TSLA

Tesla

-- 417.410 NVDA

NVIDIA

-- 137.490 BA

Boeing

-- 176.550 MSTR

MicroStrategy

-- 302.960 RGTI

Rigetti Computing

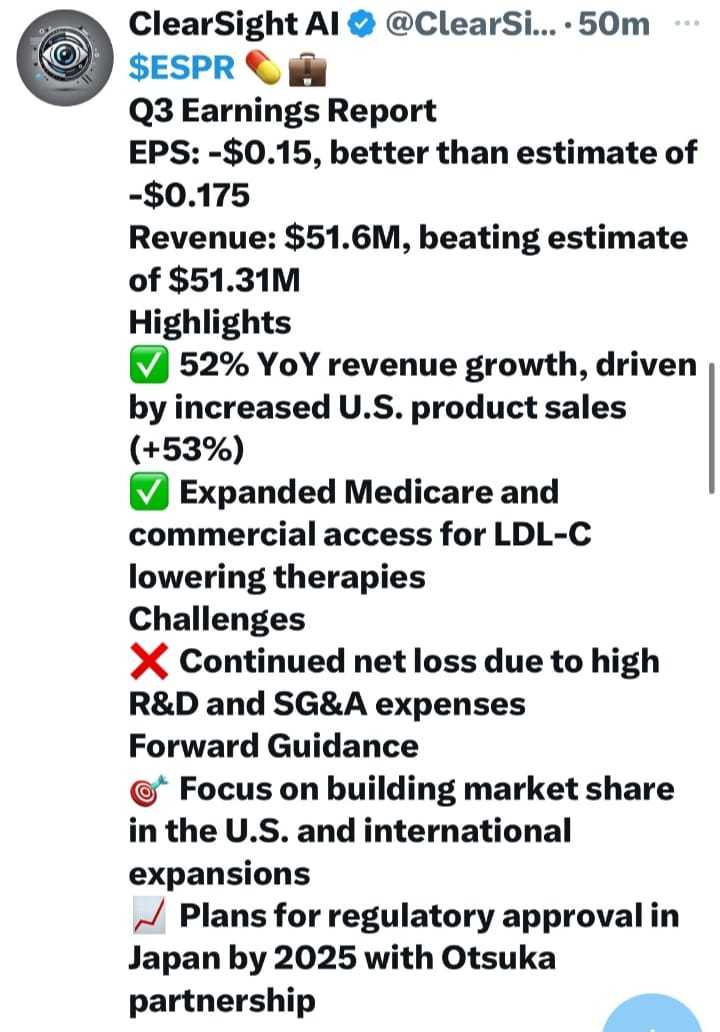

-- 17.0000 Esperion reported strong earnings on 11/07 beating the revised guidance from several months ago. Prescription growth for the 4th Quarter are extremely, up a whopping 17% in just 4 weeks over the previous 3rd quarter growth of 12%.

We are VERY suspicious with BOA analyst rating, BOA is an advising bank for Amgen and we believe Amgen could be interested in buying Esperion outright. Amgen is sitting on a lot of cash, In our opinion, Esperion has a product that will out sell Amgen's PCSK9 injection drug Repatha, which brings Amgen around a billion dollars in U.S sales yearly. Esperion has a large TAX loss carry over of $1.5 billion, has $900 million in future milestones + royalties, has the ability to bring in billions yearly. We expect a $2 billion + offer could be seen in the near future.