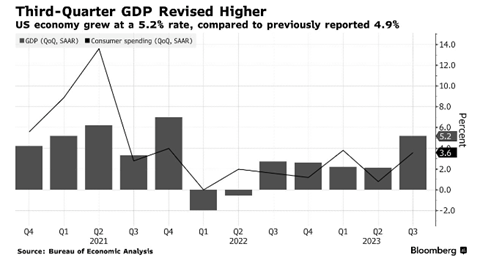

USA's GDP for the third quarter has been revised up to 5.2%, indicating a crucial change.

$ZHENGWEI GROUP (02147.HK)$ Today, the USA released the revised GDP for the third quarter. Let's take a look at the revised results and how the market interprets these data. The data shows that in the third quarter, the revised GDP grew by 5.2% year-on-year, surpassing economists' expectations of 5%, further highlighting the strong performance of the US economy.The main contribution to this revision comes from non-residential investment.The data reveals that, driven by construction investment, this category grew by 1.3%, instead of the previous 0.1%, increasing from 1.6% to 6.9%. Non-residential construction investment not only refers to building factories but also includes the purchase of commercial buildings, hotels, mines, and more. Regardless of the category, the increase in construction investment indicates that US companies still have relative confidence in the future in the third quarter.

The second largest contributor is state and local governments, with a growth rate revised from 3.7% to 4.6%, similar to the past two quarters.Government spending in 2023 has grown more than the past two years, providing a certain boost to this year's economy.On the other hand, consumption is part of the drag on the gross domestic product.The overall consumption growth rate has been revised down from 4% to 3.6%, with significant downward adjustments in durables and service consumption, especially in the service sector, adjusted from 3.6% to 3.0%.This indicates that consumers are not as strong as we imagine, but even after the revision, the growth rate remains high, not enough to cause concerns about the economy. For USA stock investors, inflation and corporate profit adjustments may be more important than changes in the gross domestic product.Personal consumption expenditure inflation rate was revised down in the third quarter, albeit only slightly by 0.1%, from 2.9% to 2.8%. As economic growth increases, the inflation rate is being lowered, approaching 2%, which means we need to question the relationship between economic growth and inflation.Can the future economy, including the fourth quarter gross domestic product data, maintain this performance? The answer is, it's hard to say, because detailed data from the third quarter shows that fiscal policy has played a key role in driving economic growth.The largest contributor to economic growth, non-residential investment, is closely related to government subsidies, and the second largest source of contribution, state and local government spending, also indicates the role of fiscal policy in promoting the economy. However, government spending is difficult to sustain high growth. Instead, consumption has become a drag on the economy ensuring its health after this adjustment.Therefore, I believe that economic slowdown is still a trend, and market expectations may not have changed. We need to remain open-minded, not underestimating the possibility of future risks simply because of optimistic past data.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment