Stock indicators in use [Part One]: DKW long-short trend market indicators

$NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ Thank you all for your attention and support, in the following we will introduce in detail the usage techniques of our custom indicator code in 6 articles, this article will first introduce the usage techniques of DKW.

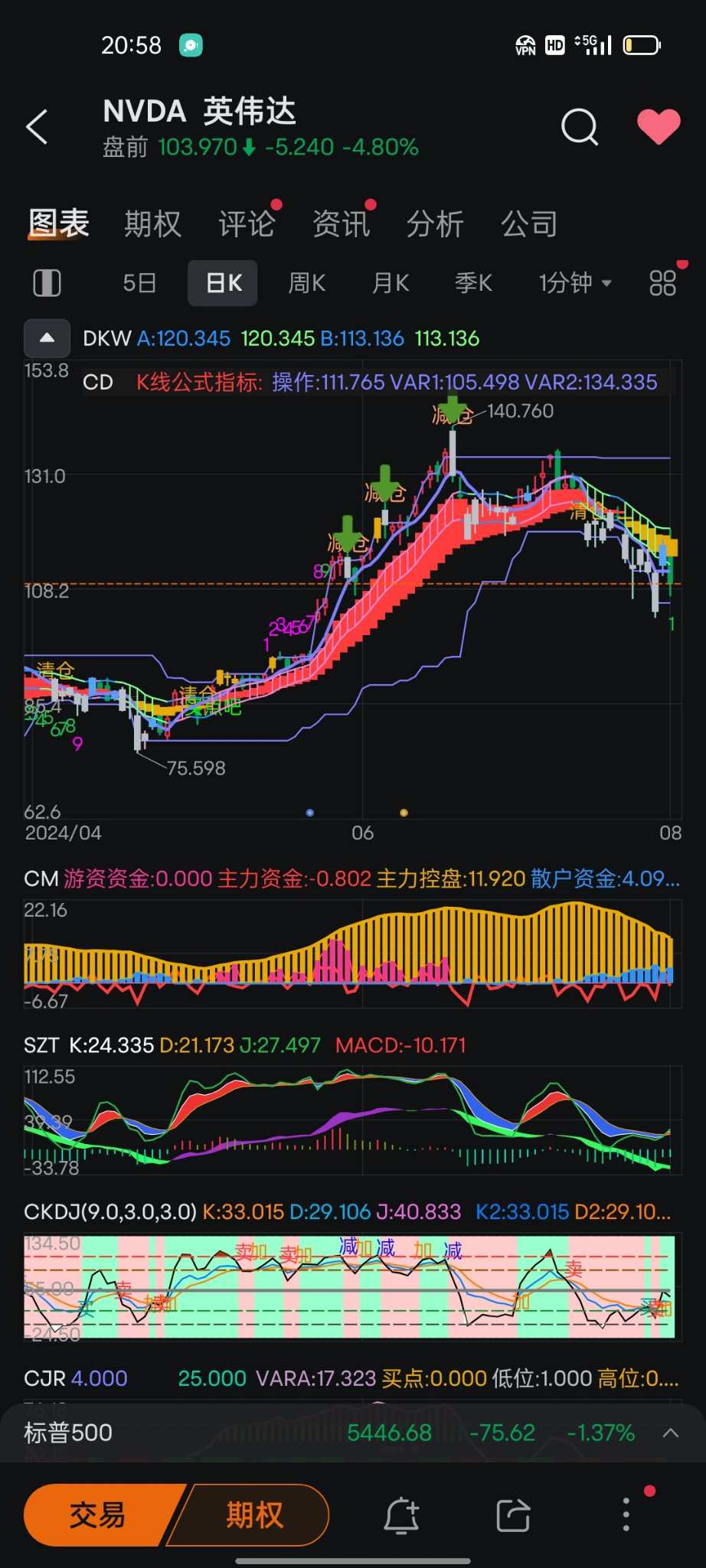

![Stock indicators in use [Part One]: DKW long-short trend market indicators](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20240803/1722652246998-random3397-103623318-android-compress.jpg/big?area=999&is_public=true)

First of all, let's understand the usage techniques of these 6 core indicators.

DKW: a trend indicator for both long and short positions, judging long and short trends with a dual-color ladder, determining buy and sell points based on the nine-transformed structure numbers [1-9] and arrow hints.

