The Week Ahead: TD, TGT and PANW Earnings; Powell's Jackson Hole Speech and Canada's Inflation Report

Earnings Preview

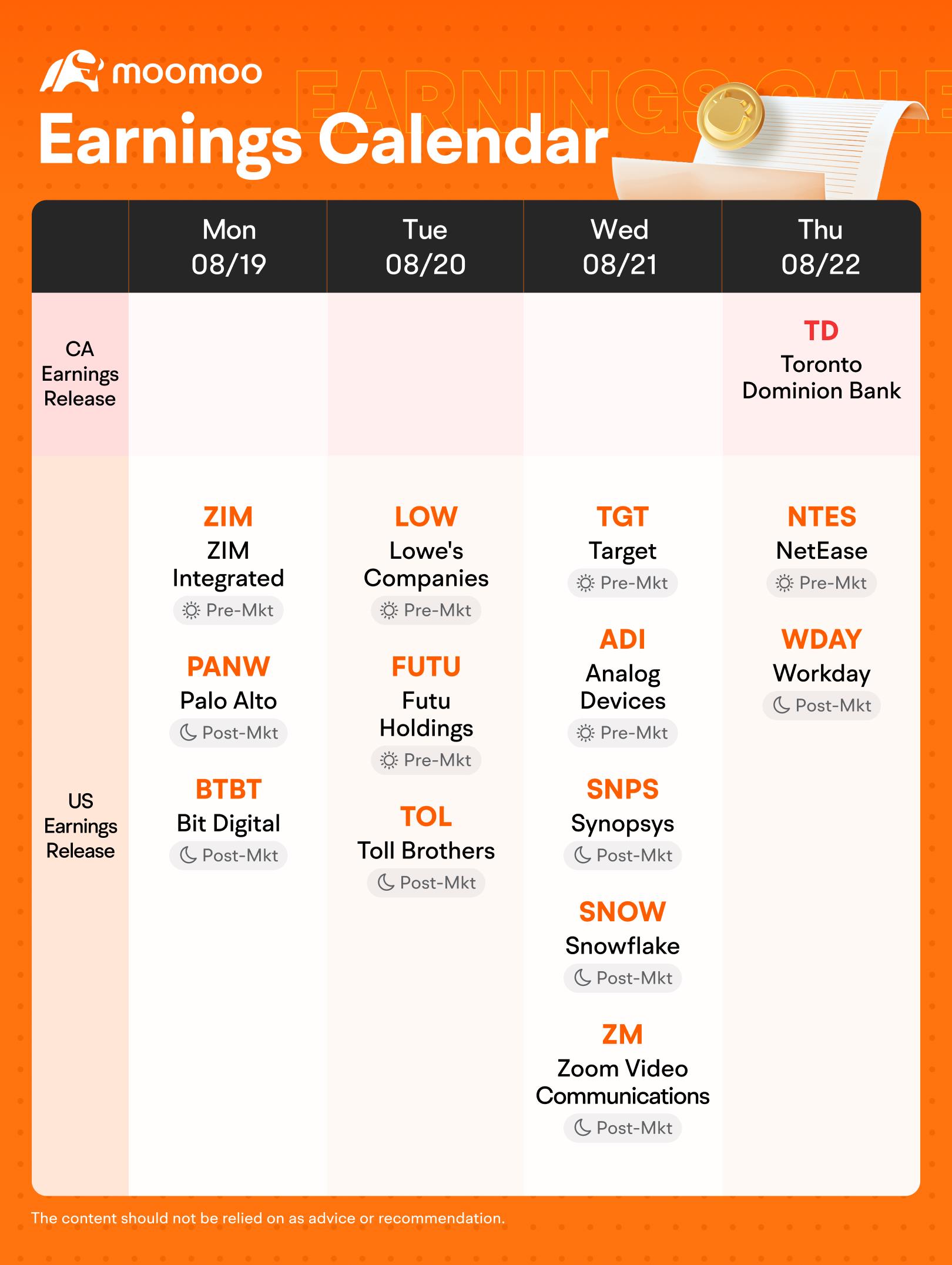

As the earnings season approaches its end, a few notable retailers and a cybersecurity giant,$Palo Alto Networks(PANW.US)$, are set to disclose their earnings in the upcoming week. $劳氏(LOW.US)$is scheduled to release its earnings on Tuesday before the market opens, whereas$塔吉特(TGT.US)$and$TJX公司(TJX.US)$will report their earnings on Wednesday before the market opens. $The Toronto-Dominion Bank (TD.US)$ $The Toronto-Dominion Bank (TD.CA)$ is set to report Q3 results on Thursday before the market opens.

Target Earnings Preview

$塔吉特(TGT.US)$is set to release its Q2 2024 earnings report on Wednesday, August 21, before markets open. Analysts are expecting a rise in sales and profits compared to last year, as Target has been cutting costs and lowering prices to boost sales and margins. According to analysts, sales are projected to increase modestly to $25.21 billion from $24.77 billion in the same period last year. EPS is also expected to rise to $2.14 from $1.80 a year ago.

