The quality and development potential of the 9 companies owned by Elon Musk: changing tracks and elevated roads.

The quality and development potential of the 9 companies owned by Elon Musk.

Elon Musk is an angel sent by God, a genius academician of the American Academy of Engineering, and also a physicist and software architect. He owns a total of 9 companies, each of which is a subversion of human conventional cognition and will undoubtedly leave an indelible contribution in the history of human development and progress. His aspirations are lofty, far beyond the measurement of mediocre, petty, and despicable people. Currently, only Tesla is publicly traded. If Musk wishes, he can easily surpass any world-class super-rich person by listing any one of his companies, even surpassing the combined wealth of the top ten world-class super-rich people.

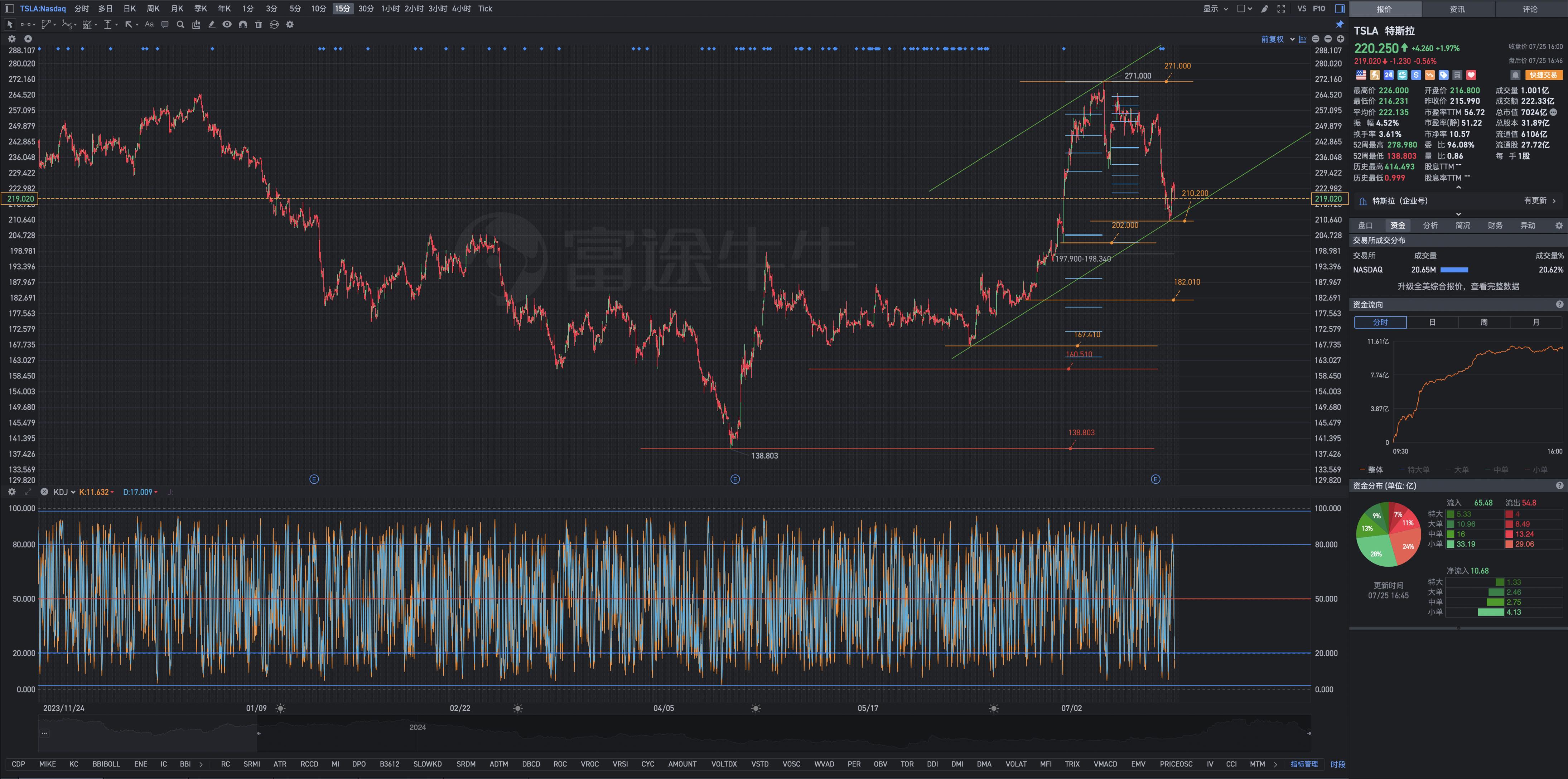

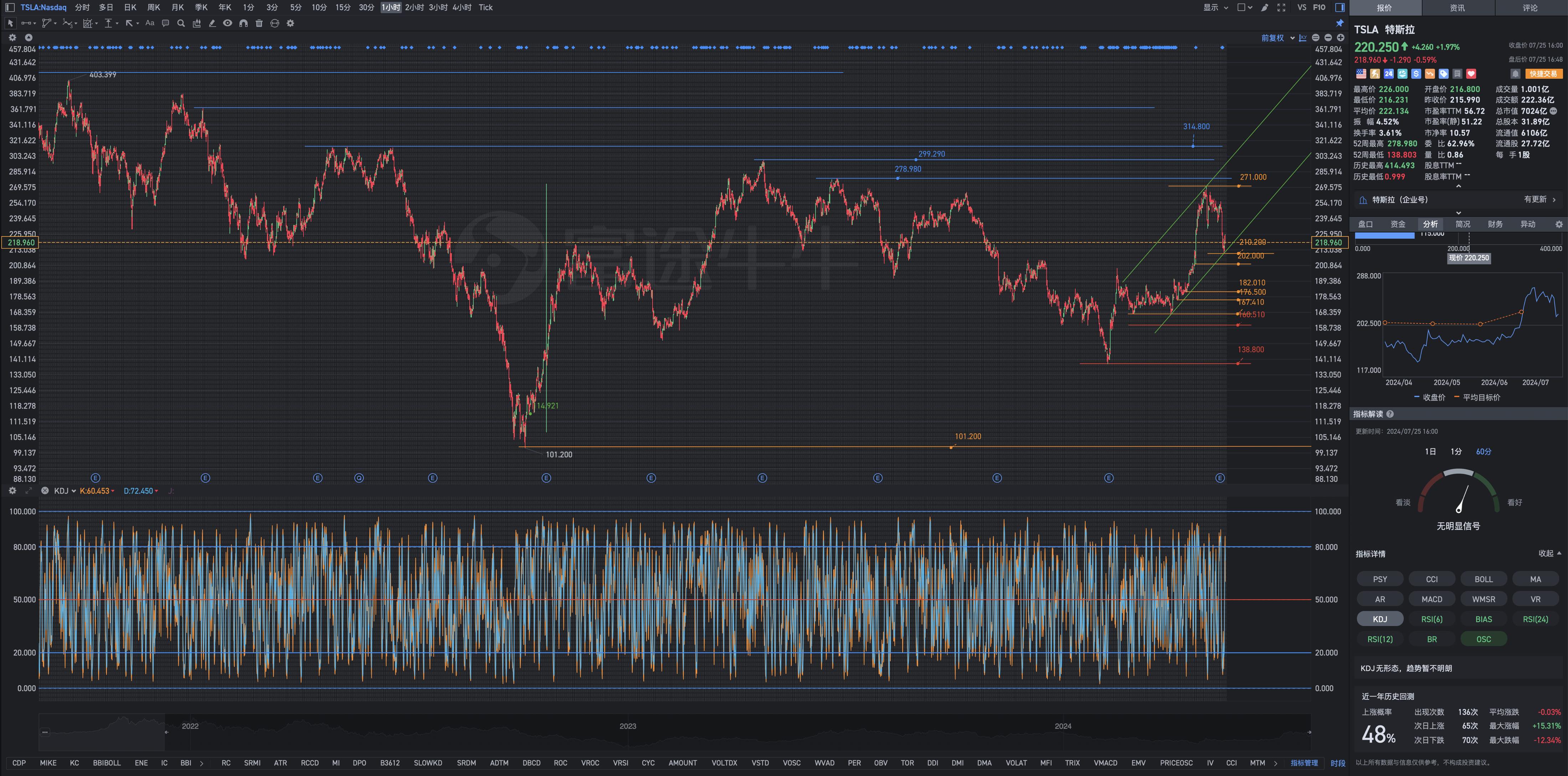

(1) Tesla is a car company that changes the way people travel through electric energy and solar energy. Tesla has surpassed Toyota to become the world's largest auto company in just a few years, firmly occupying the position of the sales champion of new energy vehicles many times, helping its stocks soar and surpassing $1,130 per share (after the split). This has also allowed Musk to regain the position of the world's richest person and can be called a 'double grand slam'. Currently, Musk only has Tesla listed, and his other companies are not listed. Tesla has a very forward-looking layout in the high-tech industry. Tesla's stock price will certainly soar over time. In simple terms, it is a smart electric car company.

When Elon Musk appears again and conducts refinancing investments for the following 8 unlisted companies, it is decisive to participate in financing investments.

