This $2.25 Stock Soon To Turn A Profit Is Highly Likely To Be Acquired Above $10

This unique biotech $Esperion Therapeutics (ESPR.US)$ Esperion has the only FDA approved statin alternative drugs NEXLIZET & NEXLETOL for Primary Prevention, Statins are a class of prescription drugs that help lower cholesterol levels. They are the most common treatment for high cholesterol, an estimated 21 Million Americans are Statin intolerant and or maxed out on Statin drugs and need additional lowering. Over 71 million Americans take statin drugs, we track prescription growth & expect over 500,000 patients in 2026 will be taking NEXLIZET alone, which will generate over a billion in yearly revenues. Our 2025 year end earnings estimate is $0.25 to $0.35 per share.

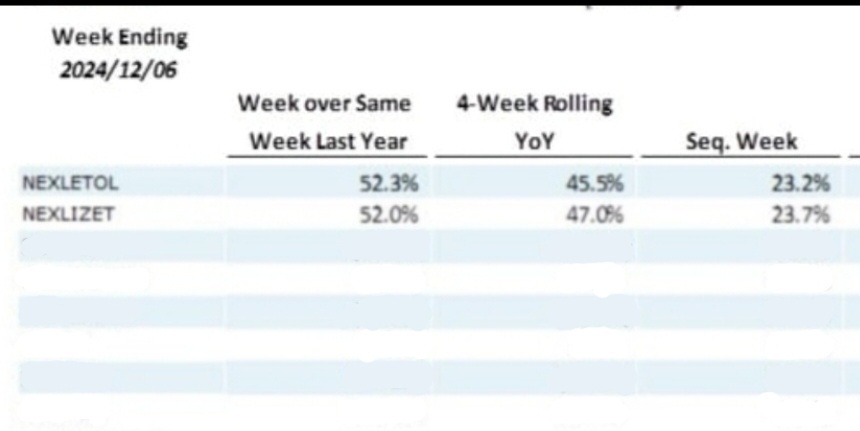

Latest weekly Script growth is exceptional:

ESPR recently traded at all time 52 week high near $4 a share, shares have pulled back on reasons that shouldn't have caused a decline, NEWS competitor NewAmsterdam Pharma’s $NewAmsterdam Pharma (NAMS.US)$ Phase III topline for its novel CETP inhibitor, which had 33% placebo adjusted low-density lipoprotein cholesterol reduction and also early 21% major adverse cardiovascular events benefit at one year. NAMS data compare favorably versus Esperion’s Nexletol, which lowers LDL-C by 25%, NEXLIZET lowers LDL-C by 38% and many patients are seeing 50% lowering, patients do not need to take a statin while on either of ESPR's drugs, NAMS drugs is considered and add on drug to a statin drug and not suggested to be taken by itself at this time. According to current research, based on Phase 3 clinical trials like BROOKLYN, Obicetrapib does not appear to significantly lower hs-CRP levels, with studies showing no notable difference in hs-CRP between the obicetrapib and placebo groups, indicating that it may not directly impact hs-CRP levels despite its effectiveness in lowering LDL-C. Both ESPR drugs do lower hs-CRP levels at 25%.

It is also important to point out $Amgen (AMGN.US)$ Drug Repatha a PCSK9 injection lowers LDL by 55% but offers no hs-CRP reduction, along with $Regeneron Pharmaceuticals (REGN.US)$ PCSK9. NEXLIZET and NEXLETOL stand out among all other statin alternative drugs because they offer hs-CRP reduction and hold the only primary prevention labels. NewAmsterdam’ data isn’t new as BROADWAY is the third Phase III trial that was disclosed and prior data from the company already showed a 35% LDL reduction with Obicetrapib monotherapy. ESPR Stock sell off should not have occurred. NAMS Drug not FDA approved until late 2027 and Insurance will take 18 months or longer to want to cover the drug cost which is predicted to be higher than that of Esperions drugs.

Key points to remember: Nexlizet (a combination of bempedoic acid and ezetimibe) has been shown to significantly lower high-sensitivity C-reactive protein (hsCRP) levels, indicating its potential to reduce inflammation in the body alongside lowering LDL cholesterol levels; clinical studies have demonstrated a reduction in hsCRP when taking Nexlizet compared to placebo.

Inflammation marker: hsCRP (high-sensitivity C-reactive protein) is a marker of inflammation in the body, and elevated levels are linked to increased risk of heart disease, even when cholesterol levels are normal.

Combined risk: Having both high cholesterol and high hsCRP levels significantly increases your risk of cardiovascular events compared to having only one elevated factor.

Lowering both is ideal: While managing your cholesterol through diet and medication is important, actively working to lower your hsCRP levels through lifestyle changes like exercise, healthy diet, and managing other health conditions can also be beneficial.

Reason 2 selloff was not justified on new debt deal: Portfolio manager research note 12/14/2024:

Why we think Esperion Therapeutics is a likely acquisition target, new favorable debt terms.

