The basic components of MACD are the DIF line, the DEA line, and the histogram. You can customize the DIF and DEA lines to correspond with different moving averages, but the main points to remember are that when the DIF line crosses above the DEA line, that is called a golden cross which is a buy signal. Also, when the DIF line drops below the DEA line, that is a sell signal which is called a death cross.

104274635 : tesla does not seems to follow the charts ..

Cow Moo-ney :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

面如冠玉的惠特克 Cow Moo-ney : How straight are the parameters? Thank you

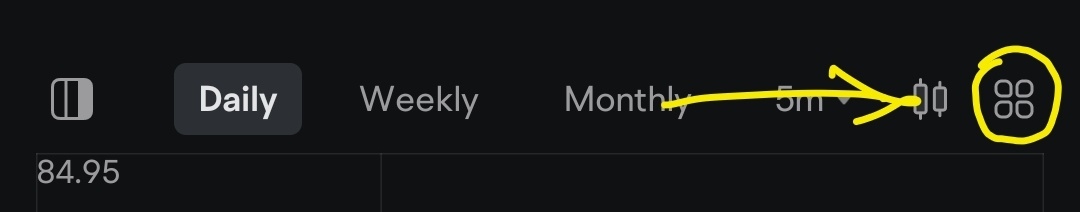

面如冠玉的惠特克 : Can you send me a picture of the parameters directly?

SpyderCall OP 面如冠玉的惠特克 : Just default parameters for KDJ.