(2) Space X is the only privately held rocket launch company in the world. Its main products are the reusable launch vehicles Falcon 1-9. In the 13 years since its operation, the number of rocket launches has exceeded that of NASA, with almost a rocket launch every few days. The Starship (formerly known as the Big Falcon Rocket) is planned to be used by SpaceX for manned missions around the moon, to Mars, and other space explorations. In simple terms, it is a company that develops reusable large rockets.

(3) SolarCity was founded in October 2008 and is a company specializing in the development of residential photovoltaic projects. It is located in Foster City, California. Its main research and development direction is photovoltaic power generation. In simple terms, it is a company that develops solar power generation.

(4) Starlink is dedicated to the deployment and application of satellite systems. It plans to build a 'Starlink' network consisting of approximately 1.2 million satellites in space between 2019 and 2024. Among them, 1,584 satellites will be deployed in a near-Earth orbit about 550 kilometers above the Earth and will start operation from 2020. In simple terms, it is a company that transforms the communication system from receiving signals from base stations to 'near-Earth satellite' phones.

(5) Neuralink is committed to the research of biological and physical interaction, and its product concept is the "brain-computer interface". This is also a great and highly imaginative technology. If successfully developed, humans will no longer need to spend a lot of time learning, and may not even need to take the university entrance exam. All the knowledge known to humans can be "infused" into the brain through the brain-computer interface. Similarly, the