According to Tesley Advisory Group's analyst Joseph Feldman:

Broadly, we believe consumers are showing resiliency as they continue to search for value and focus on essentials, while selectively spending on discretionary items and responding to innovation and newness."

As for the full-year outlook, JPMorgan analysts have noted that Target could be poised to narrow down the top half of the range for both comparable sales and EPS. This is expected to put pressure on Target shares in the near-term. They also expect the company's second-half margins to be affected by more frequent promotions to boost sales.

Despite this, Baird analysts are optimistic, stating that Target has “enough levers” to control its spending and affirm its $8.60 to $9.60 full-year adjusted EPS projection. The positive retail environment and encouraging retail sales data, along with $沃尔玛(WMT.US)$'s earnings beat, provided a favorable backdrop for Target's earnings report. However, Target's stock performance could be influenced by the trends in customer spending and inflation, which have been affecting the sales of necessities versus discretionary items. $梅西百货(M.US)$and$TJX公司(TJX.US)$are also set to release their earnings reports on the same day.

Palo Alto Earnings Preview

$Palo Alto Networks(PANW.US)$, a leading cybersecurity company, is set to report results for its fiscal Q4 after markets close on Monday, August 19. Analysts are anticipating that Palo Alto Networks' revenue will grow to $2.16 billion from $1.95 billion in the same quarter last year. Net income is expected to reach $232.9 million, or 66 cents per share, representing a slight increase compared to the year-ago period but a sequential drop.

Palo Alto Networks has been facing challenges due to spending fatigue among its customers, which has been affecting the cybersecurity industry as a whole. Analysts expect the company to provide guidance for the full fiscal year 2025, with projected revenue of $9.09 billion. The company's platformization strategy, aimed at consolidating its cybersecurity services and offering bundled solutions, is an area of focus to mitigate the impact of spending fatigue.

While Palo Alto Networks has noted that customers have responded positively to the platformization, the recent worldwide outage caused by a faulty $CrowdStrike(CRWD.US)$update may prompt queries about the market's prospects. Investors are expected to monitor for possible updates regarding the impact of the CrowdStrike outage, including whether it could result in customers abandoning CrowdStrike in favor of alternative cybersecurity providers. Analysts have suggested that Palo Alto Networks could attract new customers as a result.

TD Earnings Preview

Analysts have reached a consensus estimate that $The Toronto-Dominion Bank (TD.CA)$'s Q3 earnings will show a 2.73% decrease in revenue compared to the same quarter last year, along with a 25.78% increase in EPS, according to moomoo.

UBS analyst says expectations for slow earnings growth and regulatory overhang will weigh on the stock. While TD's valuation is among the "most dislocated" in the group, regulatory issues are an overhang on the stock in the medium-term, the analyst tells investors in a research note. The firm forecasts low-single digit earnings growth in fiscal 2024, below the mid single digit industry average, due to the challenging macro and elevated expenses.

BMO analyst Sohrab Movahedi states that the company reported a broad-based Q2 earnings beat, with noteworthy mention of results above expectations in Wealth & Insurance and Wholesale Banking, but there were no updates on U.S. anti-money-laundering investigations, the analyst tells investors in a research note. The uncertainty around this issue in the U.S. remains a headwind, BMO added.

