Today's Morning Movers and Top Ratings: F,FTNT, BABA, UBER and More

$Ford Motor (F.US)$ shares rallied

6% in premarket U.S. trading on Wednesday after the automotive giant unveiled a 2024 revenue outlook that topped analysts' expectations and vowed to return more cash to its stakeholders.

Michigan-based Ford guided for annual pre-tax income of $10 billion to $20 billion, above Bloomberg consensus estimates of $9.5 billion. The announcement, which echoed a similarly rosy outlook from rival General Motors, was driven by solid returns from its combustion-engine trucks.

$CVS Health (CVS.US)$ The stock added

1.8% after CVS surpassed Wall Street expectations for its fourth quarter, citing strength in its health services business. However, the pharmacy chain pulled back its full-year outlook due to higher medical costs.

$Enphase Energy (ENPH.US)$ Shares of the solar stock jumped

13.2%, a day after a worse earnings report than expected for the first fiscal quarter and a light revenue outlook. Enphase earned 54 cents per share excluding items on revenue at $303 million, while analysts polled by FactSet forecasted 55 cents and $328 million in revenue.

$Sonos (SONO.US)$ The audio device maker popped

10.1% the morning after an expectation-beating earnings report and reaffirmed guidance. Sonos saw 64 cents in per-share earnings and $613 million in revenue, while analysts surveyed by LSEG anticipated 40 cents and $587 million.

$Fortinet (FTNT.US)$ The cybersecurity stock rallied

9.3% in the premarket one day after Fortinet beat expectations for the fourth quarter. Fortinet beat analyst consensus estimates on both lines in the quarter, pulling attention away from its weak earnings guidance.

$Chipotle Mexican Grill (CMG.US)$ The fast-casual restaurant chain added

2.5% Wednesday, the morning after reporting stronger-than-expected earnings. In addition to beating on both top- and bottom-lines, Chipotle said restaurant traffic grew more than 7%.

$Aptiv PLC (APTV.US)$ Morgan Stanley adjusted its stance on Aptiv PLC, a global auto parts company, moving its stock rating from Equalweight to Underweight. The firm also revised its price target downward to $74 from the previous $90. The downgrade was prompted by concerns over a potential slowdown in the demand for electric vehicles (EVs) and the willingness of legacy original equipment manufacturers (OEMs) to produce them. Shares dropped by

1.98% in premarket trading.

$Uber Technologies (UBER.US)$ Shares slipped

1.8% despite a strong earnings report from the rideshare giant. Uber earned 66 cents per share and saw $9.94 billion in revenue, while analysts polled by LSEG expected 17 cents and $9.76 billion.

$Alibaba (BABA.US)$ The Chinese e-commerce giant fell by

3.7% in premarket trading after it posted quarterly revenue that missed analyst estimates — 260.35 billion Chinese yuan ($36.6 billion) versus 262.07 billion yuan expected by the LSEG consensus. The company hiked its share buyback program by $25 billion.

Source: CNBC; Investing.com

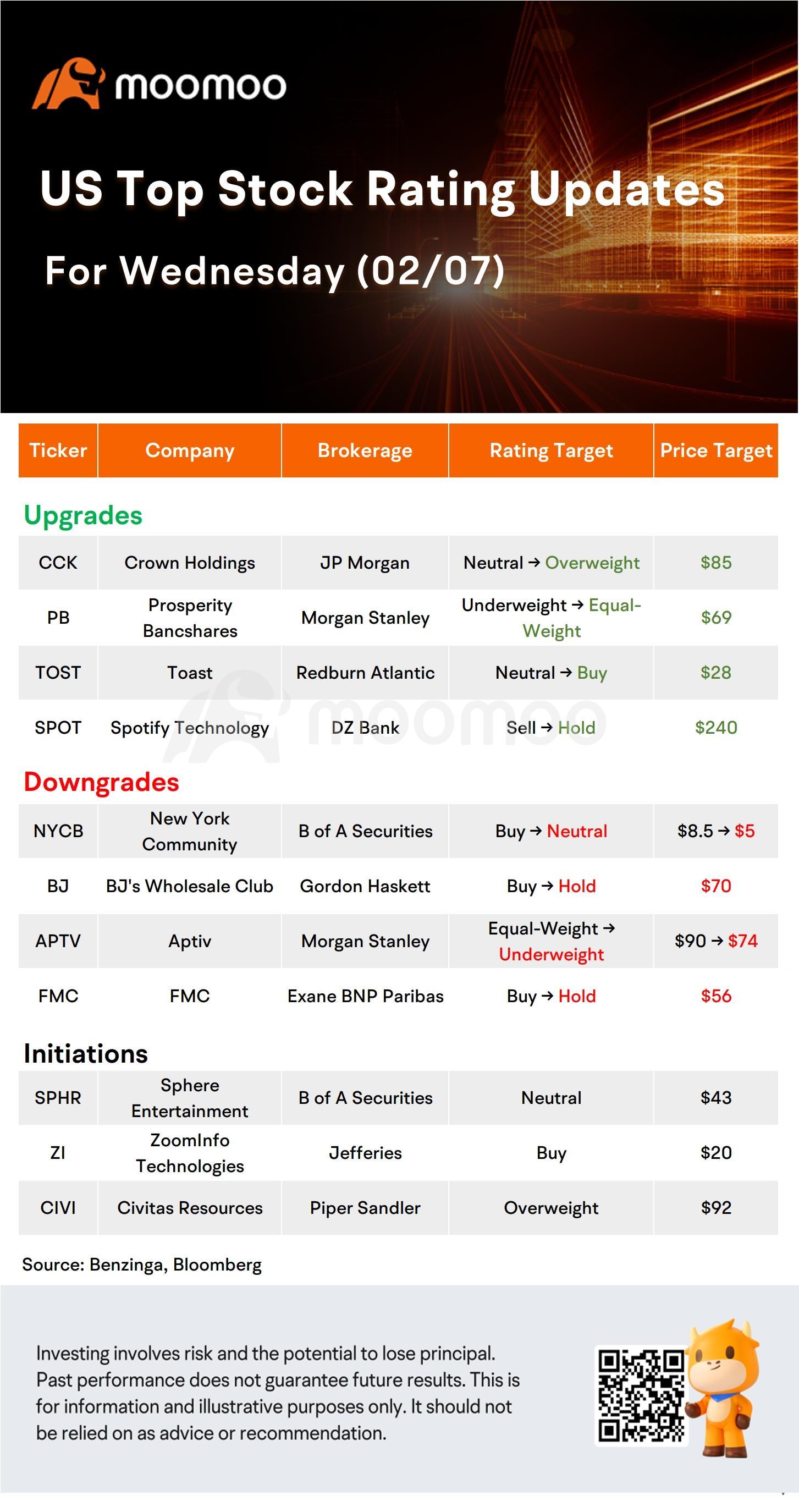

US Top Rating Updates on 02/07

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 20

20 1

1