Today's Pre-Market Movers and Top Ratings | MSTR, SAVE, GOOS, LUV and More

Morning Movers

Gapping up

$Boeing (BA.US)$ shares climbed 3.1% amid news that its employees might vote on a new agreement potentially ending a five-week strike. Additionally, there are reports of the company considering selling some assets.

$Kenvue (KVUE.US)$ experienced a 8.4% increase in stock value after Starboard Value, an activist investor, acquired a stake in the company known for products such as Band-Aid and Listerine, previously part of Johnson & Johnson.

$MicroStrategy (MSTR.US)$ BTIG analyst Andrew Harte maintains the company with buy rating, and adjust the target price from $180 to $240. Shares rose by 0.5% in premarket.

$Spirit Airlines (SAVE.US)$ saw a significant 37% jump in its stock price following an agreement with U.S. Bank National Association to extend the refinancing deadline for its 2025 bonds, essential for maintaining its bank credit-card processing deal.

$Humana (HUM.US)$ 's stock increased by 4.6% on news that Cigna, despite its own shares falling by 3.6%, has renewed its merger efforts with Humana after a previous withdrawal.

Gapping down

$United Parcel Service (UPS.US)$ 's stock decreased by 1.7% following a downgrade by Barclays to “underweight” due to heightened competition from Amazon and FedEx, coupled with the challenges of low-margin e-commerce growth.

$Southwest Airlines (LUV.US)$ shares dropped by 1.4% after reports surfaced about potential significant board representation by Elliott Investment Management following discussions.

$Tesla (TSLA.US)$ 's shares slipped by 1.2% as the market anticipates its quarterly results and further details on Elon Musk's robotaxi initiative.

$ServiceNow (NOW.US)$ saw a 1.8% reduction in its stock price after Morgan Stanley adjusted its rating to “equal-weight” from “overweight,” pointing to limited valuation growth.

$Canada Goose (GOOS.US)$ experienced a 4.0% fall in stock value after Goldman Sachs downgraded the company to “sell” from “neutral,” citing competitive pressures, a slowing luxury market, and unstable economic conditions in China.

Source: CNBC; Investing.com

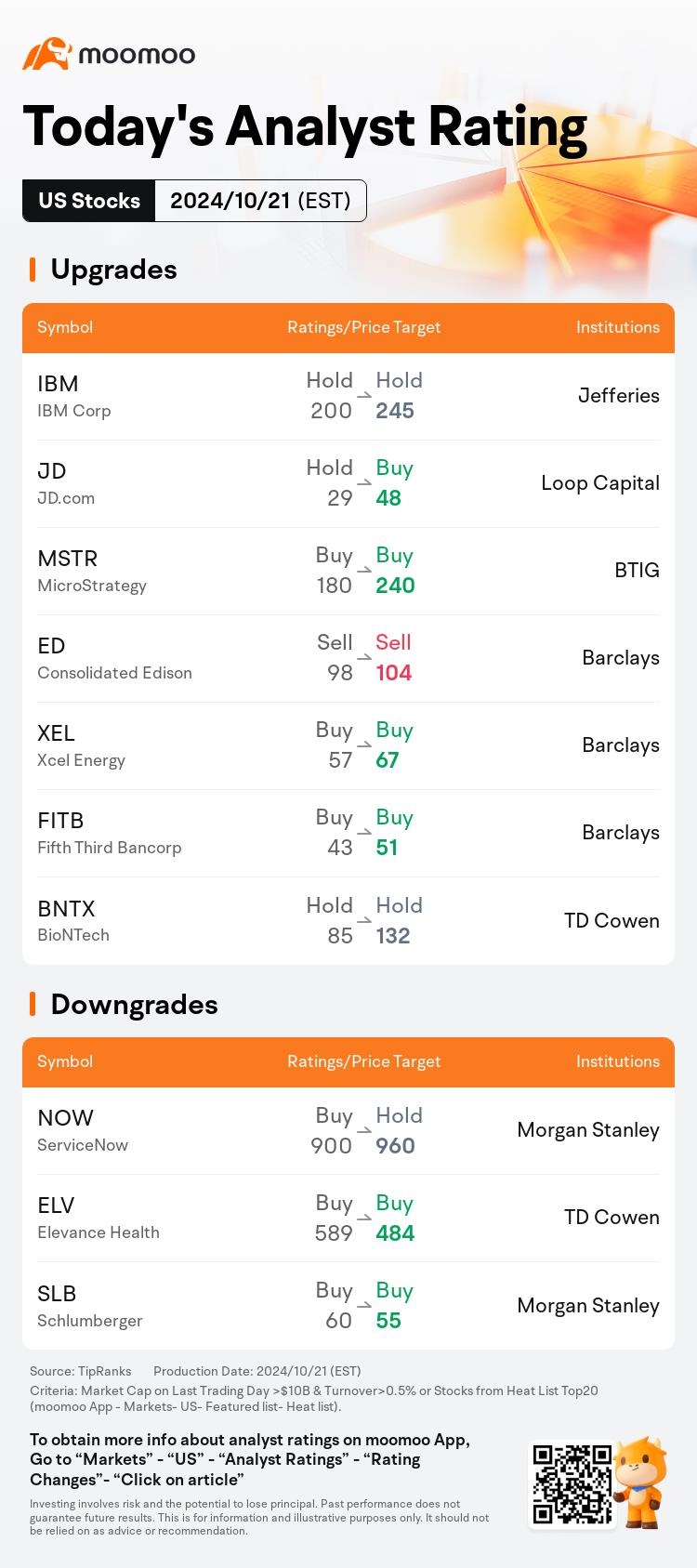

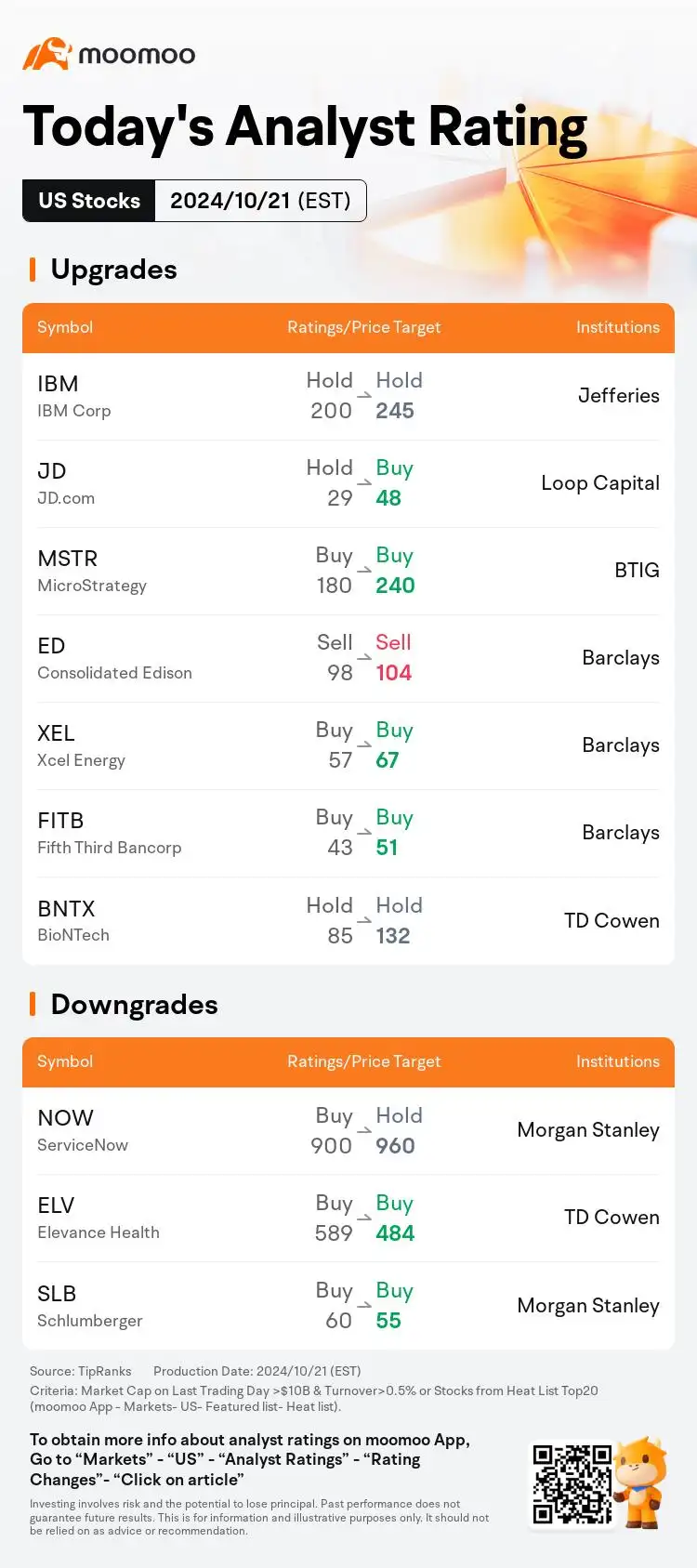

US Top Rating Updates on 10/21

Source: TipRanks

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101894806 : Wah

104437220 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Adrianlim90 : 1

Laine Ford : I wish I can buy but no money now

Laine Ford : good stock to hold make money now

AL MALIK PAIZA : I'm stollen for the are pretending biggest concern to end