The Week Ahead(WPM, PBH, ORCL and ADBE Earnings; Inflation Data)

The upcoming week in the US is poised for scrutiny as earnings reports and pivotal economic indicators are set to be released. Tuesday's CPI will shed light on inflation trends, while Thursday's retail sales will offer further insight into the economic landscape. $Oracle (ORCL.US)$ is set to release its earnings result on Monday while $Adobe (ADBE.US)$ and $Dollar General (DG.US)$ will announce on Thursday.

While in Canada, it's a fairly light week for potential market impacts, as we await the CPI figures later this month. Manufacturing and wholesaling data, as well as the upcoming housing starts figures set to be released on Friday, are worth paying attention to. Besides, we will see earnings reports from Canadian listed companies including $Ballard Power Systems Inc(BLDP.CA)$, $Wesdome Gold Mines Ltd(WDO.CA)$, $Empire Co Ltd(EMP.A.CA)$, $Wheaton Precious Metals (WPM.US)$ among others.

Earnings Calendar

Oracle Earnings Preview

Software giant $甲骨文(ORCL.US)$is scheduled to release its quarterly financial results after the market closes on Monday. The company's shares have been underperforming recently, yet the upcoming fiscal third-quarter earnings report presents an opportunity for the tech behemoth to showcase its prowess in the artificial intelligence sector.

Consensus estimates from FactSet suggest that Oracle is anticipated to report a 13% boost in adjusted earnings to $1.38 per share. Revenue is also forecasted to experience a growth of 7%, reaching $13.3 billion.

Analysts are particularly optimistic about the performance of Oracle's cloud services and license support segment, which encompasses the company's subscription-based software products. This division is expected to see an 11.4% increase in sales, totaling $9.9 billion.

Furthermore, Oracle's net income for the quarter is projected by Wall Street experts to ascend by 14%, hitting $3.87 billion.

Adobe Earnings Preview

$Adobe(ADBE.US)$has seen a shift in its standing within the stock market, with evidence of increased selling by institutions casting a shadow over its former leadership position. The stock has yet to make a significant comeback since taking a steep fall on February 16th, an event that aligned with the disclosure by OpenAI—supported by $微软(MSFT.US)$—of their intent to release a text-to-video generator that competes with Adobe's offerings.

As the market anticipates the announcement of Adobe's financial results for the quarter ending in February, which is scheduled for Thursday after the closing bell, analysts have set their expectations. They predict a profit of $4.38 per share, marking a 15% rise from the same period the previous year. Furthermore, Adobe's revenue is anticipated to show a 10% increase, reaching an estimated $5.13 billion.

Wheaton Precious Metals Earnings Preview

The market expects $Wheaton Precious Metals (WPM.US)$ to deliver a year-over-year increase in earnings on higher revenues when it reports results for the quarter ended December 2023. This widely-known consensus outlook is important in assessing the company's earnings picture , but a powerful factor that might influence its near-term stock price is how the actual results compare to these estimates.

The earnings report, which is expected to be released on March 14, 2024, might help the stock move higher if these key numbers are better than expectations. On the other hand, if they miss, the stock may move lower.

This company is expected to post quarterly earnings of $0.31 per share in its upcoming report, which represents a year-over-year change of +34.8%.

Revenues are expected to be $278.7 million, up 18.1% from the year-ago quarter.

