●

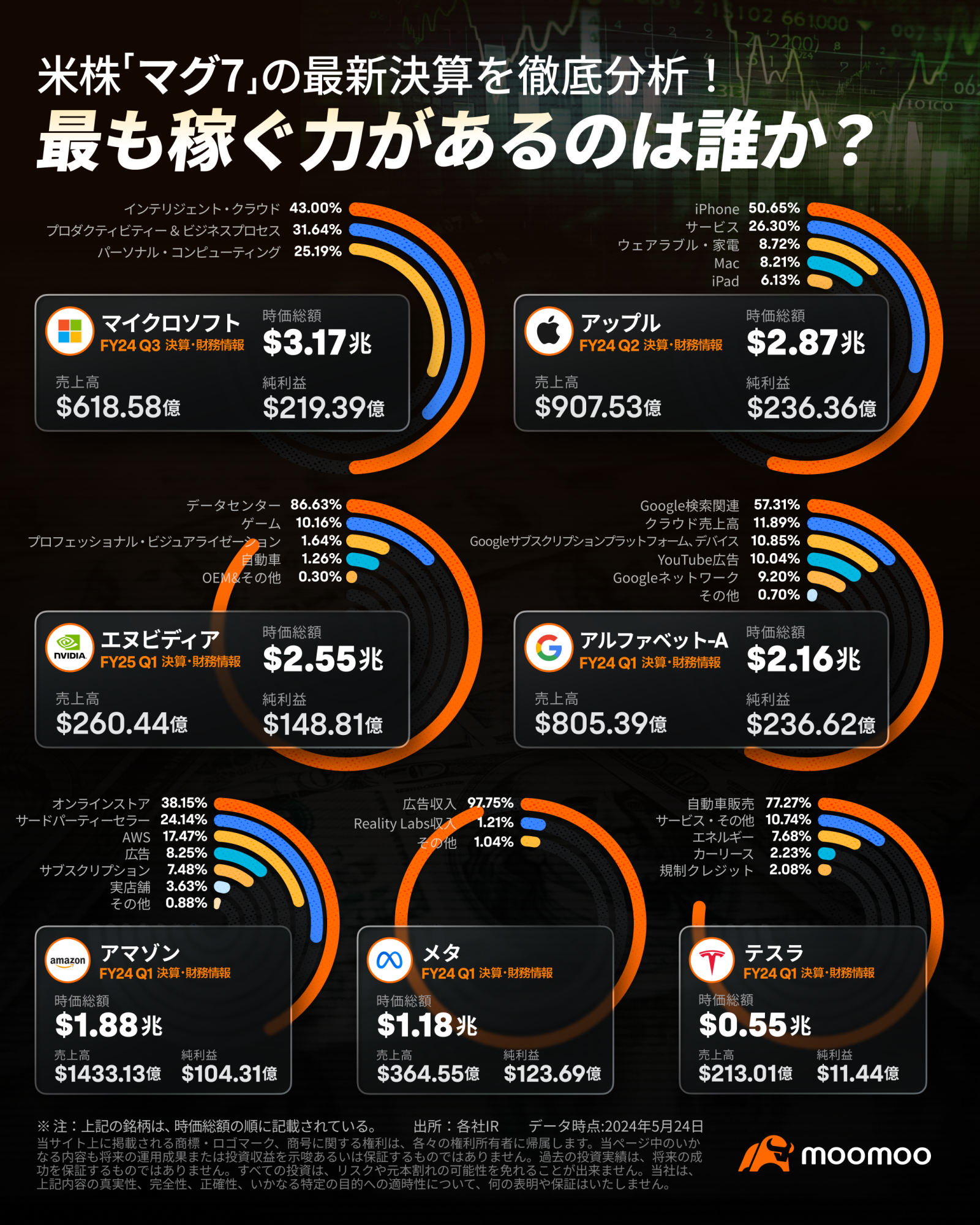

$Amazon (AMZN.US)$ Amazon Cloud Services (AWS) sales increased 17% to 25 billion dollars. Andy Jassy, the president and CEO of Amazon, pointed out in the financial results report that the growth of AWS was driven by modernization of infrastructure and enhancement of AI functions.

●

$Microsoft (MSFT.US)$Sales of the cloud business exceeded 35 billion dollars, an increase of 23% from the previous year. Among them, sales of Azure and other cloud services increased 31%, and AI services contributed to 7 point growth.

●

$Alphabet-A (GOOGL.US)$Cloud sales increased approximately 28% from the same period last year to 9.57 billion dollars, driven by strong performance of the Google Workspace product line.

$Alphabet-C (GOOG.US)$The Chief Executive Officer (CEO) pointed out the strong performance of search, YouTube, and cloud computing. Google, which has demonstrated leadership in AI research, infrastructure, and broad coverage of global products, also stated that it is expected to be in an advantageous position against the next wave of AI.

●

$Meta Platforms (META.US)$Nearly all of the company's revenue (98%) comes from the digital advertising business, and AI is an important driver of the growth achieved in this business. Meta stated in its financial results report that Llama 3, which is the latest AI model, has been integrated into Meta AI, and it is expected that this AI will first be deployed in the English-speaking world, and it is expected that it will expand even more languages and countries in the next few months.