Today's Morning Movers and Top Ratings: TSLA, DIS, ABT, COIN and More

$Royal Philips (PHG.US)$ experienced a significant boost of 10.6% after the company reported robust second-quarter earnings, attributing much of their success to cost-saving measures, including workforce reductions, and a substantial insurance payout related to liability claims.

$Tesla (TSLA.US)$ 's shares advanced by 1.9% following an endorsement by Morgan Stanley analyst Adam Jonas, naming it the top U.S. auto stock, overtaking Ford, which saw little change in the premarket.

$Disney (DIS.US)$ shares edged up nearly 1% after a record-breaking opening weekend box office performance by "Deadpool & Wolverine," which collected over $200 million, setting a new high for R-rated film debuts.

$Occidental Petroleum (OXY.US)$ 's stock increased by 0.3% after the announcement that the company has agreed to sell assets in the Delaware Basin, located in Texas and New Mexico, to Permian Resources for approximately $818 million.

$McDonald's (MCD.US)$ 's shares dipped slightly ahead of the market opening as the company reported second-quarter earnings that fell short of expectations, coupled with a broad decrease in same-store sales.

$Bristol-Myers Squibb (BMY.US)$ 's stock declined by 1.1% after Barclays downgraded it to underweight from equal weight, citing a rapid rise in the stock's price over a short period without corresponding fundamental changes, despite the company's recent earnings beat and raised full-year guidance.

$Stellantis NV (STLA.US)$ shares were down by 3.62% following a downgrade by Deutsche Bank from buy to hold. The bank expressed concerns over the automaker's outlook, highlighting numerous challenges in a difficult market environment.

$Apple (AAPL.US)$ 's stock dropped by 0.2% amidst reports from Bloomberg indicating delays in implementing new artificial intelligence features into its iPhone and iPad lineup, with these updates not expected to be part of the initial software release.

$Abbott Laboratories (ABT.US)$ shares took a notable hit, falling 4.5%, after a court verdict requiring the healthcare company to pay $495 million in damages related to a lawsuit over its premature-infant formula.

$Permian Resources (PR.US)$ saw its shares decline by 2.1% in the wake of its acquisition deal with Occidental Petroleum for assets in the Delaware Basin, worth around $818 million.

Source: CNBC; Investing.com

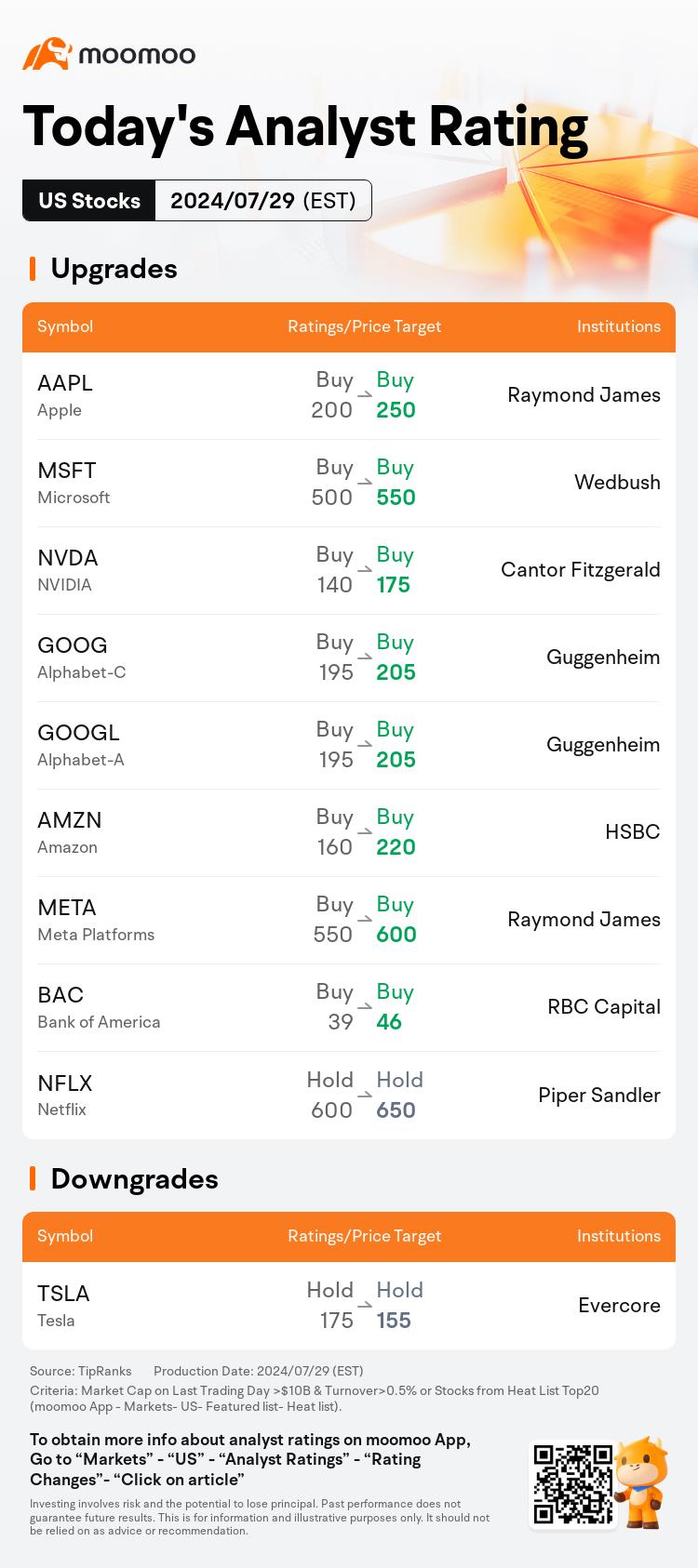

US Top Rating Updates on 07/29

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 31

31 2

2

103189865 : mony half widrow

103159190 : Why is McDonald's earnings forecast lower than expected and the pre-market price will rise?

104371487 On Paris : Thanks you

105535782 : ok

Captain Woon 103159190 : Market is irrational… buy on bad news

102188459 : Tq

101775147 AL alfijai : ok boss every single cop.main

Alen Kok : k