The trading guide: how to navigate the historical week

This week, both the U.S. elections and the Federal Reserve's interest rate decision are set to make significant impacts.

– November 5 local time marks the voting day for the 2024 U.S. presidential election, and current polls show a very intense competition between Trump and Harris.

– November 6 to November 7, local time, the Federal Reserve's monetary policy meeting will take place, and the market currently estimates a 99.7% probability of a 25 basis point rate cut.

Undoubtedly, this week is crucial for influencing the market in 2024. Market uncertainty is increasing.

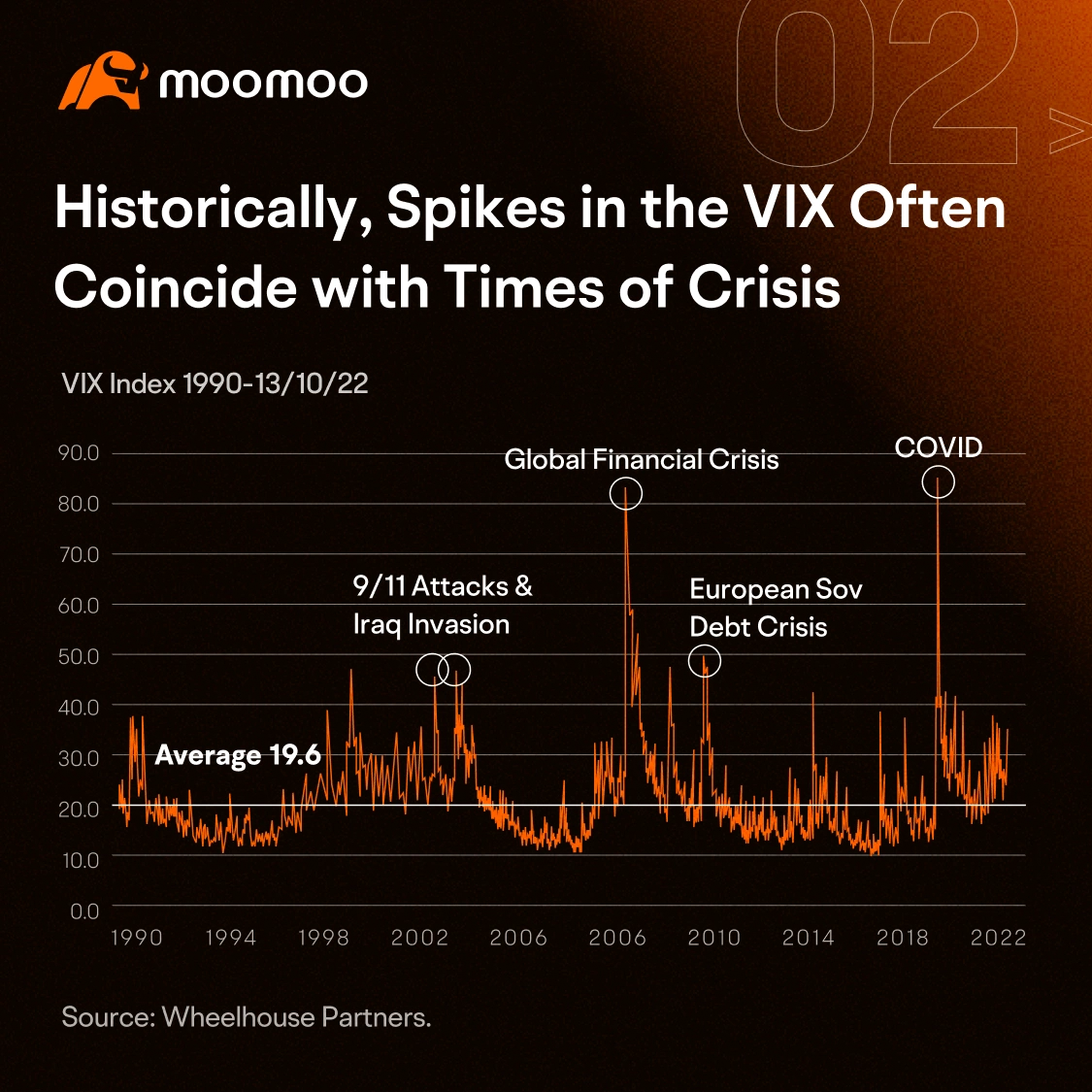

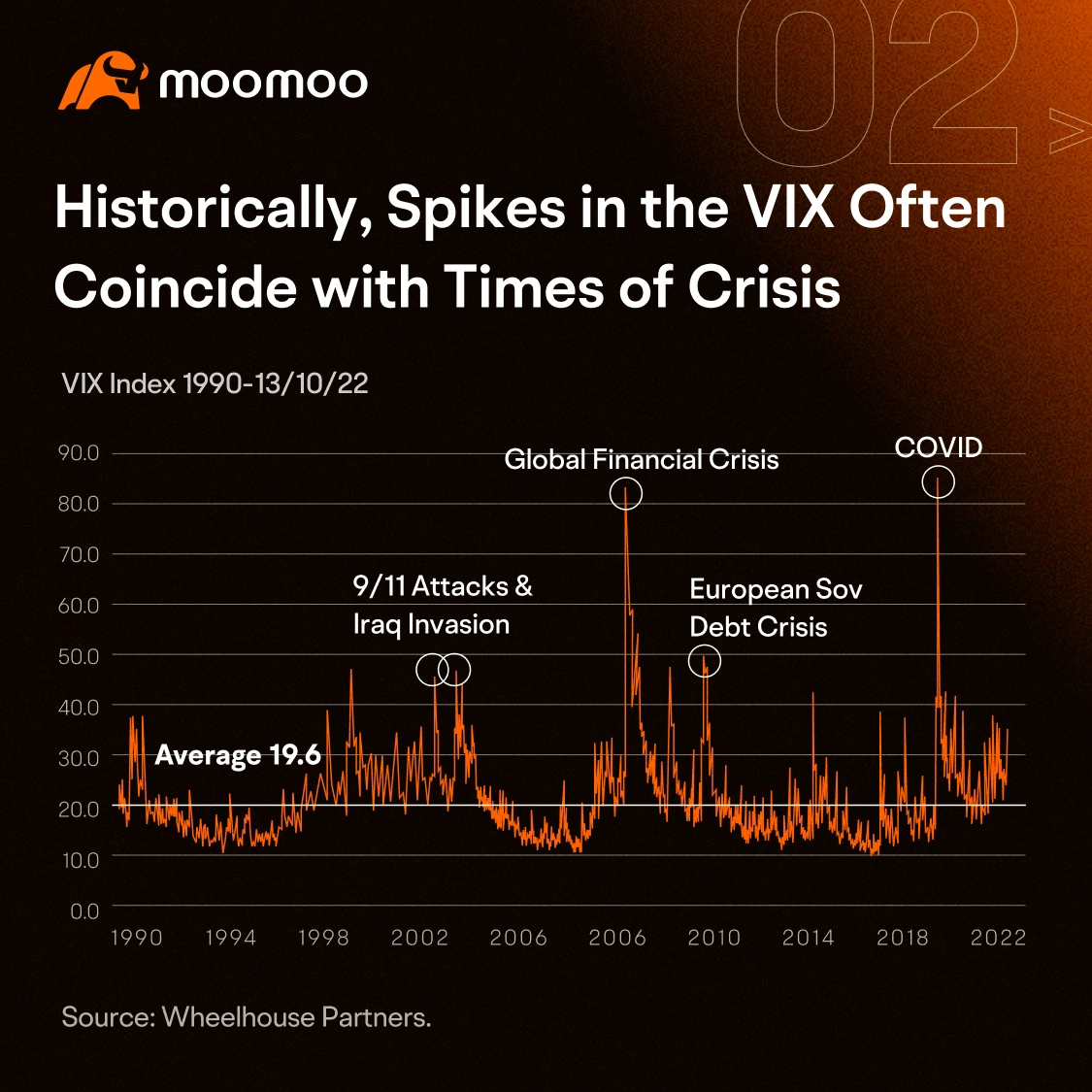

Volatility barometer: VIX

The VIX Index (Volatility Index), also known as the Fear Index, is a measure of the expected volatility in the U.S. stock market, based on the S&P 500 Index.

Typically, the $CBOE Volatility S&P 500 Index (.VIX.US)$ fluctuates between 10 and 30, with analysts generally considering 30 as a benchmark for high volatility and market panic.

In simple terms, a higher VIX indicates greater market panic and increased uncertainty. Since late October of this year, the VIX index has been on an upward trend.

Source: moomoo. Data as of Nov. 4, 2024.

1. Diversified investment

A portfolio refers to a collection of various assets such as stocks, bonds, and commodities. Diversifying investments usually helps to reduce risk.

A portfolio primarily consisting of passive index funds and including exposure to other major asset classes is relatively easy for novice investors to manage.

2. Dynamic asset allocation

Investors should regularly review the portfolio and implement rebalancing strategies. For example, if the stock market performs exceptionally well over a period, the value of stock assets will increase, leading to oversized exposure to stocks.

