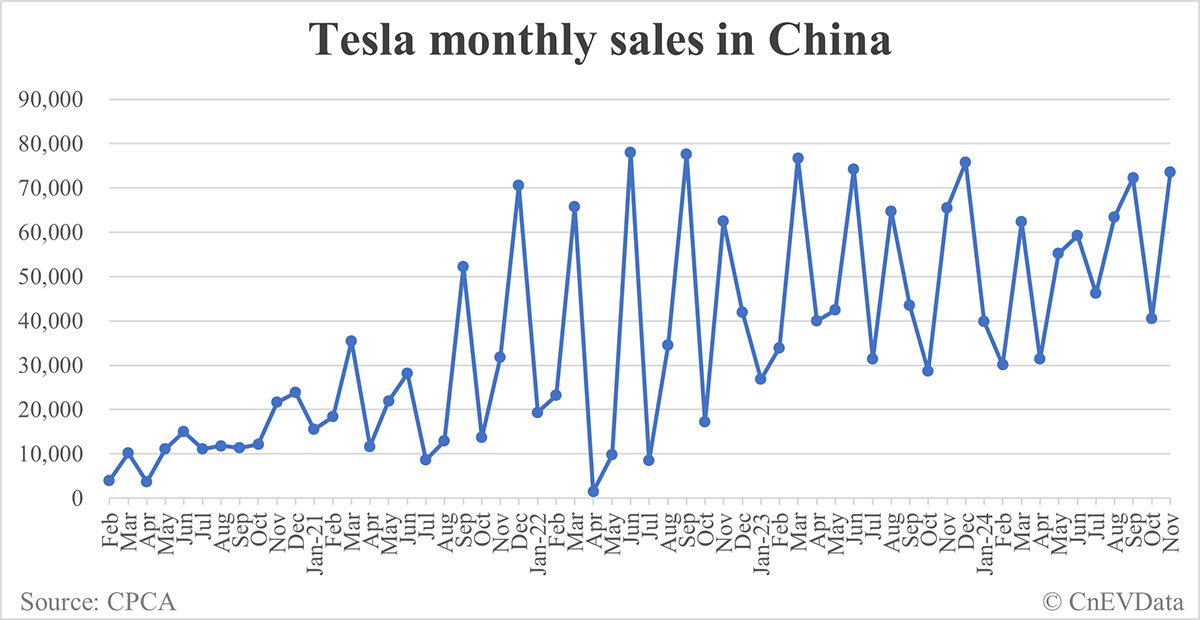

Anticipating an improvement in performance, the stock price has also shown a commendable performance. Tesla's management predicts a delivery growth of 20-30% for the year 2025, with China emerging as a significant market for the electric vehicle company, contributing to a substantial portion of the company's growth. In the third quarter, Tesla produced 469,796 electric vehicles, primarily Model 3/Y, and delivered 462,890 to customers, resulting in a year-over-year increase of 6.4% in total deliveries.

Jamesjinlin : Everyone flatters but can't fool the truth. The profit-making ability of high-tech companies grows by 50% every quarter, something Tesla simply cannot achieve. The so-called self-driving rental cars, even if they can be implemented, no one would ride in them. Unless someone is crazy enough to want to commit suicide. Not to mention profitability. Even with Self-Driving Cars, they are still taxis. There's not much money to be made. Just listening to Musk talk nonsense, he is just a lunatic.