$Esperion Therapeutics (ESPR.US) is the only pharmaceutical company with statin alternative medications Nexletol & Nexlizet for primary prevention with compounding monthly script growth in a massive market space, Millions of Americans need statin alternative medications, either due to statin intolerance or need additional LDL-C lowering. ESPR now has $188M cash on its books, up from $145M. The new $250M debt is very favorable for shareholders and makes it easy for an acquisition. The previous $265M debt has been paid down by $210M, remains $55M at 4% interest ($2.2M) will be paid in full 11/2025 maturity, going forward ESPR will pay additional $9.7M over previous interest payments, total new debt interest yearly payments are $20,375,000 starting 2025 ($100M at 5.75%) ($150M at 9.75%).

The very good news is that $140M will have been paid by OTSUKA for 2025 along with new royalties that will flow in. The great news is cost of goods expenses are removed by ESPR partner DSE taking over product manufacturing, we estimate savings will equal a minimum of $5.96 per script cost savings X current DSE's 475,000 script count X 12 months. DSE should have over 600k scripts by the end of 2025. we estimate the cost of goods savings at a minimum of $33.9M for the year, expected mid year change over to DSE manufacturing, estimating a minimum of $17M in savings for 2025. Esperion will have a strong profitable 2025. The year-end stock price range is estimated from $7 to $9 on a conservative range. New markets, CANADA, ISRAEL & AUSTRALIA, should generate revenues starting in 2025.

Esperion has now increased as an excellent merger & acquisition candidate based on the new debt structure deal. It is very favorable for investors, along with making it easier for an acquisition. The $150M loan we believe was deliberately arranged as non dilutive with Athyrium Capital Management who funded the entire $150M, while the $100M loan is dilutive above $7.04 a share with a cost of $3.06 equal to 32,679,740 shares, and only dilutive after 12/20/2027 with restrictions on stock price has closed 130% above $3.06 equal to $7.04 a share for 41 consecutive trading days. Potential offers could arise in early 2025, and both Needham & Jefferies analysts anticipate offers for Esperion. HC Wainwright analyst Joseph Pantginis has a $16 PT and hear he believes a $12 to $16 a share buyout offer would be reasonable given the tax loss carry over near $1.5 billion for the acquirer, along with milestones and royalties owed. Omers royalty deal with DSE will 100% divert back to Esperion after $516M has been paid from DSE to Omers, expected in 2028. ESPR has enormous growth potential, having the only primary prevention labels in the foreseeable future, solid patent protection until 2031, with additional patents out to 2040. esperion.com/ne...

Jefferies analyst Dennis Ding note:

NAMS has a current market cap of $2.3 billion, while ESPR has a market cap of under $450 million, it should be the other way around, ESPR entering a growth curve, insurance companies now covering the cost of the drugs, script sales will only continue to grow at a compounding growth rate, milestones and royalties will continue to pour in, with $300 million & $600 million expected within the next 3 years.

Patients are moving away from Statin drugs because of the many side effects: More studies are suggesting now over 30% of patients taking a statin will develop side effects, such as Muscle pain and tendonapathy, Type2 Diabetes, Memory loss, Fatigue, Depression, Low testosterone, Vision problems. The problem with statin drugs is statins get into all the cells in the body, Nexletol works just in the liver, Nexlizet works only in the liver and small intestines, PCSK9 pull cholesterol from the blood and also have side effects, low energy, flu symptoms, difficulty thinking, rashes, swelling at the injection site.

Dr. Peter Attia explains why NEXLIZET & NEXLETOL have NO side effects - YouTube

The Facts are Statin drugs are the #1 most prescribed drugs in the world

Over 10% of people are statin intolerant and over 20% need statin alternative drugs to lower bad cholesterol, such as a PCSK9 injection, $Amgen (AMGN.US)$ Repatha PCSK9 or $Regeneron Pharmaceuticals (REGN.US)$ Alirocumab or $Merck & Co (MRK.US)$ Ezetimibe, or the ONLY Statin alternative drugs with a primary prevention label NEXLIZET as a combo drug with Ezetimibe or NEXLETOL Esperions Bempedoic Acid. we know 71 million Americans that take statin drugs need additional combination lowering to get to a safe LDL-C level. Ezetimibe is only 15% effective by itself and had almost 9 million prescriptions in 2023, that number is set to decline considering the new label for both NEXLIZET and NEXLETOL. NEXLIZET is as effective as a statin and works better than many statin drugs without serious side effects or raised blood sugar, it drops your levels by 40% & some patients over 50% , this drug should easily exceed 2 million scripts on yearly basis by 2028, which would generate a massive amount of revenues.

Doctors expected to prescribe Nexlizet & Nexletol

Amgen $Amgen (AMGN.US)$ and other PCSK9 companies know they will lose market share, a once a day pill is by far the easier and safer option versus an injection, also PCSK9 drugs don't lower HSCRP levels, and that is a BIG concern. NEXLIZET and NEXLETOL significantly lower hscrp levels, they have an edge over statin drugs and pcsk9 injections because they basically have no side effects and do not cause A1C #'s to rise, which is a becoming a serious concern because more and more people are seeing their A1C levels rise while taking a statin drug and at the risk of type 2 diabetes.

