Of the ~$9.5B valuation, only $660M is being raised through IPO. Of that $660M, flagship investors have bought approximately $450M. That leaves only ~$200M for purchase for the general public. This tells me their goal is to give employees and investors a direct way to cash out shares.

Also, they have a strong balance sheet and are profitable. They don't need to raise money.

2. Competition is the biggest concern.

I'm always hesitant to invest in companies competing with big tech, especially one with the resources and delivery expertise of

$Amazon (AMZN.US)$ .

3. This is a cheap IPO price.

This is not an expensive IPO.

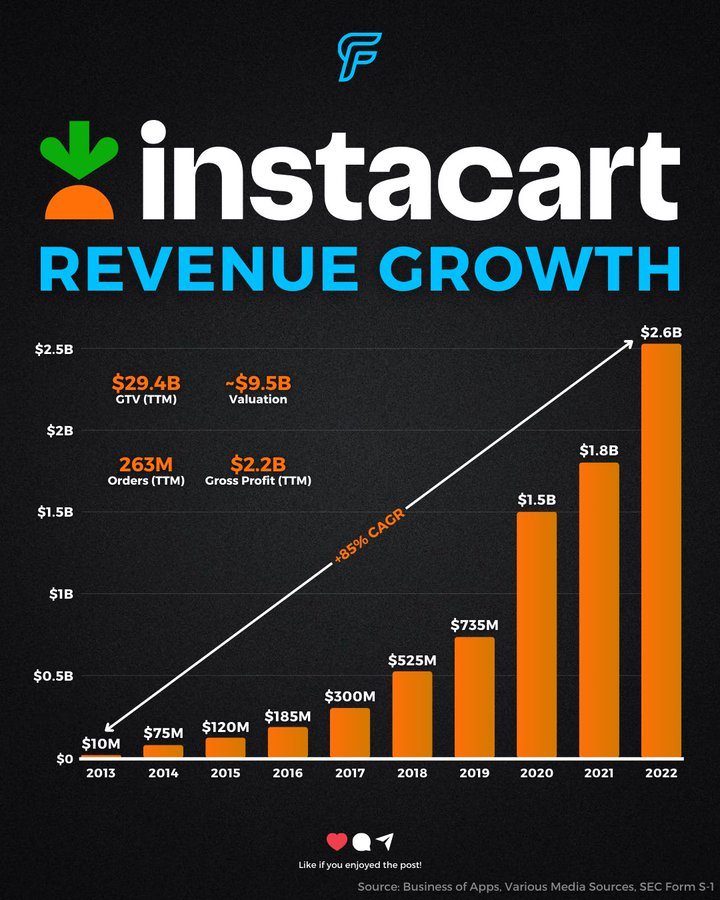

$Maplebear (CART.US)$ has a P/S of ~5 and a P/E of ~29 with a valuation of $12.5B. This is after seeing 31% YoY revenue growth through the first 6 months of 2023. Gross profit grew 44% over the same time period. If Instacart continues to successfully grow or is acquired by a larger company, this will be a great price to pay.

4. Final thoughts

Competition is always my biggest concern with small tech companies, so I won’t be buying the IPO.

However, if you are a fan of Instacart's product and believe they can defend against competition, this will be a great price to pay.

KingNY-Life : Isn't the net market ratio 48 times higher? Net assets of the balance sheet as of the second quarter were less than 200 million US dollars. Is this strong? Are you a trustee?