Today's Morning Movers and Top Ratings | NVDA, JWN, KSS, ANF and More

Morning Movers

Gapping up

$Chewy (CHWY.US)$ stock rose 1.25% after the online retailer of pet products reported strong second-quarter earnings, exceeding expectations.

$NVIDIA (NVDA.US)$ edged 0.23% higher ahead of the release of the latest quarterly results from the semiconductor after the close, with a year-over-year doubling of revenue in the second quarter.

$Nordstrom (JWN.US)$ stock gained 1.3% after the retailer beat earnings expectations in the second quarter, helped by its crucial Anniversary Sale event.

$Li Auto (LI.US)$, the Chinese electric vehicle manufacturer, exceeded second-quarter expectations with adjusted earnings per ADS of RMB1.42 ($0.20), surpassing analyst forecasts of RMB1.33. Revenue grew 10.6% YoY to RMB31.7 billion ($4.4 billion), also beating expectations. This positive report sent its shares up 0.61% in Wednesday's premarket trading.

$Kohl's Corp (KSS.US)$ increased its yearly profit outlook following better-than-expected second-quarter earnings, aided by strict cost management and streamlined inventories amidst cautious consumer spending on clothing and accessories. The company's shares climbed 3.2% in Wednesday's premarket trading. Despite this, shares have fallen approximately 32% this year, as retailers face inconsistent demand due to persistent inflation and prolonged high interest rates.

$Royal Bank of Canada (RY.US)$ exceeded quarterly profit expectations on Wednesday, thanks to setting aside less than anticipated for potential loan losses. The bank's performance was further enhanced by a 17% increase in earnings from its personal and commercial banking segment, which reached C$2.49 billion ($1.85 billion). This boost was partly due to its C$13.5 billion acquisition of HSBC's domestic operations and an increase in net interest income. Shares increased by 1.37% in premarket trading.

Gapping down

$Bath & Body Works (BBWI.US)$ announced mixed financial results for the second quarter. The specialty retailer recorded second-quarter EPS of $0.37, slightly surpassing the consensus forecast of $0.36. However, the company's revenue for the quarter amounted to $1.5 billion, which did not meet the anticipated $1.55 billion consensus estimate. Shares decreased by 5.3% in premarket trading.

$PVH Corp (PVH.US)$ stock fell 8.3% after the clothing giant, which owns brands like Calvin Klein and Tommy Hilfiger, reported a drop in second-quarter sales.

$Abercrombie & Fitch (ANF.US)$ stock fell 9.1% after the clothes retailer's CEO Fran Horowitz warned of an “increasingly uncertain environment” as macro conditions worsened, even after the company lifted its forecast for annual sales.

