Today's Morning Movers and Top Ratings: MCD, EL, TJX, CAT and More

$Caterpillar (CAT.US)$ reported a double-digit increase in operating profit on Monday, beating Wall Street estimates as mining equipment sales remained robust as did demand for large construction equipment amid a rebound in the U.S. residential real estate market.

Shares for the Texas-based company were up 4.4% before the bell.

Expenditure on heavy machinery held steady among commercial clients. Dealer inventories fell for the first time in four quarters, by $900 million, in an encouraging sign that spending remains resilient helped by President Joe Biden's $1 trillion infrastructure law to upgrade roads, bridges and other transportation infrastructure. Retail sales in North America were up 11% year on year.

$Estee Lauder (EL.US)$ Beauty products company Estée Lauder beat analysts' expectations in Q2 FY2024. Shares surged by

15% in premarket trading.

Estée Lauder Q2 FY2024 Highlights:

Revenue: $4.28 billion vs analyst estimates of $4.24 billion (0.9% beat)

EPS (non-GAAP): $0.88 vs analyst estimates of $0.56 (57.5% beat)

Free Cash Flow of $1.11 billion is up from -$703 million in the previous quarter

Gross Margin (GAAP): 73%, in line with the same quarter last year.

$Cigna Group (CI.US)$ received an upgrade in its stock rating by Cantor Fitzgerald, moving from Neutral to Overweight. The firm also increased its price target for the healthcare services provider to $372 from the previous $334.

Cantor Fitzgerald's revision of Cigna's outlook is based on the company's promising earnings potential for the years 2025 and 2026. The analyst highlighted the role of Evernorth, Cigna's health services platform, as a key driver for this anticipated growth. Shares rose 0.76% in premarket trading.

$NVIDIA (NVDA.US)$ Shares in the chipmaker added about

3% before the opening bell after Goldman Sachs increased its price target to $800, suggesting 21% upside ahead. The firm said it was optimistic ahead of its quarterly results on Feb. 21 due to “various data points from the broader eco-system that point to sustained strength in demand for accelerated computing.”

$McDonald's (MCD.US)$ has reported fourth-quarter global comparable sales growth of 3.4%, missing analysts' average estimates of 4.79%.

Shares in the burger chain dropped by 0.69% in premarket U.S. trading on Monday.

$Air Products & Chemicals (APD.US)$ Shares dropped

9% after Air Products and Chemicals posted disappointing quarterly results. In its first quarter, the industrial gas supplier reported adjusted earnings of $2.82 per share, weaker than earnings of $3.00 per share expected by analysts polled by StreetAccount. Revenue of $3.00 billion came in below the consensus estimate of $3.20 billion.

$GlobalFoundries (GFS.US)$ The stock slid about

2% after JPMorgan downgraded GlobalFoundries to neutral from overweight, citing a “deeper cycle bottom” as manufacturing activity weakens.

Source: CNBC; Investing.com

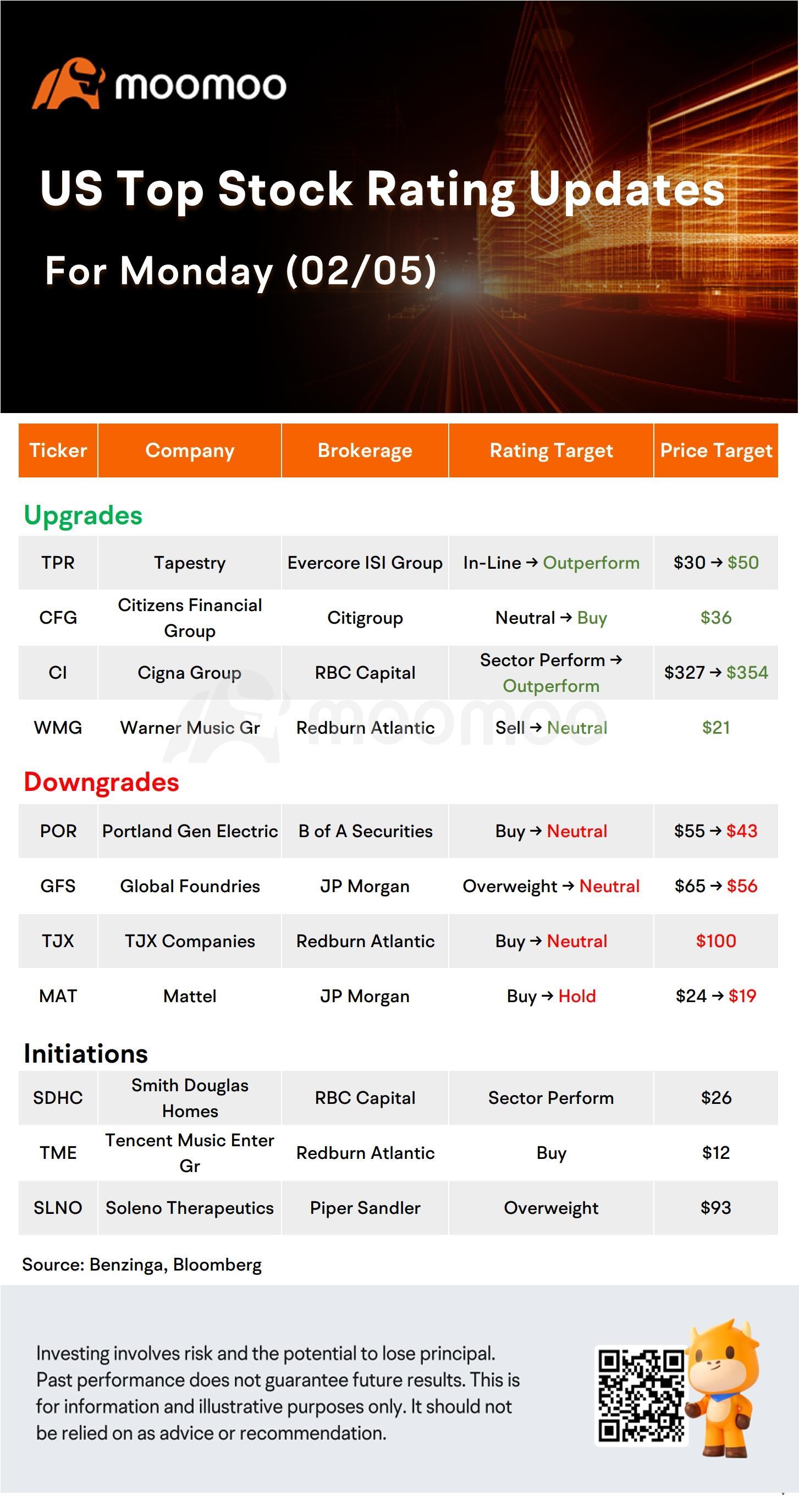

US Top Rating Updates on 02/05

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 18

18 2

2