The Week Ahead (Blackberry Earnings, Disney Shareholder Annual Meeting; Canada and U.S. Unemployment Rate)

In Canada, the Bank of Canada will be watching closely to the March employment numbers, along with their own business and consumer surveys for further signs on how much the economic backdrop is deteriorating. $BlackBerry Ltd (BB.CA)$ is scheduled to report quarterly results on Wednesday.

In the US, Friday's non-farm payrolls, PMI data metrics are among the key points to watch out for in the coming week starts on April 1st. Federal Reserve Chair Jerome Powell will take the stage again on Wednesday. His remarks will be worth watching to see if he strikes a dovish tone like he did at last week's monetary policy meeting or takes a more hawkish stance. $Disney(DIS.US)$'s shareholder annual meeting is scheduled for Wednesday, marking the conclusion of a prolonged and acrimonious dispute over proxy, suggesting that it could become "one of the costliest proxy battles ever recorded."

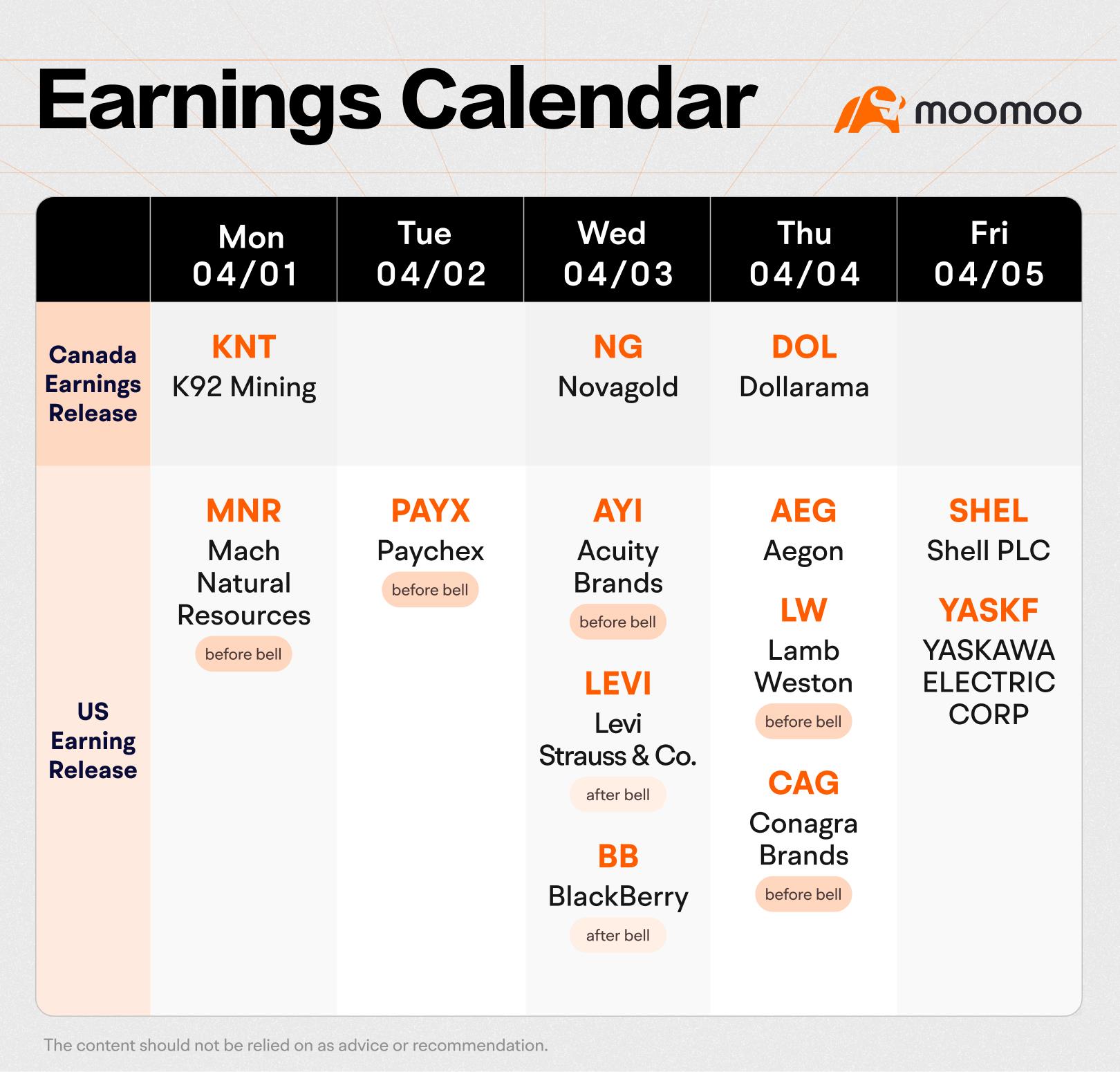

Earnings Calendar

Human capital management solutions provider $Paychex(PAYX.US)$ will report third-quarter results next week. The management's outlook for the second half of 2024 is positive, reflecting the resilience of the small and medium-sized business sector, which accounts for a large portion of the company's clientele. Paychex has been a consistent dividend payer over the past several years, marked by regular hikes except during the pandemic when the company temporarily suspended dividend payments. The current yield of 4.6% is much higher than the S&P 500 average. For the past five years, the company's quarterly earnings have consistently met or exceeded estimates.