memories stored in the human brain can also be stored in a physical disk through the brain-computer interface, which may fundamentally change the course of human history. In simple terms, the human brain has a "usb interface" to copy in and out memories, knowledge, and information. If successful, human immortality will become a reality.

(6) Model π mobile phone, netizens have uploaded promotional and demonstration videos of the Tesla mobile phone. The phone is named "Model π" and is in the typical Tesla style. The phone can be charged by light energy and can communicate through the Starlink system, allowing internet surfing anywhere, whether in the desert, the middle of the ocean, or the top of a mountain, without being affected, and possibly even communicate for free. In simple terms, it's a phone that can access the internet anywhere without any fees.

(7) Hyperloop, a rail transport company, focuses on the research of a closed vacuum maglev train. Its research and development progress is fast approaching the trial operation stage. In an ideal state, the maglev train will travel at super high speeds similar to a capsule running in a tube. At that time, the distance from Beijing to Shanghai will only take 10 minutes, leading to another revolutionary advancement in human transportation history. In simple terms, it's a closed, super high-speed rail.

(8) Boring Company's main research direction is underground transportation tunnels. In February and May 2021, they dug two tunnels underground at the Las Vegas Convention Center as part of a complete underground transportation system. The LVCC project is expected to be officially operational at CES in January 2021, with a total budget of 52.5 million USD. In simple terms, it's high-speed intercity underground transportation.