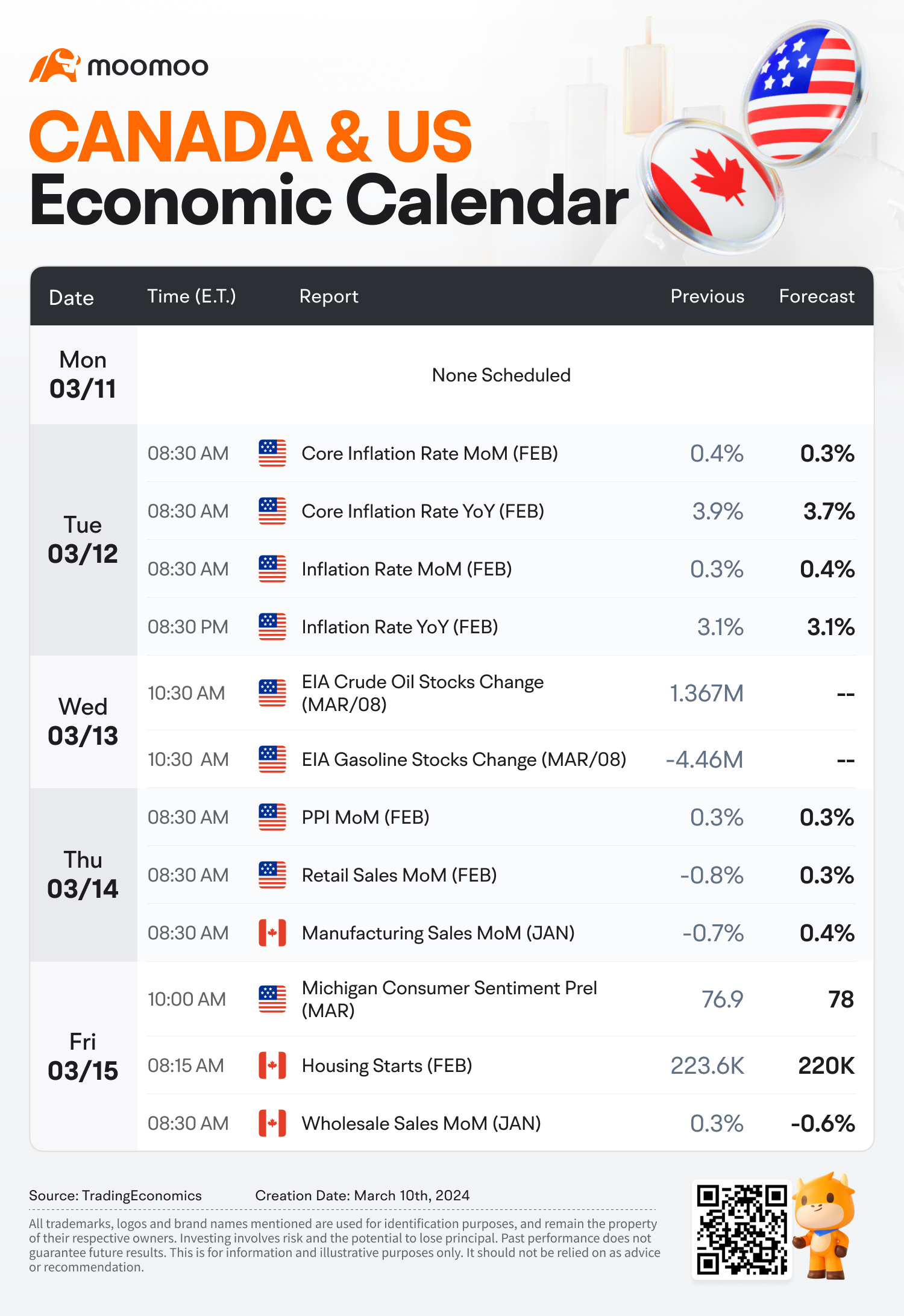

Economic Calendar

In the US, inflation numbers will be in the spotlight on Tuesday as U.S. Federal Reserve officials consider when it might be appropriate to begin lowering interest rates.

Economists are expecting a slight uptick in the monthly CPI figures, suggesting an increase from the previous month's numbers, while the annual inflation rate is projected to hold steady. According to surveys conducted by FactSet, the anticipated rise for the headline CPI on a month-over-month basis is 0.4%, which is a step up from the last reported increase of 0.3%. The year-over-year inflation rate is forecasted to remain constant at 3.1%.

Looking at the Core CPI, which removes the more unpredictable food and energy prices from the equation, a minor decrease in inflation's pace is projected. On a month-to-month and year-to-year basis, economists are estimating increases of 0.3% and 3.7%, respectively. These figures represent a slight reduction from the 0.4% monthly and 3.9% annual increases reported in January.

Nevertheless, Wall Street's focus will be particularly sharp on areas of the economy where inflation has been persistently high. The January CPI report highlighted concerns about rising costs in several sectors, including medical care, transportation, and airline fares. Of special note to consumers was the inflation in the cost of food consumed outside the home. A significant factor contributing to inflation was the increase in shelter costs, driven by a relentless climb in home prices as the demand for housing continues to surpass supply.

In Canada, we don't build as many homes in the winter, but when winter seems a bit like spring in parts of the country, that can help lift seasonally adjusted starts. We might see a pop in February housing starts figures as a result. Manufacturing and wholesaling data are likely to present a mixed picture of economic activity in January. Overall, it's a fairly light week for potential market impacts, as we await the CPI figures later this month.

Source: CIBC, Trading Economics, RBC, CanadianInsider

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Jacob Krahn3 : Hi, it's been very good.

FARAMARZ AKBARY :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)