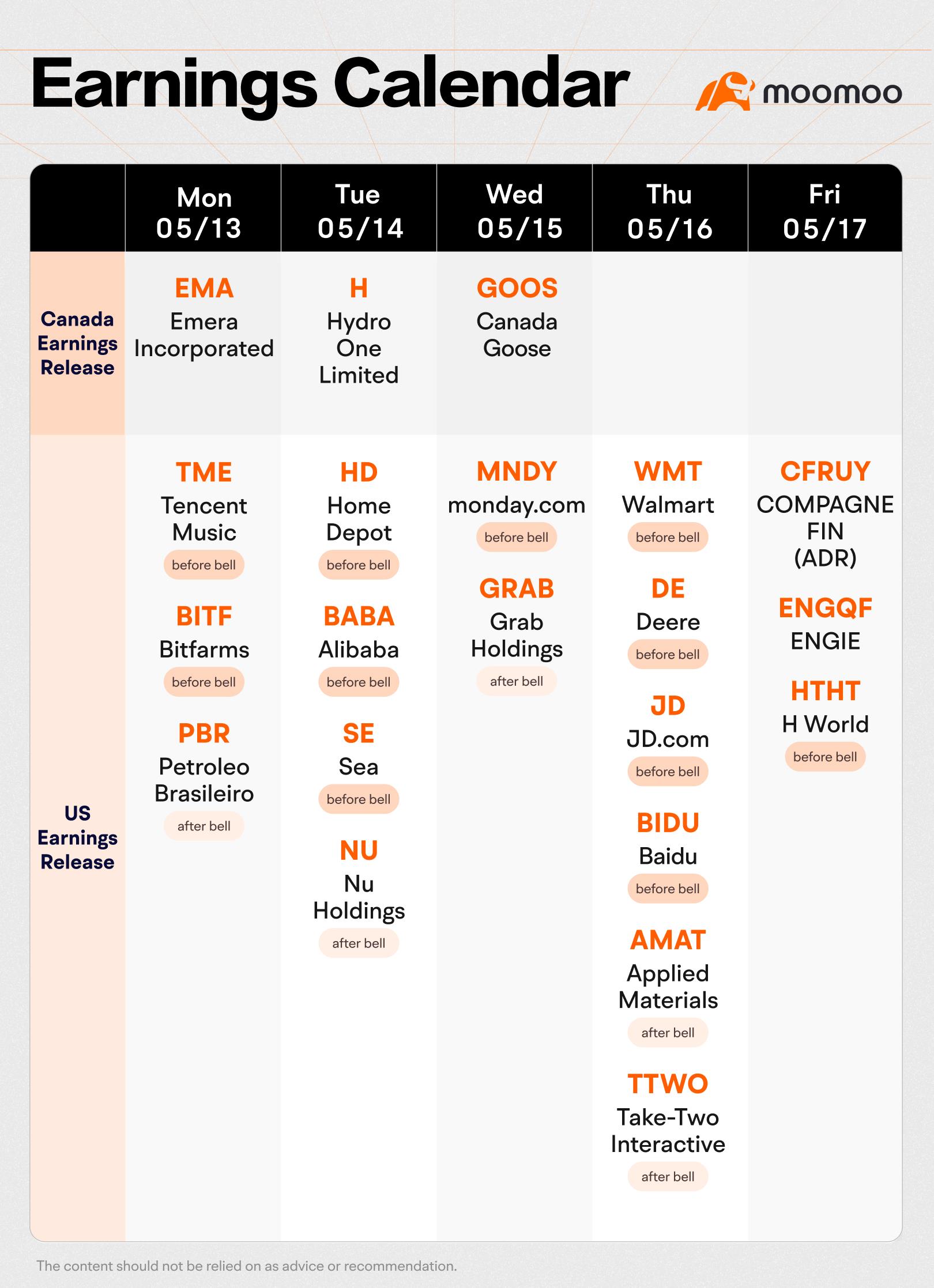

The Week Ahead (HD, BABA, GOOS, WMT Earnings; U.S. CPI Data; Canada Housing Starts)

On Tuesday, Home Depot is slated to release its quarterly results. Investors are hoping the retailer will announce some price reductions as a countermeasure against inflation. Alibaba is also scheduled to report on the same day.

On Wednesday, the Toronto-based winter clothing manufacturer,

$Canada Goose Holdings Inc (GOOS.CA)$, is expected to release its fourth quarter and fiscal year 2024 earnings report before the markets open. Amidst the headwinds faced by the luxury sector, the stock has slid almost 20% from its peak of C$19.42 in February this year. Investors are eagerly anticipating further insights from the upcoming report and management's earnings outlook.

The U.S. stock market is bracing for a significant test with the release of the U.S. CPI data for April scheduled for next Wednesday. With inflation remaining stubbornly high during the first three months of the year, several Federal Reserve officials have adopted a cautious stance on future monetary policy. Some hawkish members have ruled out rate cuts for the year, and further rate hikes have not been discounted. Should the U.S. CPI for April exceed expectations and show an increase from the previous figure, this could severely impact market bets on the number of Fed rate cuts for the year.

Before the CPI data release, the U.S. Producer Price Index (PPI) for March, announced on Tuesday, could provide an early indication of inflation trends. Also set to be released on Wednesday alongside the U.S. CPI data is the so-called "scary data" of April's retail sales figures, which will offer clues as to whether the U.S. economy's strength remains robust. Additionally, the weekly initial jobless claims will be announced on Thursday.

In Canada, data reports should confirm a softer economic backdrop at the end of Q1. Both manufacturing and wholesale sales contracted in March, according to preliminary estimates from Statistics Canada. Retail was little changed, and total hours worked (among private industries) fell by 0.3% from February. That leaves Q1 GDP on track for a seventh consecutive decline on a per-capita basis despite what increasingly looks like a temporary jump in output growth in January. In April, early reports on the housing market showed a dip in major markets. The softer Canadian economic backdrop continues to call for earlier and more interest rate cuts from the Bank of Canada than the Fed this year.

Source: CIBC, Trading Economics, RBC, CanadianInsider, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 11

11