Today's Morning Movers and Top Ratings: PLTR, DIS, GPS, LCID and More

Morning Movers

Gapping up

$Hims & Hers Health (HIMS.US)$ Shares jumped 14% as the telehealth consultation platform, Hims & Hers Health, forecasted second-quarter revenue that outstripped estimates. The company expects revenue to be between $292 million and $297 million, surpassing the LSEG consensus estimate of $288 million. Additionally, their first-quarter performance also beat expectations.

$Gap Inc (GPS.US)$ The apparel retailer's stock rose 3.2% following an upgrade by Citi from neutral to buy, along with an increased price target. Citi's optimistic stance suggests that Gap may exceed earnings expectations for the first quarter.

$Target (TGT.US)$ The retailer's shares saw a 1.6% increase after receiving positive assessments from Wall Street. Citi elevated the stock's status from neutral to buy, identifying the company as a top performer in its industry. Concurrently, UBS, which maintains a buy rating, suggested that the forthcoming first-quarter earnings report is likely to act as a favorable trigger for the stock's value and reinforce the optimistic outlook.

Gapping down

$Disney (DIS.US)$ stock fell by over 4%, even though the company announced fiscal second-quarter earnings that exceeded expectations and showed reduced losses in its streaming division.

$Palantir (PLTR.US)$ The defense-technology company's stock plummeted by 11% following the release of its guidance, which did not meet expectations. Palantir projected its full-year revenue to be in the range of $2.68 billion to $2.69 billion, which is below the analyst consensus of $2.71 billion as surveyed by LSEG. For the current quarter, the company anticipates revenue between $649 million and $653 million, compared to the LSEG consensus estimate of $653 million.

$Lucid Group (LCID.US)$ Shares of the electric vehicle manufacturer fell by 8% following the announcement of its recent financial outcomes. Lucid reported a GAAP loss of 30 cents per share and maintained its 2024 production forecast of approximately 9,000 vehicles. The company's revenue totaled $173 million, surpassing the anticipated $157 million.

Source: CNBC; Investing.com

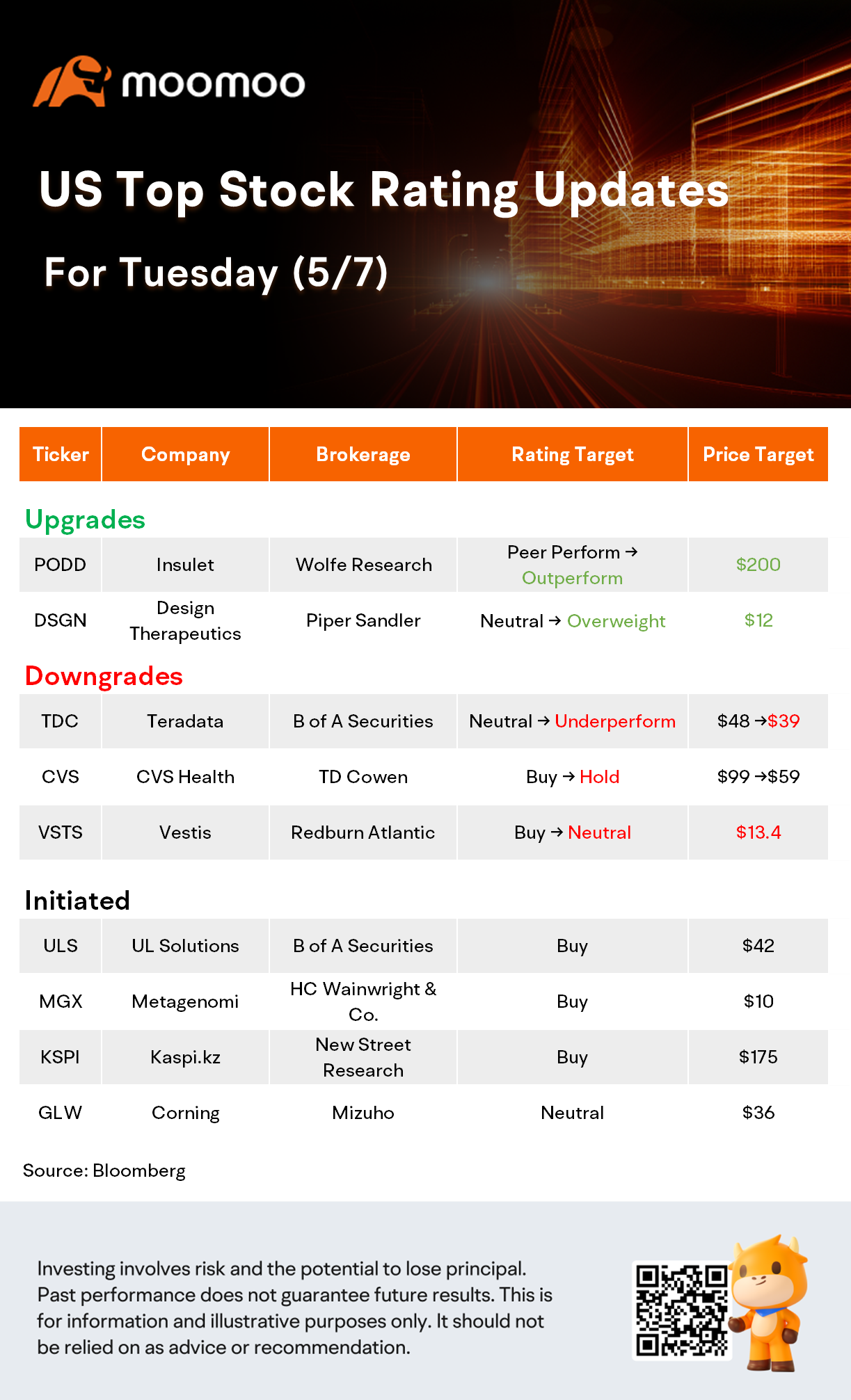

US Top Rating Updates on 05/07

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103241063 : TQ