$Pfizer (PFE.US)$ has been active in the cardiovascular space and acquiring Esperion would complement its existing portfolio, providing a boost with Esperion's cholesterol lowering drugs, Pfizer's extensive marketing and distribution network could significantly increase the reach and sales of Esperion's drugs.

AstraZeneca $AstraZeneca (AZN.US)$ has a strong cardiovascular franchise and has shown interest in expanding its pipeline in this therapeutic area. Esperion's products would enhance AstraZeneca's offerings, especially given the complementary nature of their drug portfolios.

Novartis $Novartis AG (NVS.US)$ has also been expanding its cardiovascular and metabolic disease portfolio. Acquiring Esperion could fit, adding innovative therapies that align with Novartis's focus on cardiovascular.

Merck $Merck & Co (MRK.US)$ Is developing a PCSK9 pill that could come to market by 2030 yet it would be wise for Merck to snap up Esperion now before NEXLIZET becomes a blockbuster drug. Merck could easily offer a stock deal that could be very favorable and value ESPERION near the $15 per share valuation. MRK has an oral PCSK9 in trials that will be completed in Nov 2029. So won't come to market until 2030. it takes additional years for the FDA to grant a primary prevention label.

AstraZeneca $AstraZeneca (AZN.US)$ has a strong cardiovascular franchise and has shown interest in expanding its pipeline in this therapeutic area. Esperion's products would enhance AstraZeneca's offerings, especially given the complementary nature of their drug portfolios.

Novartis $Novartis AG (NVS.US)$ has also been expanding its cardiovascular and metabolic disease portfolio. Acquiring Esperion could fit, adding innovative therapies that align with Novartis's focus on cardiovascular.

Merck $Merck & Co (MRK.US)$ Is developing a PCSK9 pill that could come to market by 2030 yet it would be wise for Merck to snap up Esperion now before NEXLIZET becomes a blockbuster drug. Merck could easily offer a stock deal that could be very favorable and value ESPERION near the $15 per share valuation. MRK has an oral PCSK9 in trials that will be completed in Nov 2029. So won't come to market until 2030. it takes additional years for the FDA to grant a primary prevention label.

$Johnson & Johnson (JNJ.US)$ is another company that would do well to acquire Esperion, Interesting is Esperion former Chief medical Officer is now at JNJ,

Esperion currently has 18% of the float held short, if investors in $GameStop (GME.US)$ $Chewy (CHWY.US)$ $AMC Entertainment (AMC.US)$ with #wallstreetbets seriously researched Esperion they would realize how deeply undervalued the company is and recognize the upside reward is incredible. I doubt you will find another biotech or company that is valued so low and could generate billions on a yearly basis, investing in ESPR now is like buying some of these big names before the massive upside returns, such as $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$ $AST SpaceMobile (ASTS.US)$ $SoundHound AI (SOUN.US)$ $Alphabet-C (GOOG.US)$ $CrowdStrike (CRWD.US)$ $Coinbase (COIN.US)$ $Qualcomm (QCOM.US)$ $Spotify Technology (SPOT.US)$ $Adobe (ADBE.US)$ $Lululemon Athletica (LULU.US)$ $Oracle (ORCL.US)$ $Palo Alto Networks (PANW.US)$ $Carvana (CVNA.US)$ $Dell Technologies (DELL.US)$ $Arista Networks (ANET.US)$ $Applied Materials (AMAT.US)$ $Texas Instruments (TXN.US)$ $Ulta Beauty (ULTA.US)$ $Synopsys (SNPS.US)$ $Cummins (CMI.US)$ $Trump Media & Technology (DJT.US)$ $KLA Corp (KLAC.US)$ $GE Aerospace (GE.US)$ $Intuitive Machines (LUNR.US)$ $Netflix (NFLX.US)$ $Apple (AAPL.US)$ $Regeneron Pharmaceuticals (REGN.US)$ $Jazz Pharmaceuticals (JAZZ.US)$ $C3.ai (AI.US)$ $Palantir (PLTR.US)$ $Snowflake (SNOW.US)$ $Costco (COST.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Uber Technologies (UBER.US)$ $Lyft Inc (LYFT.US)$ $Core Scientific (CORZ.US)$ $Moderna (MRNA.US)$ $MARA Holdings (MARA.US)$ $Riot Platforms (RIOT.US)$ $Tilray Brands (TLRY.US)$ $Viking Therapeutics (VKTX.US)$ $Meta Platforms (META.US)$ $Novavax (NVAX.US)$ $Broadcom (AVGO.US)$ $Intel (INTC.US)$ $Tesla (TSLA.US)$ $Super Micro Computer (SMCI.US)$ $Salesforce (CRM.US)$ $Micron Technology (MU.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

10xStockPicks OP : This is the correctly edited research report. Previous article has a few typos. Special thanks to Fund manager John for his notes. Please do your own research. I firmly believe ESPR will be a solid bet.