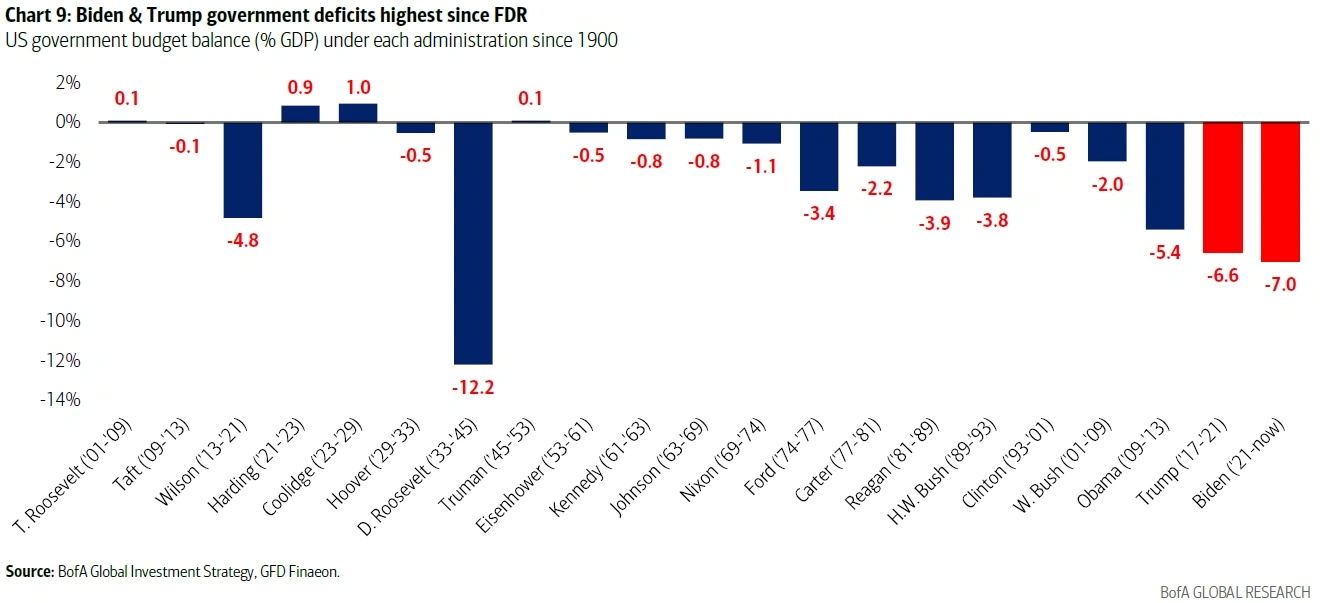

The political stances of both Harris and Trump indicate a strong fiscal stance. Neither Trump nor Harris outlined policies to reduce the deficit in their previous debate. On the one hand, both Harris and Trump support infrastructure investment and the reshoring of manufacturing. On the other hand, in terms of fiscal receipts and expenditure, Trump advocates tax cuts; Harris advocates fiscal policies that reduce living costs, corresponding to an increase in the deficit of 1.7-2 trillion dollars over ten years, a study by CRFB (Committee for a Responsible Federal Budget) shows. Compared to history, this increase of 1.7-2 trillion dollars in deficit is significant. According to CRFB’s estimates, the fiscal deficit to GDP ratio in 2035 is expected to cumulatively increase by 4.65% compared to 2026. Therefore, regardless of who wins the election, it is highly likely that we will not see a significant reduction in fiscal intensity.

A Humble Mooer : no matter how many times the theory of monetarism is disproven in the real world there is no shaking it from simplistic analysis like this.

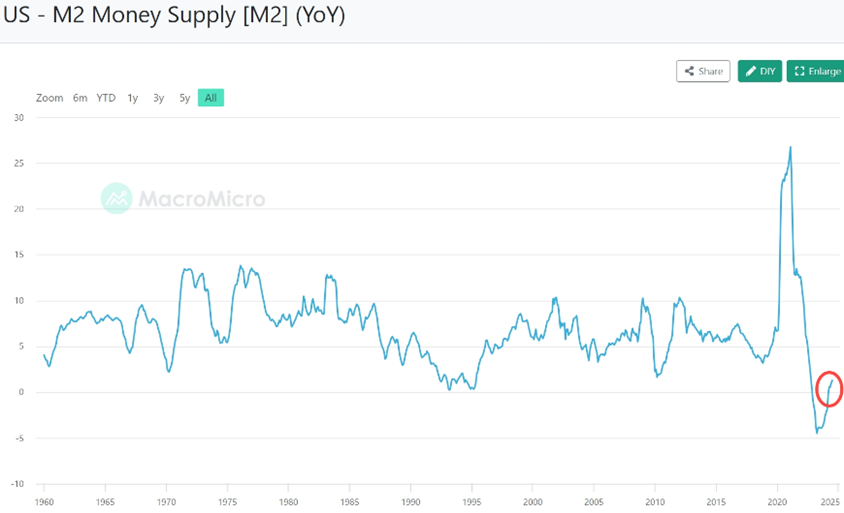

"When the growth rate of the money supply exceeds the growth rate of the actual economy, it means that the real purchasing power of money may decline"

thank you for at least putting in a may before decline.

IMO monetarism is the reason economics is a discredited field of scholarship.

105742796 Learner : Great

Guardian87 : intensive middle east wars

ztock_boy Guardian87 : [Commando] yes but countries with large gold reserves are not directly involved [Emoticon]

Alen Kok : ok

Adrianlim90 : a

Adrianlim90 : good

103677010 : noted

103677010 : noted

john song : gold is scarce

View more comments...