$BlackBerry Ltd (BB.CA)$ is set to report Q4 results on Wednesday. Shareholders scrutinized the struggling firm's earnings, assessed its new leadership under a new Chief Executive Officer, and considered the cancellation of its IoT spinoff. Analysts expect BlackBerry to post loss of $-0.05 per share for the quarter. In related news, Director Philip Gordon Brace bought 35,000 shares of the company's stock in a transaction dated Wednesday, February 14th. The stock was bought at an average price of C$2.79 per share, with a total value of C$97,650.00. 1.67% of the stock is currently owned by company insiders.

$Shell PLC(SHEL.US)$is scheduled to release earnings on Friday. The stock has risen over 20% in 2023 amid rising oil prices. Analysts expect the company to report earnings of $1.49 and revenue of $87.02B, followed by EPS and revenue miss in the fourth quarter of 2023.

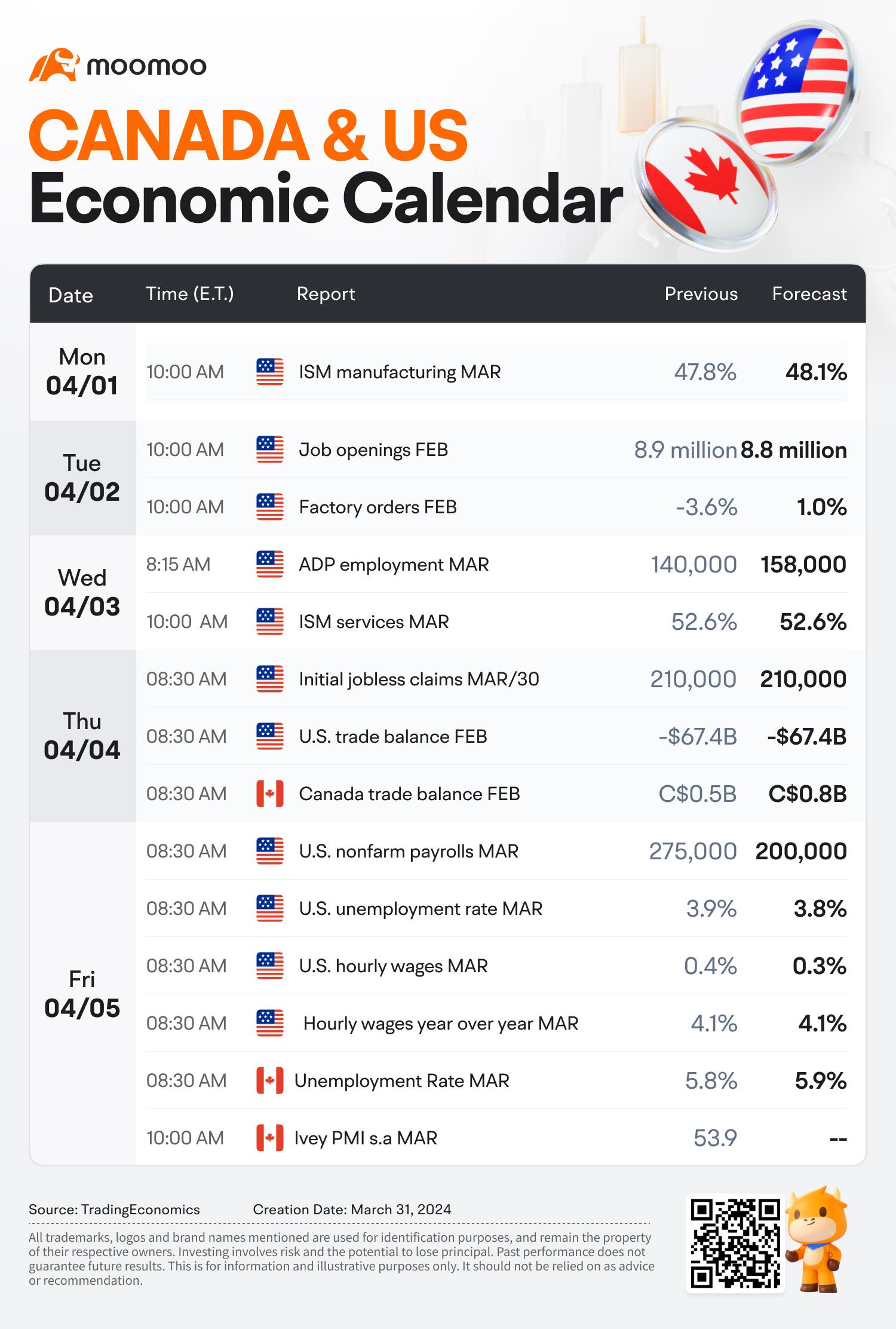

Friday's Canada employment data is expected to show job growth remained in positive territory (+25,000 from February), but again it will not be enough to keep up with surging growth in labour supply. Therefore, we forecast another tick higher in the unemployment rate to 5.9% from 5.8%—further above the 5% in January 2023.

Up to this point, the climb in the unemployment rate has been predominantly driven by extended job search durations for newcomers to the job market, mainly recent graduates, rather than by an increase in layoffs. Nevertheless, there's a noticeable deceleration in the demand for new hires, with job vacancies currently 25% lower than they were at the same time last year. Additionally, a recent surge in business insolvencies at the start of 2024 serves as a caution of potential negative impacts on economic growth projections.

Meanwhile, U.S. employment data is expected to show persistent strength in the labour market. Payroll employment is likely to post another large gain of 200,000 in March, following an average rate of 265,000 increase over the previous three months. The unemployment rate is expected to rise 3.8% after having risen 3.9% in Februrary.

Source: Trading Economics, RBC, CanadianInsider

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

awilldill : nice

74538471 : Nice

FARAMARZ AKBARY :