Today's Morning Movers and Top Ratings: GM, SMCI, UPS, SPOT and More

$General Motors (GM.US)$ stock soared 7.8% after the auto giant reported lower pretax profit for the fourth quarter but gave investors an upbeat outlook for 2024 and signaled more capital could be returned to shareholders.

$Pfizer (PFE.US)$ stock rose 1.1% after the drugmaker reported a surprise quarterly profit, helped by COVID products demand being stronger than expectations and lower research costs.

$Ford Motor (F.US)$ stock rose 2.7% after the auto manufacturer said it would supply more than 1,000 F-150 Lightning and Mustang Mach-E electric vehicles to Ecolab to replace the water treatment firm's gas-powered vehicles in California.

$F5 Inc (FFIV.US)$ stock rose 10% after the cybersecurity stock raised its earnings outlook for 2024 after releasing strong first-quarter numbers.

$Super Micro Computer (SMCI.US)$ stock rose over 12% after the artificial intelligence server maker delivered strong quarterly results and raised its full-year revenue forecast.

$United Parcel Service (UPS.US)$ stock fell 7% after the world's biggest package delivery firm forecast annual revenue below expectations, facing sluggish domestic and international e-commerce demand.

$Whirlpool (WHR.US)$ stock fell 4.6% after the white goods maker forecast full-year sales and profit below expectations, suffering from pricing pressure from rivals and higher expenses.

$Calix (CALX.US)$ stock slumped over 20% after the telecom software provider unveiled first-quarter guidance that was well short of Wall Street estimates as customers rethink their spending plans.

$JetBlue Airways (JBLU.US)$ stock fell 0.9% after the low-cost carrier swung to a loss in the fourth quarter and forecast a fall in first-quarter revenue amid early signs of softening domestic demand.

Source: CNBC; Investing.com

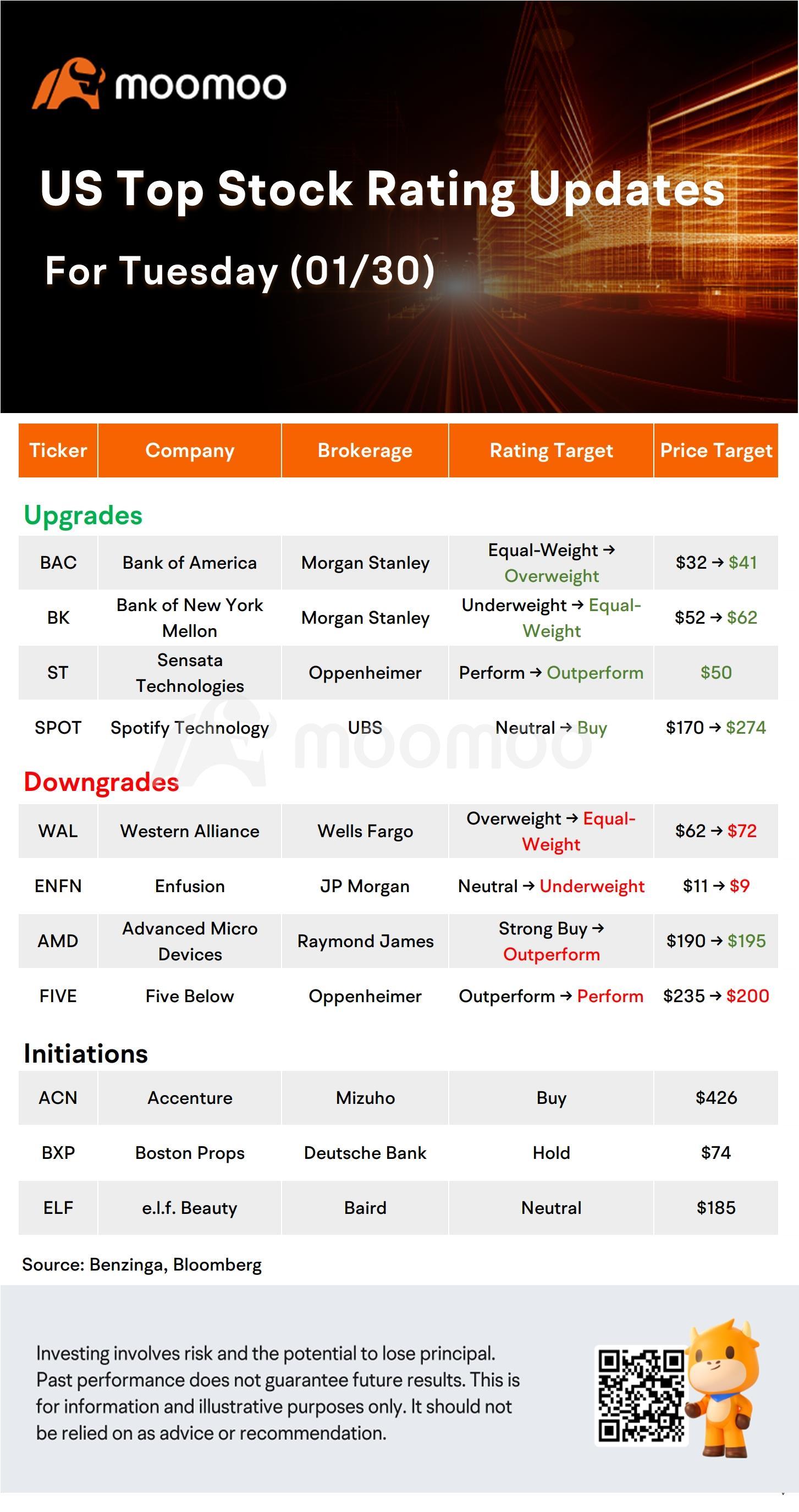

US Top Rating Updates on 01/30

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 13

13 2

2

Malik ritduan : ok