List price and net price are two key pricing metrics in the US drug industry. List price refers to the retail price at the terminal market, or the price at which Lilly is selling Zepbound for $1,059.87. However, this price does not all go into Lilly's pocket. Lilly must pay rebates and discounts to payers (insurers), PBMs (pharmacy benefit managers), the US government, and other supply chain entities (wholesalers, distributors). The remaining amount that goes into Lilly's pocket is called the net price.

Therefore, net price = list price - distribution - rebates. Since distribution costs are relatively low, net price can be approximated as net price = list price - rebates, and multiplied by total consumption to determine Lilly's gross profit (net sales).

The US drug distribution system is complex, but most of the rebate and discount costs occur through PBMs. Therefore, PBMs have a decisive influence on the final price that drug companies charge.

PBMs have the power to audit physician prescriptions, develop prescription sets, and negotiate drug prices. Data shows that the three largest PBMs in the US control 85% of prescription drug sales.

According to the American Association of Pharmaceutical Scientists (AAPS), "Generic (small molecule) and biosimilar products (large molecule) represent 91% of all prescription drugs but only 18.2% of prescription drug spending."

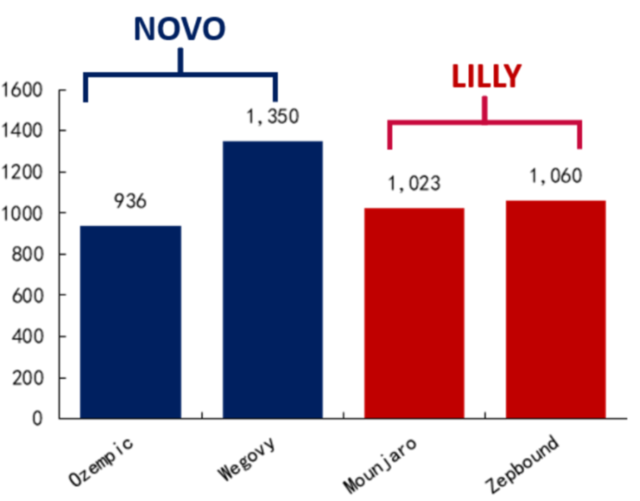

For innovative drugs, PBM plays a crucial role in pricing negotiations. Lilly chose to price Zepbound, a product with better efficacy, 20% lower than Wegovy, possibly because as a US-based company, Lilly receives lower rebates and discounts and can achieve sufficient net price advantages with lower list prices. Additionally, Lilly's lower pricing could attract more terminally ill patients, especially first-time patients.

Since the rebate changes according to product usage and market share, PBM's demand is for the lowest total cost and maximum rebate benefits across all products under an indication. Therefore, each product's pricing factors include various elements such as efficacy, market share, and sales growth within the indication.

PBM's drug rebates are a trade secret and cannot be disclosed. Market assumptions suggest that the difference between net price and list price is usually 20%-30%, but in 2022, this gap could exceed 50% for the top 10 leading pharmaceutical companies in the US. This means that drug makers selling their products in the US are selling at less than half the price (Lilly discloses 65% in the following discussion).

In a report released in 2022, Johnson & Johnson detailed the shocking $39 billion in rebates, fees, and discounts it paid, offering a glimpse into the iceberg of US drug rebates.

Tyler Flanagan : Tyler Flanagan