(9) OpenAI was established in 2015 and is currently renamed xAI. From the beginning, it positioned itself as a "non-profit organization" with the goal of achieving general artificial intelligence (AGI) in a safe manner, benefiting all humans equally instead of creating profits for company shareholders. It is an open research company, and all research findings will be published and made available for free use. In simple terms, it's providing research results for free to serve the people.

Musk has stated that the Tesla board will discuss whether the electric vehicle manufacturer should invest 5 billion USD in his artificial intelligence startup, xAI. Earlier this week, Musk initiated a public opinion poll asking Tesla users if they approved the transaction. After more than two-thirds of respondents cast affirmative votes, Musk stated on Thursday that it seems "the public is in favor." The electric vehicle manufacturer will consider this matter.

In a preliminary opinion poll released on Tuesday, Musk stated that investment requires approval from the Tesla board and shareholder voting beforehand. Shortly before this issue was released, Tesla's disappointing performance was announced, with four consecutive quarters of profit.

Musk was asked during the earnings conference call whether the company would invest in xAI or integrate its chatbot named Grok into Tesla's software. "Tesla has learned a lot from xAI," Musk said, and added that it has helped advance Full Self-Driving.

Musk said that if the shareholders agree, he supports Tesla's investment in AI. This is a major event and significant change for Tesla. Tesla's profit model and capabilities will undergo significant changes. Wall Street's valuation system for Tesla will also undergo important changes. The upward long-term trend and main trend trajectory of Tesla will unfold in another more aggressive curve.

Elias=Jerome's judgment on Tesla is: short on the downside, long on the upside.

Elias=Jerome is a strategic investor in Tesla. For Elias=Jerome, a drop is an opportunity, with a planned and step-by-step approach, with discrete random variables and positioning the portfolio.

Refinancing, increasing capital, increasing positions, and adding investments to Tesla.

Elias=Jerome, a golden rule of the JC trading family (it cannot be emphasized enough):

Win in a bear market; win in volatility; win with courage; win with wisdom; win with magnanimity; win in learning; win in change; win in adaptation; win in mathematics; win in physics; win in models; win in functions; win in vibration; win in quantification; win in framework; win in moderation; win in probability; win in technology; win in psychology; win in dexterity; win in versatility; win in oscillation; win in long-term; win in investment; win in mentality; win in tolerance.

Lose due to closed-mindedness; lose to the ego; lose to rigidity; lose to self-abandonment; lose to self-deception; lose to chasing highs; lose to chasing strength; lose to surging highs; lose to stagnant uptrend; lose to one-sidedness; lose to gambling; lose to protecting holdings; lose by going all in; lose due to financing; lose due to liquidation; lose due to perpetual motion; lose to gambling; lose to complaining; lose to making excuses; lose to cursing; lose to daydreaming; lose to contingency planning; lose to forecasting; lose in the short term; lose due to impatience; lose due to greed; lose due to mindset.

98% of people can never successfully predict or be consistently bullish or bearish. Without a strong backing of risk management strategies that include a certain proportion of protective capital, 98% of people can only end up failing. Investing and trading is about making a living, not being a stock slave or engaging in battles of opinions (JC does not participate in battles of opinions, as he has no interest). It's about winning in investment and trading.

Warning: The first and last chapters of the book of wisdom are written as 'There is no free lunch in the world'. Don't expect to make money without working hard by relying on others' post-market recap chart analysis. Here, at this moment, all of JC's posts are personal expressions of thoughts before, during, and after trading, research and exploration, not engaging in self-righteous viewpoint battles, stock recommendations, and certainly not serving as the basis for trading. The resulting trading gains and losses can only be borne by oneself, regardless of profit or loss, all self-inflicted.

We were originally strangers, not to mention that even if you are capable in finance, you are easily regarded as a fraud in this money-playing finance market, so JC will not use research results as a vehicle for giving away money, because there is no need for that. Where can you find so-called true friends in the financial market? Everyone goes their own way, does their own thing, and is strong when they have no desires. JC doesn't rely on you, doesn't play by your rules, doesn't care about your face. Besides Jesus Christ (who is actually God, the Holy Trinity of the Father, the Son, and the Holy Spirit), JC is afraid of no one.

