Focus of this week

The US March CPI data came in unexpectedly high, which has reduced investors' expectations of a near-term interest rate cut by the Federal Reserve. The March PCE price index, which is the inflation indicator the Fed pays the most attention to, is expected to remain high, reinforcing market expectations for patience on rate cuts. According to market forecasts, the March PCE index may have a slight increase of 2.6% YoY due to rising energy costs.

In terms of economic growth, the US first quarter real GDP is expected to increase by only 2% on an annualized QoQ basis, a significant slowdown compared to the previous quarter's 3.4%. This indicates that the US economy is starting to show signs of deceleration under the influence of sustained high interest rates. However, last year, the US economy demonstrated some resilience, primarily due to growth in consumer spending and local government expenditure.

In terms of policy outlook, Federal Reserve officials may need to reevaluate their strategy against inflation, as current data shows a stagnation in progress against inflation. This could mean that the Fed will need to maintain interest rates at higher levels for a longer period than expected.

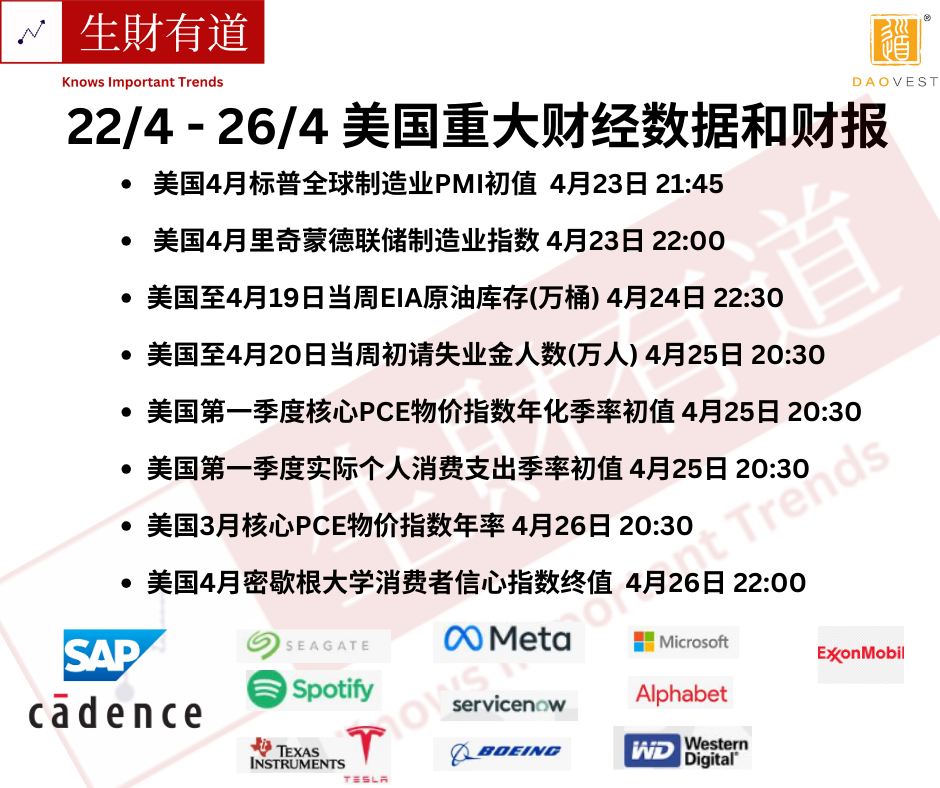

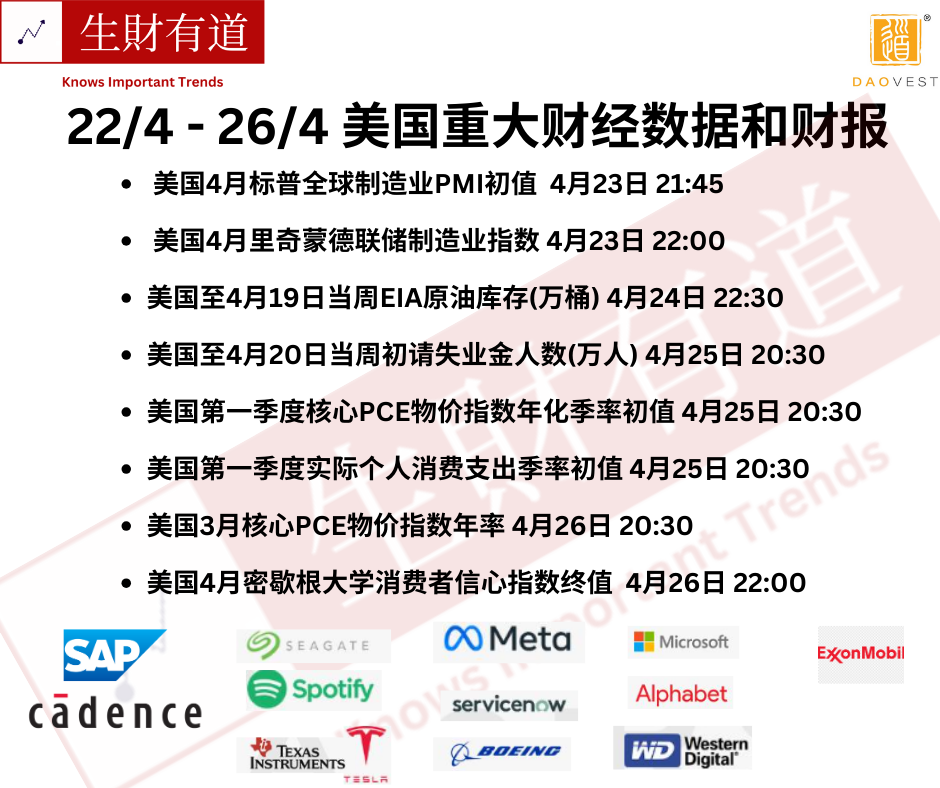

This week is also an important week for corporate earnings reports, as many industry giants will release their quarterly performances. The market will closely monitor these reports to assess the health of the economy and various industries. These data and reports will have a significant impact on market sentiment and policy expectations.

$SAP SE (SAP.US)$ $Cadence Bancorp (CADE.US)$ $Seagate Technology (STX.US)$ $Tesla (TSLA.US)$ $Spotify Technology (SPOT.US)$ $Texas Instruments (TXN.US)$ $Meta Platforms (META.US)$ $ServiceNow (NOW.US)$ $Boeing (BA.US)$ $Microsoft (MSFT.US)$ $Alphabet-A (GOOGL.US)$ $Western Digital (WDC.US)$ $Exxon Mobil (XOM.US)$

======= 我是分割线 =======

MY Moomoo account opening link🔗

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment