Magnificent Earnings Week: What was your fave?

Magnificent Earnings Week: What was your fave?

Views 97K

Contents 476

Today's Pre-Market Movers and Top Ratings | EL, META, MSFT, UBER and More

$Mobileye Global (MBLY.US)$ saw an 8.7% increase in its stock after surpassing quarterly revenue expectations, thanks to a surge in car sales in China boosting demand for its driver-assistance technology.

$Peloton Interactive (PTON.US)$ 's stock appreciated by 26.5% after the company announced Peter Stern as the new CEO, ending the extensive search for a successor and setting the stage for strategic changes aimed at rejuvenating its subscription model.

$Comcast (CMCSA.US)$ enjoyed a 6.7% rise in its stock following third-quarter earnings that beat expectations, fueled by outstanding studio performances, increased advertising sales during the 2024 Paris Olympics, and fewer broadband subscriber losses than anticipated.

$Meta Platforms (META.US)$ experienced a 1.8% drop in stock value after reporting increased costs linked to artificial intelligence, overshadowing its strong third-quarter results, which had been boosted by significant growth in advertising activities.

$Microsoft (MSFT.US)$ 's shares decreased by 3.5% as it forecasted a slowdown in its Azure cloud segment, highlighting that its substantial investments in AI were still not meeting capacity needs.

$eBay (EBAY.US)$ saw a 6.6% decline in its stock after issuing weak guidance for the key holiday shopping period.

$Robinhood (HOOD.US)$ 's shares tumbled by 9.0% following a report that its third-quarter earnings fell short of analyst expectations, despite a notable increase in cryptocurrency trading.

$Uber Technologies (UBER.US)$ 's stock dipped 9.3% after reporting its slowest growth in total bookings in more than a year, even though it managed to exceed profit forecasts slightly.

$Merck & Co (MRK.US)$ shares dropped by 2.1% due to persistently low sales of its Gardasil vaccine in China, despite posting third-quarter profits above forecasts.

$Estee Lauder (EL.US)$ 's shares plummeted by 24% after missing revenue expectations and retracting its fiscal 2025 forecast, citing continuous market challenges in China and the travel retail sector.

Source: CNBC; Investing.com

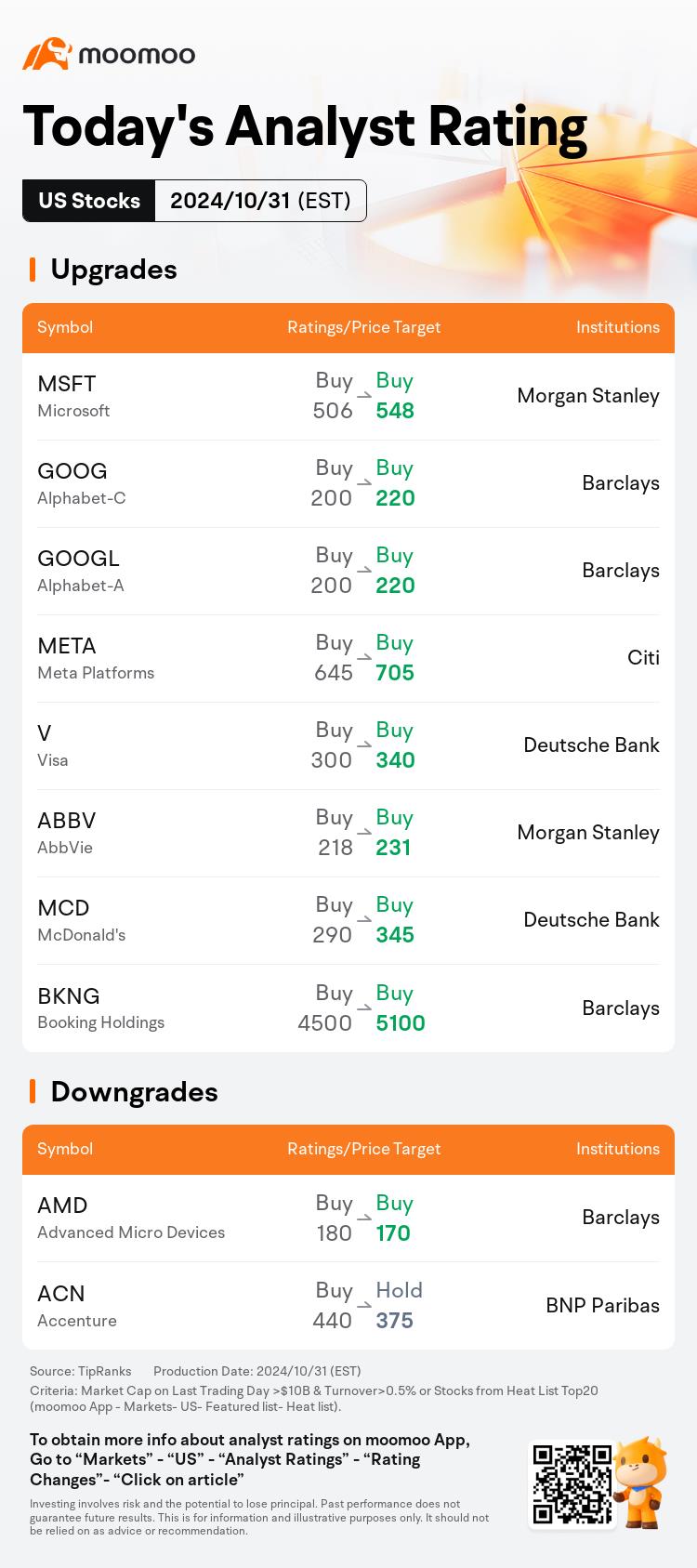

US Top Rating Updates on 10/31

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Han6698 : It is a shame to increase the stock’s target price. No matter what’s going on on the PE values of the stocks

TechTrek Invest : Can Uber innovate through the upcoming Robotaxi disruption?