Key Macroeconomic Data

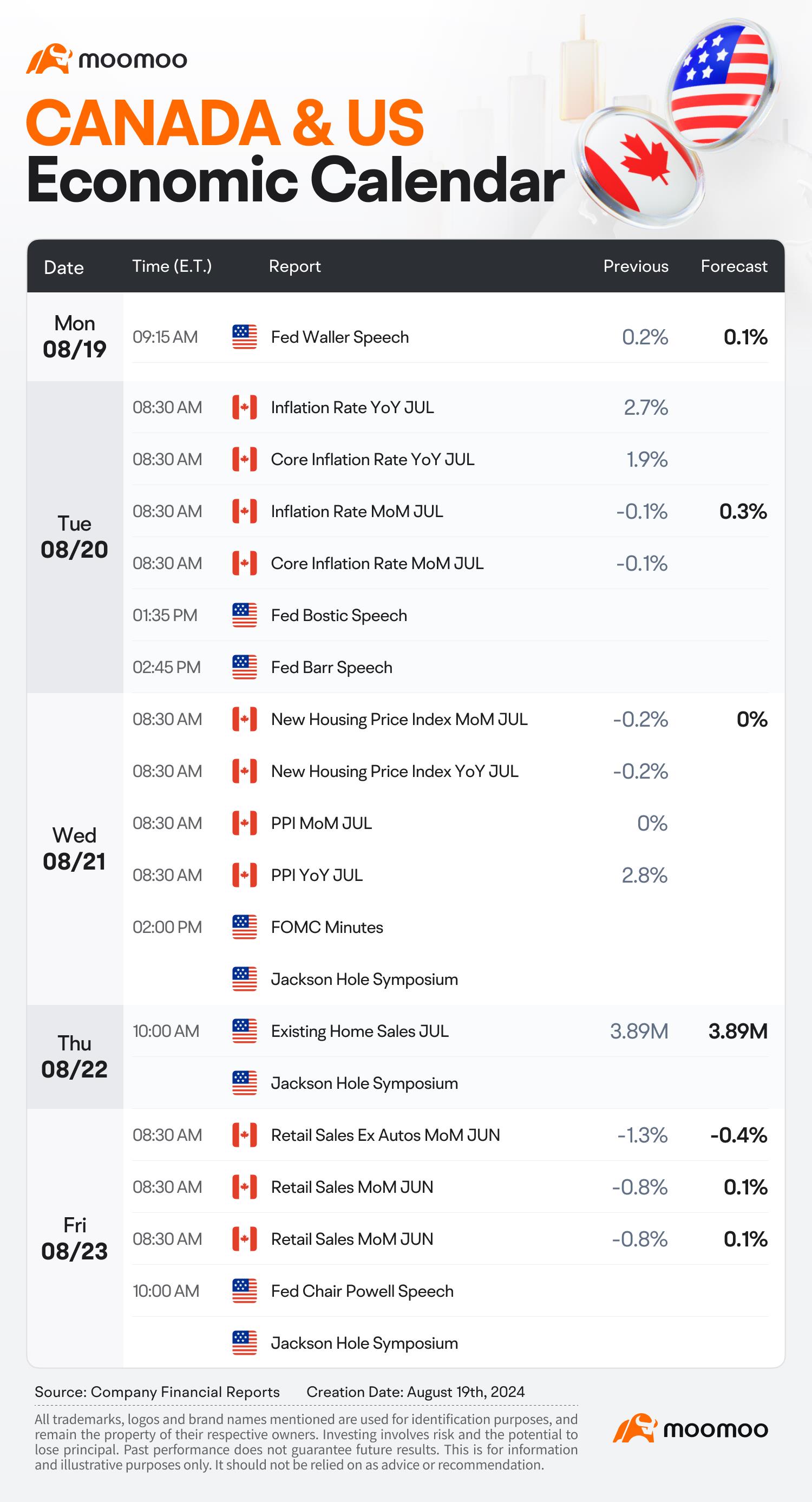

In the week ahead, investors are advised to closely monitor several key macroeconomic events that could significantly impact the market. These events include the release of the FOMC minutes, a speech by US Fed Chair Jerome Powell at the Jackson Hole Economic Symposium, and global economic trends.

The FOMC minutes, scheduled for Wednesday, and Powell's speech at the Jackson Hole Economic Symposium on Friday, August 23, will be closely observed by global investors. They are eager to gain insights into the Fed's monetary policy outlook and its updated assessment of US economic growth. The symposium is strategically timed just before the September policy meeting, where the Fed is expected to initiate a rate cut cycle. While most experts anticipate a 25 basis point reduction in the Fed funds rate in September, some economists suggest that the possibility of a 50 basis point cut may increase if there are further signs of weakness in the labor market.

In addition to the FOMC minutes and Powell's speech, investors will also be closely monitoring various economic data releases next week. These include the weekly jobs data, US existing home sales, and new home sales data new home sales data from the US, as well as inflation data for July from Europe and Japan. Flash numbers for the manufacturing and services PMI in August from several key economies will also be watched closely.

Recent inflation in Canada has shown a slowing trend. On Tuesday, projections indicate that July's annual inflation rates are expected to remain unchanged at 2.7% for the headline rate and 2.9% when excluding food and energy. The primary driver, shelter inflation, is also decelerating, partly due to the falling mortgage interest costs (MIC) resulting from lower interest rates. Excluding MIC, the consumer price index has hovered around the 2% target since the start of the year.

The Bank of Canada (BoC) is more concerned with the trajectory of inflation rather than its current state. The three-month rolling average for the BoC's preferred median and trim core inflation metrics is set to rise modestly for the second consecutive month, attributable to a small increase in April no longer being included in the calculation. However, due to softer readings earlier, the yearly growth rates for these metrics are anticipated to keep declining. Despite initial worries that interest rate reductions by the BoC might trigger a surge in housing prices, the market reaction to the 25 basis point cuts in June and July has been subdued, with signs that rent price inflation is also slowing down.

The broader economic and job market weakness is expected to exert downward pressure on inflation. The per-capita GDP has continued its downward trajectory in Q2, and the unemployment rate in July has increased by nearly one percent from the previous year, alongside decreases in job vacancies and wage growth. BoC Governor Tiff Macklem has recently expressed increased confidence that inflation will trend downward, though not without potential setbacks, following the July rate cut. Given that the current rates are considerably higher than what the BoC considers normal for the long term, it is predicted that the BoC will implement 25 basis point rate cuts in the upcoming September and October meetings.

Source: Trading Economics, Dow Jones, Market Watch, CNBC, RBC Economics

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

74423696 : Thank you so much .

Options Newsman 74423696 : My pleasure![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)