Timing is Everything: Here's 2025 Calendar for Options Traders

Looking back at 2024, the options market experienced some thrilling events: the return of the meme-stock mania 2.0, an IV crush in $Trump Media & Technology (DJT.US)$ after Trump won the election, and a record-breaking $6.5 trillion in options expiring on the last 'Triple Witching Day' of the year.

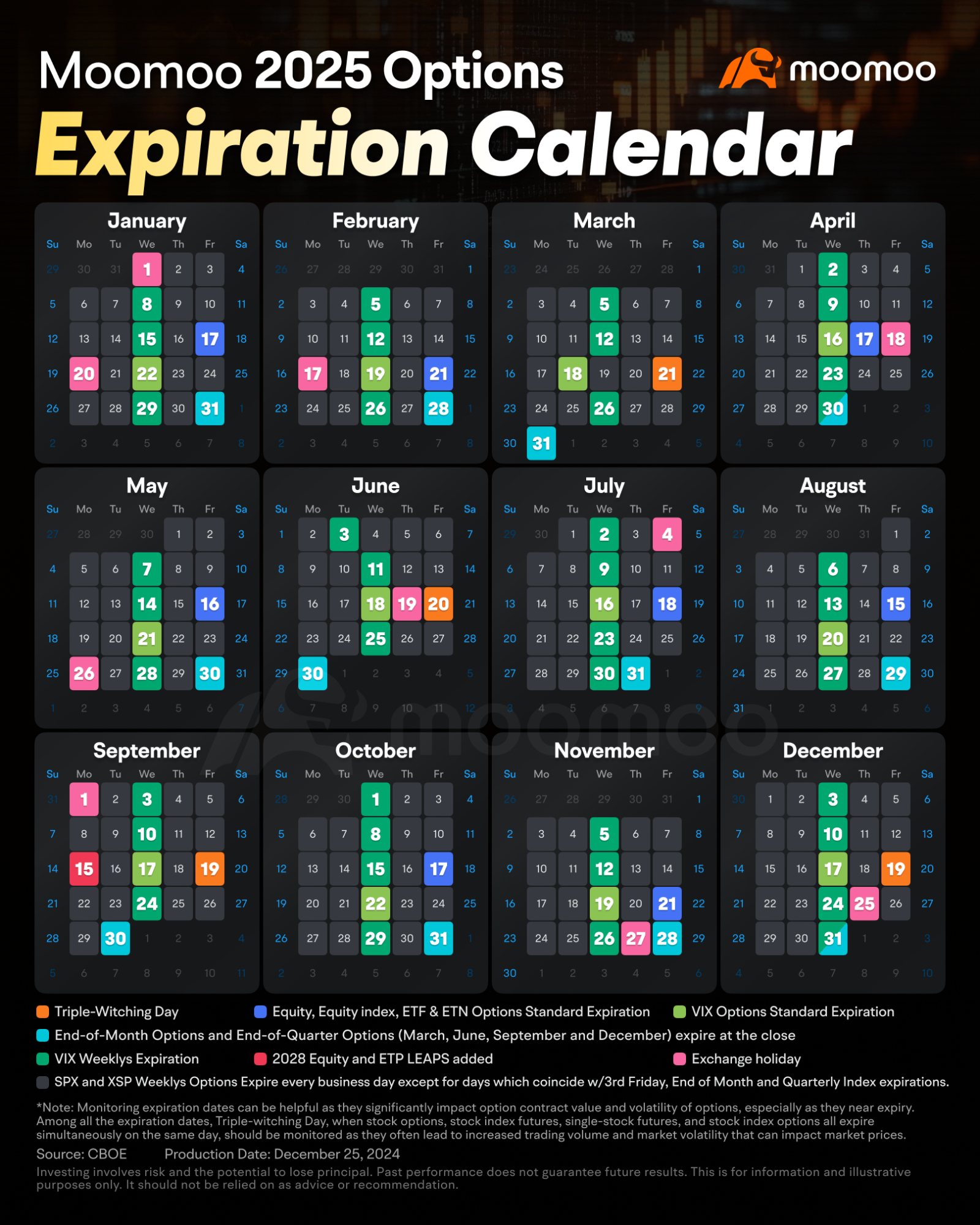

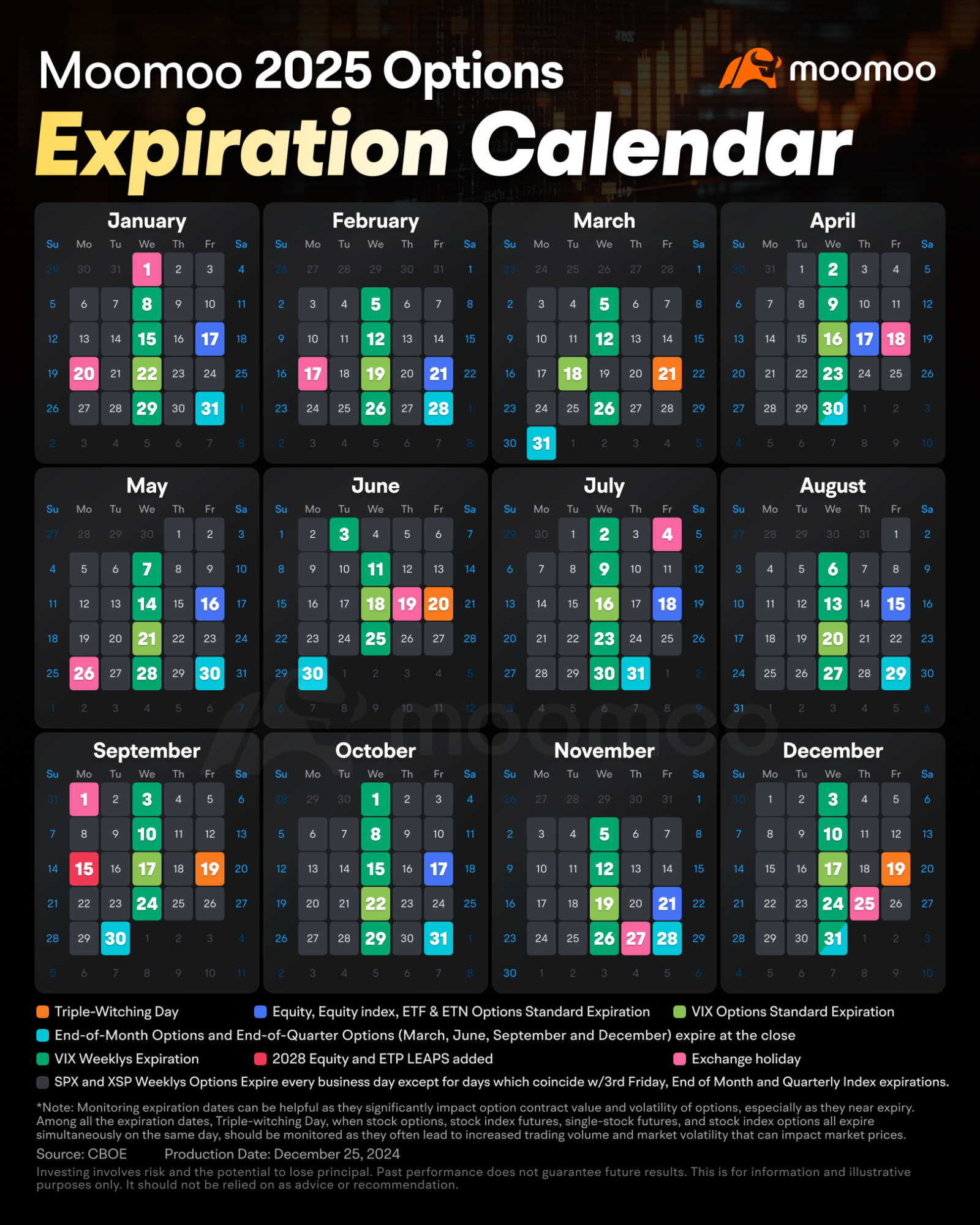

Looking ahead to 2025, what big events will occur in the options market? Check out the 2025 options trading calendar in one chart.

Triple Witching Day

"Triple Witching" refers to the simultaneous expiration of stock options, index options, and index futures contracts. It occurs four times a year—on the third Fridays of March, June, September, and December—and can be known to trigger sharp price movements as traders roll over their existing positions or start new ones.

However, although it is still a closely watched event, the rise of shorter-term options has allowed traders to hedge risk in a more granular way, leaving them less reliant on contracts expiring the third Friday of the month and taking some of the drama out of triple-witching.

“Each specific expiration has less impact these days because there are so many expirations thanks to daily options,” said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group.

Additionally, for the majority of long-term buy-and-hold investors, the volatility exhibited on triple-witching days shouldn’t be ominous. Unusual price movements are often short-lived and, because investors know triple-witching is happening, turbulence is unlikely to materially change market sentiment.

VIX Options Expiration

