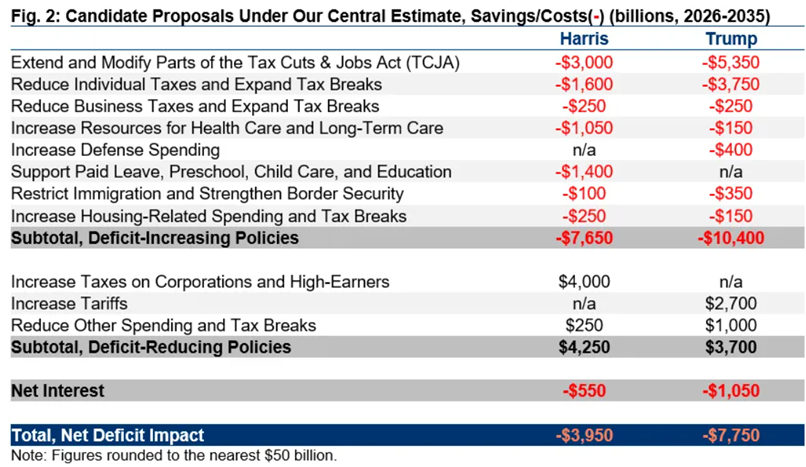

Impact on Asset Prices:U.S. stock is likely to be driven primarily by valuation boosts, while gold and copper would see moderate increases. In contrast to the "Trump trade," if Harris were elected, the macroeconomic environment would be more similar to that of 2019. On the one hand, the Democrats' smaller fiscal measures mean more room for monetary policy, resulting in a combination of a weaker dollar and lower interest rates, which would likely lead to a moderate rise in gold prices. On the other hand, the absence of tariffs impacting bulk commodities would reduce the bearish pressure on copper prices, and a weaker dollar would boost copper.

J Servai (JLAPT) : tq

103827803 : good

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

71074728 : Thank you! It would be even better if the data during President Biden's tenure from 2021 to 2024.10 could also be included in the statistics.

103727516 :

103827296 : ayah ini game no understand

103827296 : stop please no understand game

103827296 : halo I game game no please no run stop please

Turnbuckle :

Turnbuckle Turnbuckle : THE ORANGEMAN COMETH

View more comments...