Source: CNBC; Investing.com

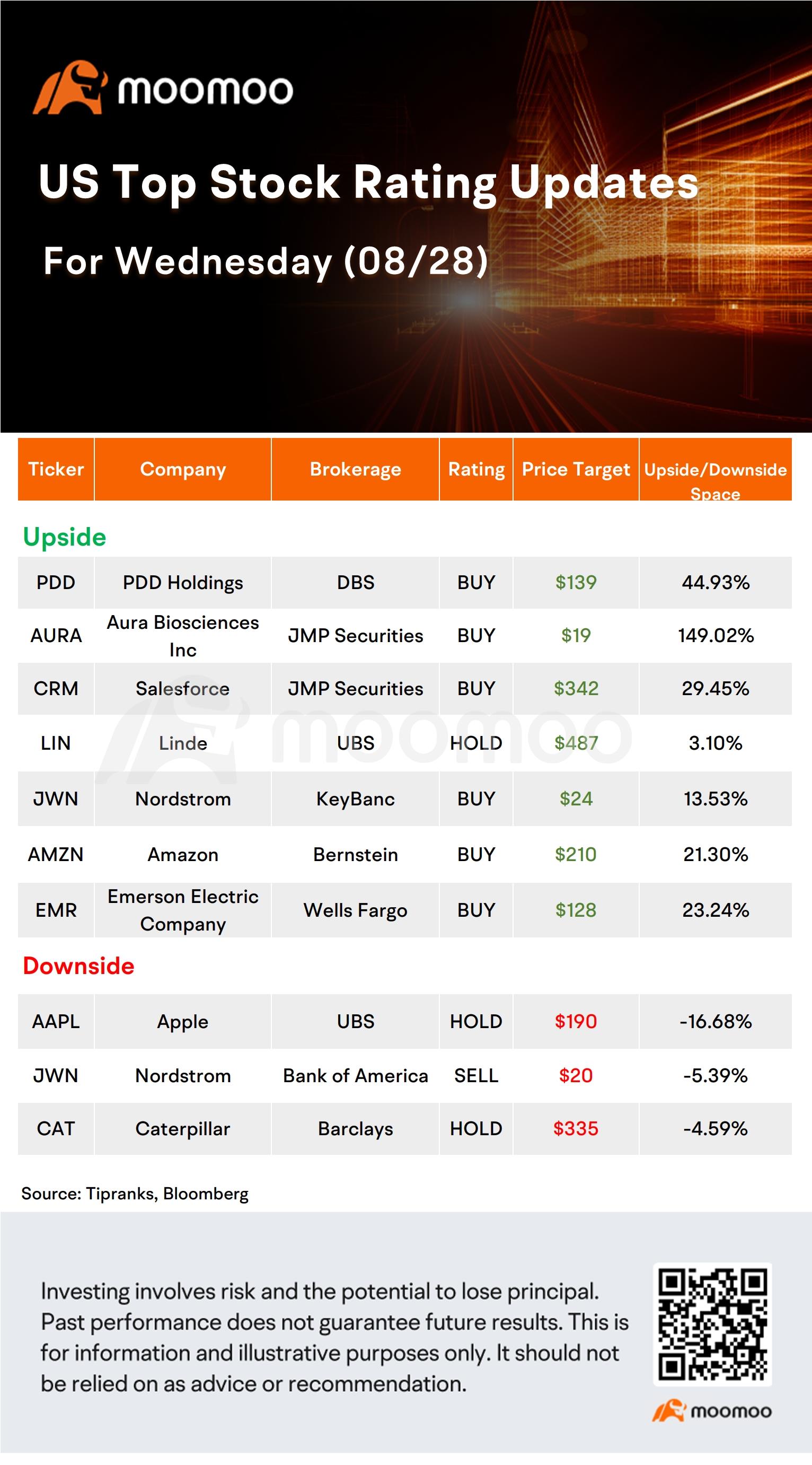

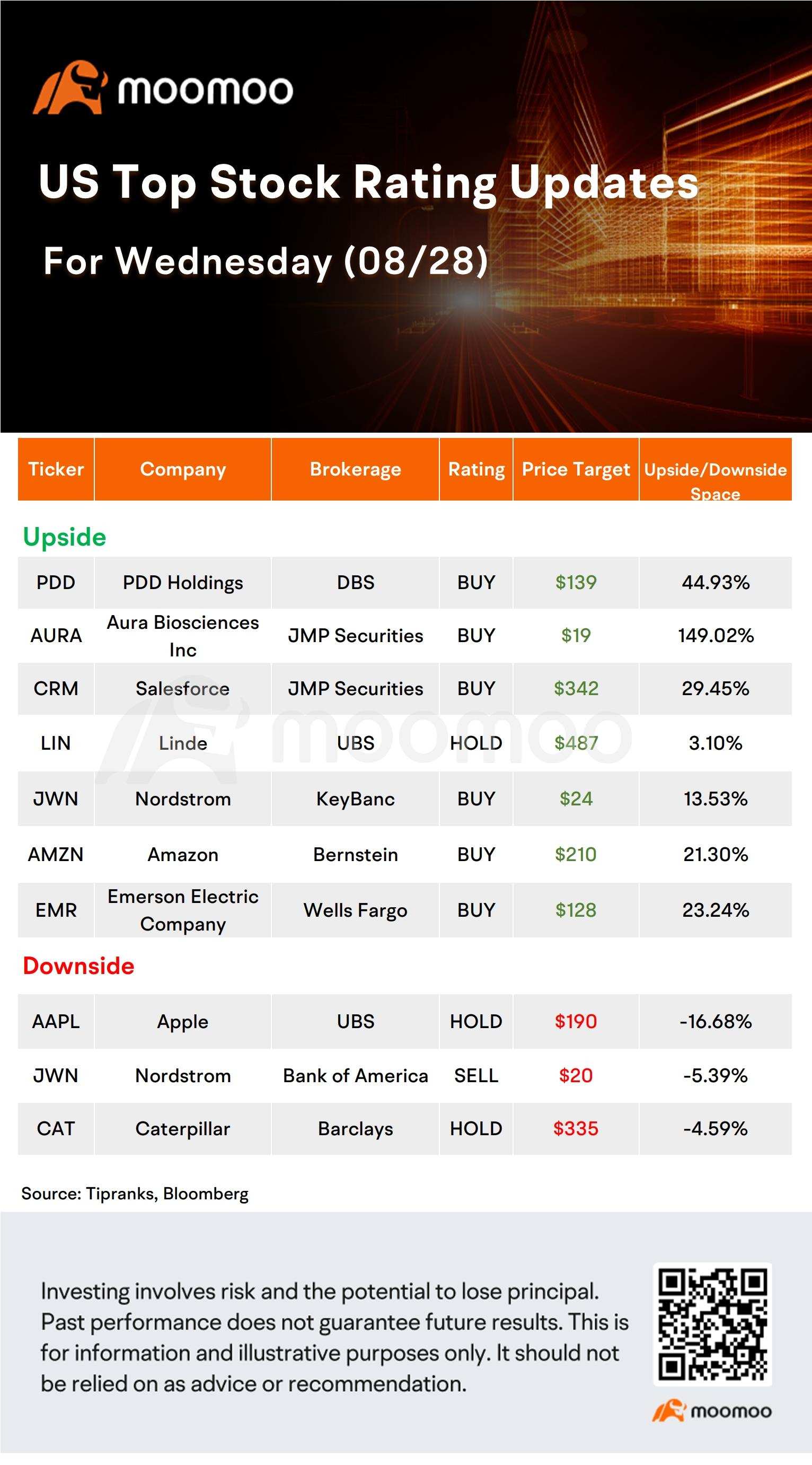

US Top Rating Updates on 08/28

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Laine Ford : money stock