VIX options typically expire on Wednesday. If that Wednesday and Friday of the month are Exchange holidays, the expiration date is moved up to the preceding Tuesday. VIX options are traded frequently, providing investors with good liquidity, meaning investors can usually buy and sell without disruptions or delays when a broker fills a trade.

VIX options are powerful instruments that traders can add to their arsenals. They isolate volatility, trade in a range, have high volatility of their own, and cannot go to zero.

For those who are new to options trading, the VIX options are even more exciting. Most experienced professionals who focus on volatility trading are both buying and selling options. However, new traders often find that their brokerage firms do not allow them to sell options. By buying VIX calls, puts, or spreads, new traders gain access to a wider variety of volatility trades.

However, investors must be aware that options trading entails significant risk and is not appropriate for all customers. Options transactions are often complex, and it's possible to lose the entire principal invested, and sometimes more.

As an options holder, you risk the entire amount of the premium you pay. But as an options writer, you take on a much higher level of risk. For example, if you write an uncovered call, you face unlimited potential loss, since there is no cap on how high a stock price can rise.

Source: CBOE, Investopedia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104476495 : h

ScandiMan : interesting

Laine Ford : It time to make money for the future to come good stock future

iceguy : good

Adrianlim90 : 1

KWSeow : What does it take to truly read an article?

Alice Lim choo :

105232125 : good

102377918 : Good.

103762341 : I see

View more comments...