Today's Morning Movers and Top Ratings: LLY, AAPL, UAA, MNST and More

$Eli Lilly and Co (LLY.US)$ 's stock increased by 11.5% after the pharmaceutical company boosted its annual profit forecast, with sales of its weight-loss drug Zepbound surpassing the $1 billion mark in a single quarter for the first time.

$Apple (AAPL.US)$ 's stock edged up by 0.1% following a report from CNBC that the tech giant may introduce a charge of up to $20 for advanced artificial intelligence features, aiming to expand its high-margin services segment.

$Under Armour-A (UAA.US)$ popped 12% following a surprise profit of 1 cent per share with revenue reaching $1.18 billion, surpassing estimates.

$Robinhood (HOOD.US)$ 's stock climbed 2.9% as the brokerage platform reported a profitable second quarter in 2024, driven by a resurgence in cryptocurrency trading interest.

$Zillow-A (ZG.US)$ 's stock surged 12.4% after the online real estate marketplace beat second-quarter forecasts and announced COO Jeremy Wacksman as the new CEO, succeeding Rich Barton.

$Warner Bros Discovery (WBD.US)$ 's stock dropped 10.5% premarket after the media conglomerate revealed a $10 billion net loss for the quarter and a $9.1 billion write-down of its traditional television network assets, highlighting the swift impact of streaming on the cable industry.

$Bumble (BMBL.US)$ 's stock plummeted 40.2% as the online dating company lowered its annual revenue growth projection, raising concerns over its future expansion.

$Restaurant Brands International (QSR.US)$ ' stock decreased by 2.5% after the fast-food corporation reported slower-than-anticipated sales growth in the second quarter, suggesting a challenging consumer environment.

$Monster Beverage (MNST.US)$ 's stock fell 8.4% in response to the company's weaker-than-expected second-quarter sales, amid signs that an uncertain economic climate is affecting consumer demand.

$SolarEdge Technologies (SEDG.US)$ plunged nearly 16.7% due to its second-quarter earnings report showing an adjusted quarterly loss of $1.79 per share, which was wider than the anticipated loss of $1.58 per share. However, the company's revenue of $265 million beat the forecast of $262 million.

Source: CNBC; Investing.com

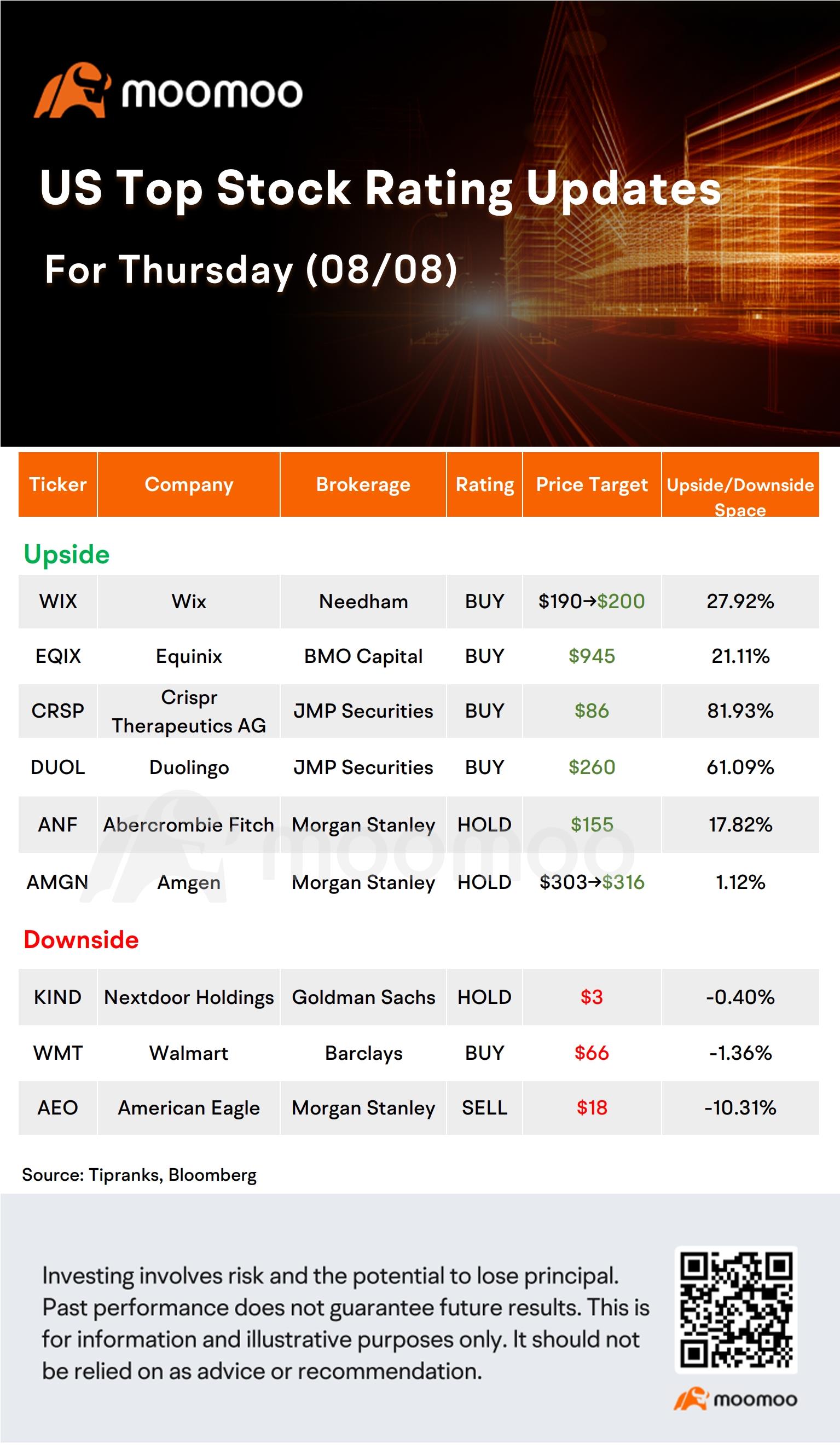

US Top Rating Updates on 08/08

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 26

26 2

2