Disclaimer: There are many crazy people in the securities market, so it's better to make it clear. This article is a personal trading log, not opinions and stock recommendations. This is the well-regulated U.S. securities market, not the A-share securities market. The blogger has a long-term trading style. However, in special circumstances, such as when the market is particularly good and the profit chip ratio exceeds 80-90% for a long time, the blogger will choose to sell some positions and realize some floating profits. In the case of a poor market and stocks, especially when it reaches an extreme and extremely bad state, such as when the profit chip ratio is below 21-7%, JC will choose to have a planned and systematic approach and use a discrete random variable positioning strategy in a graded and phased manner. Therefore, ordinary traders should not imitate this operation.

Win in a bear market; win in volatility; win with courage; win with wisdom; win with magnanimity; win in learning; win in change; win in adaptation; win in mathematics; win in physics; win in models; win in functions; win in vibration; win in quantification; win in framework; win in moderation; win in probability; win in technology; win in psychology; win in dexterity; win in versatility; win in oscillation; win in long-term; win in investment; win in mentality; win in tolerance.

Lose due to closed-mindedness; lose to the ego; lose to rigidity; lose to self-abandonment; lose to self-deception; lose to chasing highs; lose to chasing strength; lose to surging highs; lose to stagnant uptrend; lose to one-sidedness; lose to gambling; lose to protecting holdings; lose by going all in; lose due to financing; lose due to liquidation; lose due to perpetual motion; lose to gambling; lose to complaining; lose to making excuses; lose to cursing; lose to daydreaming; lose to contingency planning; lose to forecasting; lose in the short term; lose due to impatience; lose due to greed; lose due to mindset.

98% of people can never successfully predict or be consistently bullish or bearish. Without a strong backing of risk management strategies that include a certain proportion of protective capital, 98% of people can only end up failing. Investing and trading is about making a living, not being a stock slave or engaging in battles of opinions (JC does not participate in battles of opinions, as he has no interest). It's about winning in investment and trading.

Warning: The first and last chapters of the book of wisdom are written as 'There is no free lunch in the world'. Don't expect to make money without working hard by relying on others' post-market recap chart analysis. Here, at this moment, all of JC's posts are personal expressions of thoughts before, during, and after trading, research and exploration, not engaging in self-righteous viewpoint battles, stock recommendations, and certainly not serving as the basis for trading. The resulting trading gains and losses can only be borne by oneself, regardless of profit or loss, all self-inflicted.

We were originally strangers, not to mention that even if you are capable in finance, you are easily regarded as a fraud in this money-playing finance market, so JC will not use research results as a vehicle for giving away money, because there is no need for that. Where can you find so-called true friends in the financial market? Everyone goes their own way, does their own thing, and is strong when they have no desires. JC doesn't rely on you, doesn't play by your rules, doesn't care about your face. Besides Jesus Christ (who is actually God, the Holy Trinity of the Father, the Son, and the Holy Spirit), JC is afraid of no one.

Disclaimer: There are many crazy people in the securities market, so it's better to make it clear. This article is a personal trading log, not opinions and stock recommendations. This is the well-regulated U.S. securities market, not the A-share securities market. The blogger has a long-term trading style. However, in special circumstances, such as when the market is particularly good and the profit chip ratio exceeds 80-90% for a long time, the blogger will choose to sell some positions and realize some floating profits. In the case of a poor market and stocks, especially when it reaches an extreme and extremely bad state, such as when the profit chip ratio is below 21-7%, JC will choose to have a planned and systematic approach and use a discrete random variable positioning strategy in a graded and phased manner. Therefore, ordinary traders should not imitate this operation.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Elias Chen OP 104151183 : Elias=Jerome's judgment on Tesla is that it grows in a short space. Elias=Jerome is Tesla's strategic investor. For Elias=Jerome, a decline is an opportunity. There are plans and steps, divided into gradients and batches, discrete random variables, and position opening layout.