Micron Q3 earnings: Time to buy the dip?

Micron Q3 earnings: Time to buy the dip?

Views 40K

Contents 99

Today's Morning Movers and Top Ratings: AAPL, ACN, RIVN, FDX and More

$Apple (AAPL.US)$ On Wednesday, Rosenblatt Securities upgraded Apple shares to a "Buy" rating, citing the potential for the company's privacy-centric Apple Intelligence platform to help it capture a larger share of the artificial intelligence market. Shares rose by 0.86% in premarket trading.

$Micron Technology (MU.US)$ 's shares rose by 2.46% in anticipation of its quarterly earnings report, which was scheduled to be released after the closing bell. The uptick reflects optimism on Wall Street, where many anticipate that the memory chipmaker will not only surpass quarterly expectations but also raise its future guidance, buoyed by the relentless demand driven by artificial intelligence applications.

$NVIDIA (NVDA.US)$ 's stock climbed 1.83%, continuing its substantial gains from the previous session that took its market cap to $3.1 trillion, alleviating concerns regarding its prominence in the AI revolution.

$Rivian Automotive (RIVN.US)$ 's stock surged 40.64% following the announcement of a significant investment by German automotive heavyweight Volkswagen in the American luxury electric truck company.

$FedEx (FDX.US)$ saw its shares increase by 14.67% after the delivery titan shared an optimistic outlook and announced a $2.5 billion share repurchase plan for its current fiscal year.

$Albemarle (ALB.US)$ 's stock appreciated by 2.7%, as the top lithium producer in the world indicated it would conduct more auctions for the metal, which is essential for EV batteries.

$Whirlpool (WHR.US)$ 's shares jumped 17.2% on reports that German engineering conglomerate Robert Bosch is considering an offer for the U.S. appliance maker.

$Robinhood (HOOD.US)$ 's stock advanced 3.8% after Wolfe Research upgraded the brokerage firm to “outperform” from “peer perform,” highlighting robust net deposits, significant operating leverage, and strong free cash flow.

$Vista Outdoor (VSTO.US)$ shares rose 10% when MCN Capital Partners increased its all-cash takeover proposal for the firearms and outdoor sports company to $42 per share, totaling about $3.2 billion, up from the previous $39.50.

$Blackstone (BX.US)$ 's shares dipped 0.86% after the investment firm reached a deal to acquire British hotel chain Village Hotels, amid a broader investing shift into the hospitality sector, which is outpacing the general commercial real estate market.

$Chipotle Mexican Grill (CMG.US)$ 's stock edged down 0.75% after the fast-casual restaurant chain executed a substantial 50-for-1 stock split, marking its inaugural split and one of the largest on the New York Stock Exchange.

$Southwest Airlines (LUV.US)$ saw its stock price decrease by 3.96% as the airline trimmed its revenue outlook for the second quarter, pointing to inconsistent travel demand.

Source: CNBC; Investing.com

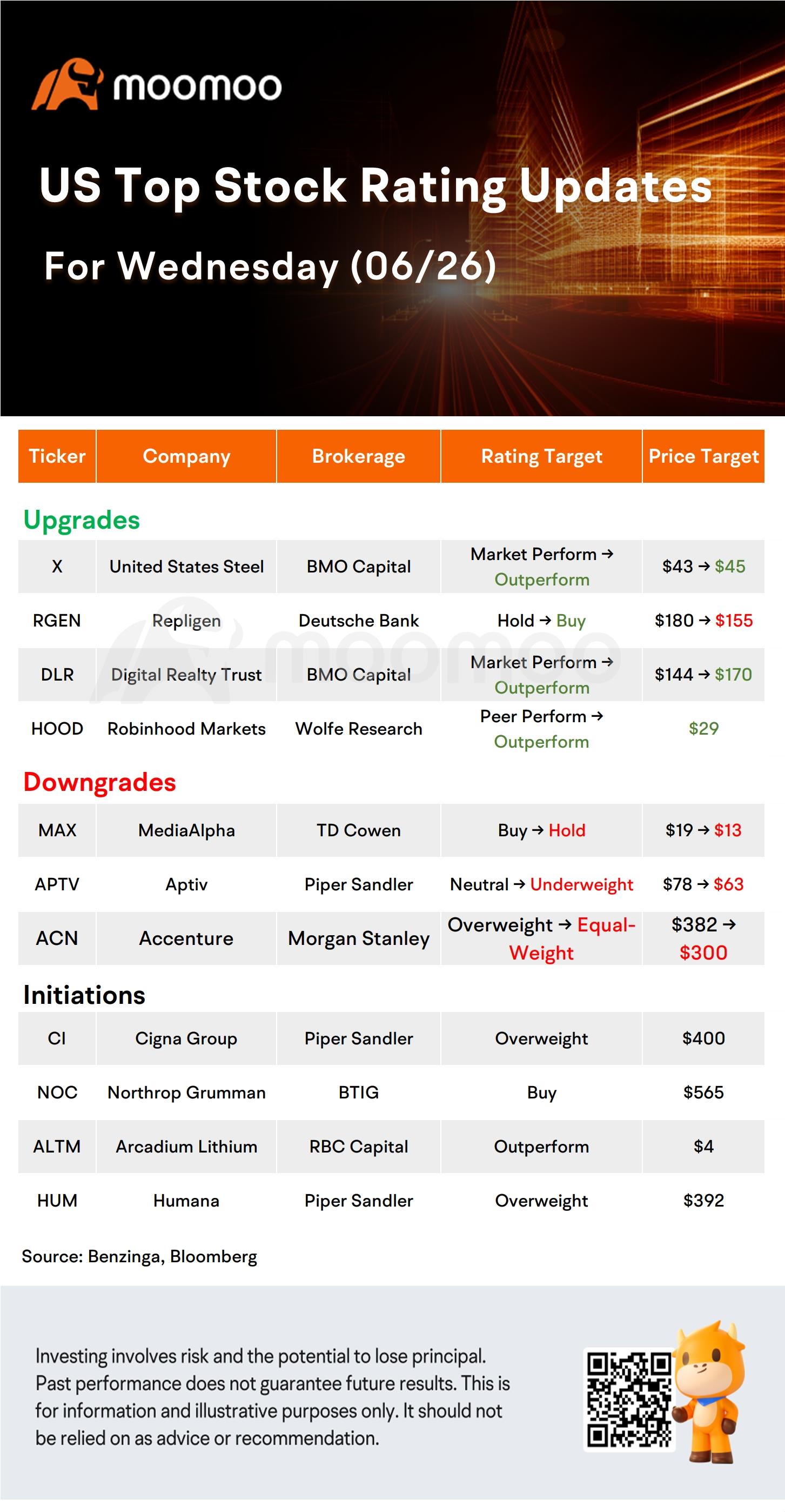

US Top Rating Updates on 06/26

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

GKCHN : title have ACN share but in news it's not

RDK79 : Nvidia actually down 2% now.

101863200 GKCHN : yes,not mentioned inside

Movers and Shakers OP GKCHN : Thank you for reaching out and bringing this to our attention. We would like to clarify that the information of ACN is presented in the picture of the Rating Updates part. We apologize for any confusion this may have caused and appreciate your understanding.