Today's Morning Movers and Top Ratings: X, NIO, LUV, PLD and More

Morning Movers

Gapping up

$Illumina (ILMN.US)$ shares rose by 5.33% in premarket trading in New York on Monday, after the gene-sequencing device maker said it will offload cancer screening start-up Grail.

In a statement on Sunday, San Diego-based Illumina noted that divestiture will be executed through a "third-party sale or capital markets transaction" and is expected to be finalized by the end of the second quarter of next year.

$Salesforce (CRM.US)$ shares rose more than 1% pre-market today after Wolfe Research upgraded the company to Outperform from Peerperform with a price target of $315.00.

$Equifax (EFX.US)$ shares rose more than 1% pre-market today after Jefferies upgraded the company to Buy from Hold and raised its price target to $315.00 from $200.00. This represents the third upgrade for the stock this month.

“With headwinds dissipating and us having greater conviction in the Workforce Solutions moat, our new higher resolution model suggests the potential for sustainable multi-year double-digit revenue and earnings growth on continued strong pricing power, TWN records growth, client penetration, and a return to more normalized volumes in mortgage."

$United States Steel (X.US)$ , commonly known as U.S. Steel, is being acquired by Japan's Nippon Steel, the two companies confirmed today. Nippon Steel will pay $55 per share in an all-cash transaction that values the company at $14.1 billion. The agreed represents a 40% premium to U. S. Steel's closing stock price on December 15, 2023. U.S. Steel shares added 23.2% on the report.

$NIO Inc (NIO.US)$ Electric vehicle maker Nio has signed a pact for an investment of $2.2 billion from CYVN Holdings, an investment vehicle based in Abu Dhabi, the Chinese company said on Monday. The deal, expected to close in the final week of December, would take CYVN's shareholding to 20.1% of Nio's total issued and outstanding shares. Shares rose by 8.9% on the report.

$Bank of New York Mellon (BK.US)$ JPMorgan upgraded Bank of New York Mellon to Overweight from Neutral and raised its price target to $54.50 from $49.00. Shares rose by 0.74% in the premarket trading.

The analysts highlighted three key reasons for the upgrade. Firstly, the bank's prospects for positive operating leverage stand out in comparison to its peers. Secondly, it exhibits better net interest income trends relative to other banks. Lastly, its diverse business mix is poised to perform more robustly in case of an economic slowdown and its effects on equity markets.

Gapping down

$Southwest Airlines (LUV.US)$ agreed to a record-setting $140 million civil penalty over the December 2022 holiday meltdown that led to 16,900 flight cancellations and stranded 2 million passengers, the U.S. government said on Monday.

The settlement includes a $35 million cash fine and a three-year mandate that Southwest provide $90 million in travel vouchers of $75 or more to passengers delayed at least three hours getting to final destinations because of an airline-caused issue or cancellation. Shares dropped by 0.38% in premarket trading.

Source: CNBC; Investing.com

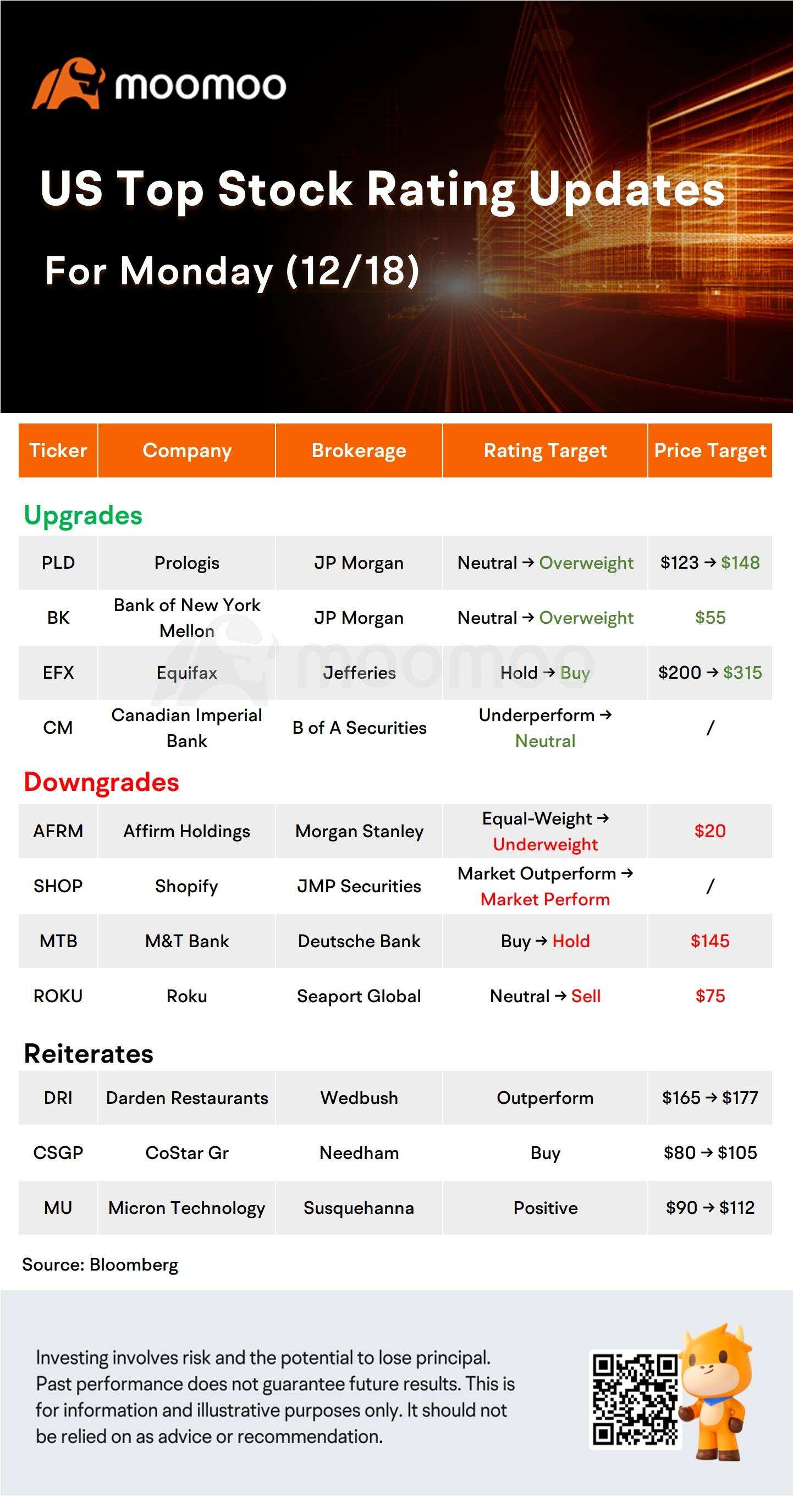

US Top Rating Updates on 12/18

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment