Magnificent Earnings Week: What was your fave?

Magnificent Earnings Week: What was your fave?

Views 97K

Contents 476

Today's Pre-Market Movers and Top Ratings | AAPL, TSLA, XOM, COIN and More

$Apple (AAPL.US)$ s stock increased by 0.4% as it approaches its earnings release later this week, with analysts at Wedbush suggesting that it may soon become the first company to achieve a market capitalization of $4 trillion.

$Tesla (TSLA.US)$ 's shares rose by 0.7%, building on gains from Friday. This rise followed CEO Elon Musk's announcement of a 30% projected increase in vehicle sales for the next year, spurred by the introduction of a more affordable model and excitement around its self-driving technology.

$Trump Media & Technology (DJT.US)$ experienced a significant surge, up 8.8%, as it extended its recent strong performance. This rally is fueled by speculations of a potential win for Trump in the upcoming 2024 U.S. presidential election.

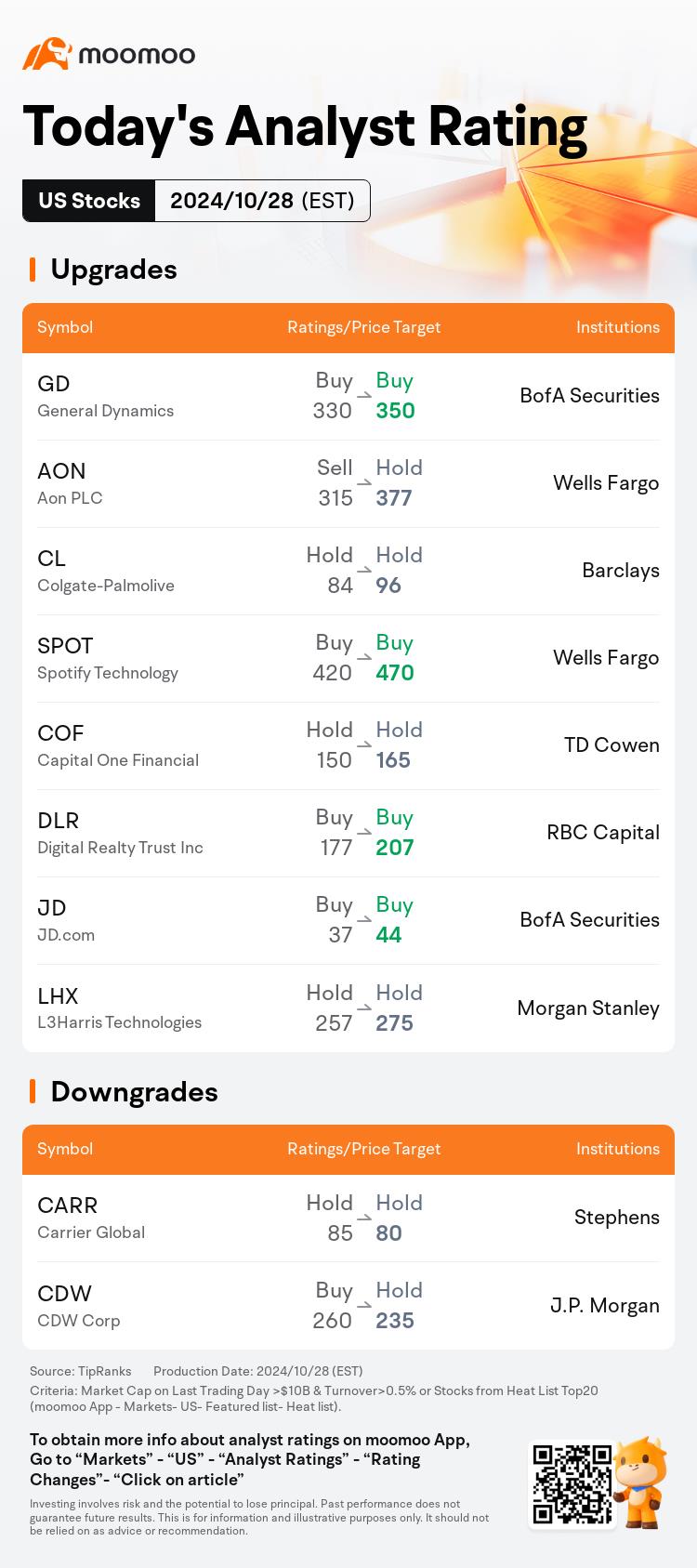

$General Dynamics (GD.US)$ BofA Securities analyst Ronald Epstein maintains the buy rating, and adjust the target price from USD330 to USD350. Shares rose by 0.4% in premarket.

$Robinhood (HOOD.US)$ 's shares saw a 2.2% jump after the company unveiled new U.S. presidential election event contracts on their trading platform, allowing users to speculate on the outcomes of the closely watched race.

$GlobalFoundries (GFS.US)$ experienced a 1% decrease in its stock value following a downgrade by Morgan Stanley from 'overweight' to 'equal weight'. The downgrade was based on expected pressure on wafer pricing from competitors, including TSMC and various Chinese foundries.

$Royal Philips (PHG.US)$ ADRs took a steep dive, dropping 16.7%, after the company reported a miss on third-quarter revenue and adjusted its forecast downwards, largely attributing this to diminished demand in China.

Source: CNBC; Investing.com

US Top Rating Updates on 10/28

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

NoDragonsPlz : so today is a recovery day?

AL MALIK PAIZA : as are you Long time we're here a water claud his son