In such cases, investors can sell some stocks and buy other assets to rebalance the proportions.

Although Trump and Harris have different policies, they both may be favorable for cryptocurrencies and gold.

Recently, institutions and investors have significantly increased their holdings in Bitcoin.

Trump claimed that if elected, he would designate Bitcoin as a strategic reserve asset for the United States. Harris also vowed to support cryptocurrencies.

Additionally, the easing of monetary policy may enhance investors' risk appetite, acting as a catalyst. The expectation of currency depreciation resulting from interest rate cuts may also benefit gold.

Thematic ETFs provide a relatively straightforward way to invest in cryptocurrencies and gold: go to moomoo> Markets> ETF> Thematic ETFs.

The securities mentioned are for illustration purposes only, and any statement involved does not constitute investment advice.

– While a diversified portfolio can help mitigate market risk, it also carries the risk of drawdowns. Investors should pay attention to the market changes and continuously adjust their investment strategies.

– The current market is highly uncertain. Future market expectations may already be reflected in current asset prices, so the impacts of events such as elections and interest rate cuts on assets are not guaranteed.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

villan : come and hack my phone and my situation I know I am suffer

Vadaana Saycosie : why ?. its comig to Navigate ? so who's Proven them ?

TracyMallett : International affairs is required by companies like?????????? $Pfizer (PFE.US)$

Andre Tiller : cool

DimondHandsDsolo94 : lets go

AL MALIK PAIZA : when you're ready back I will come send are spending arts

101758943 : $MAYBANK (1155.MY)$