CD: bottom-fishing signal indicator, red represents a bullish market, orange-yellow represents a bearish market. By following the changes in the color of the DKW trend ladder and the color changes and signals of the CD indicator [buy point, clear position], you can find a relatively suitable buy and sell point.

CM: chip indicator, orange-yellow indicates the entry of block orders, usually in a bullish uptrend; blue indicates retail funds, usually in a bearish downtrend. When speculative funds enter a stock, it indicates a potentially strong outbreak in the short term, with a very bright increase.

STZ: three-wave resonance indicator, optimized in combination with the advantages of KDJ, MACD indicators, enhances the accuracy of DKW buy and sell points, requiring coordinated use.

CKDJ: a super stochastic indicator. It strengthens the accuracy of DKW, CD, and STZ indicators based on the strength of stock price trends and overbought/oversold phenomena.

CJR: a super trend intervention indicator. It identifies overbought and oversold phenomena in stocks and should be used in conjunction with CKDJ and STZ to verify the accuracy of each signal.

Now let's take a look at the techniques for using DKW.

(1) How to determine the long and short trend market: The double-color ladder represents the long and short trend market. When the pink ladder appears, it is usually accompanied by the nine-turn structure and the pink number [1] prompt. At this time, if there is block order entering according to the CM chip indicator, then you can consider entering the long position. When the bullish market continues and the nine-turn structure prompts the number [9], it is mostly the high point of short-term market, so be cautious and consider exiting near this position.

![Stock indicators in use [Part One]: DKW long-short trend market indicators](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20240803/1722652251261-random3896-103623318-android-org.jpeg/big?area=999&is_public=true)

![Stock indicators in use [Part One]: DKW long-short trend market indicators](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20240803/1722652252604-random1921-103623318-android-org.jpeg/big?area=999&is_public=true)

When the ladder appears in green and the nine-turn structure prompts the green number [1], the candlestick chart is gray, and when the CM indicator sees that retail investors are entering, you can consider taking profit, stop loss, or buying put positions. Usually, DKW is used in combination with the CD indicator. When using the double-color ladder and the nine-turn structure as buying and selling points, you need to consider the individual stock market situation, whether it is a one-sided bullish market, a one-sided bearish market, or a volatile market.

![Stock indicators in use [Part One]: DKW long-short trend market indicators](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20240803/1722652253810-random7378-103623318-android-org.jpeg/big?area=999&is_public=true)

(2) How to determine the buying and selling points of individual stocks:

When a stock falls a certain distance and there is a rebound demand, consider buying when the following conditions appear on the indicators:

a. When the 1-minute candlestick chart shows blue color

b. When the ladder color changes from green to pink

c. When the color area of the bottom-fishing indicator gradually narrows

d. When the indicators STZ and CKDJ are trending upwards

e. When the CM chip indicator shows alternating red and green colors of block orders

After most of the above conditions are met, you can consider entering the buying point. Here, I would like to remind everyone to be cautious. Indicators are not omnipotent. Indicators only help improve accuracy when making judgments, and cannot rely entirely on operational prompts from indicators. The use of specific code for each indicator needs to be trained and studied by each individual. Please feel free to share your experience in the comments section.

![Stock indicators in use [Part One]: DKW long-short trend market indicators](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20240803/1722652255201-random4761-103623318-android-org.jpeg/big?area=999&is_public=true)

Welcome friends who are interested in trading to discuss and share.

![Stock indicators in use [Part One]: DKW long-short trend market indicators](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20241114/1731579880332-random9122-103623318-android-org.jpeg/big?area=999&is_public=true)

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

JohnCS : Like and bookmark That stz has two bands of different colors. What does it represent? Blue-red/green-purple..

That stz has two bands of different colors. What does it represent? Blue-red/green-purple..

104741793 : How to add some of these into community developed indicators? Thank you.

斯似楼阑 OP JohnCS : The colors are meaningless, just to distinguish between an uptrend and a downtrend

斯似楼阑 OP 104741793 : Chart Management Arrows——Indicator Management——Modify——Import Indicators

104741793 : Thank you. I'll try later.

54088 FROM MBS : refuelling

Thai : Thank you for sharing

Bullish Law :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

151494132 : Hello, the group is already full. May I ask how can I obtain these indicators?

斯似楼阑 OP 151494132 : Add me as a friend to get in touch.