Today's Pre-Market Stock Movers and Top Ratings: DELL, LULU, VALE, VMW and More

Pre-Market Stock MoverGapping up $Dell Technologies (DELL.US)$(Dell Technologies surged 10.5% after exceeding analysts’ second-quarter expectations. The computer company reported adjusted per-share earnings of $1.74 and revenue of $22.93 billion. Analysts polled by Refinitiv anticipated per-share earnings of $1.14 and $20.85 billion. Morgan Stanley named Dell a top pick in IT hardware.)

(MongoDB advanced 5% after topping Wall Street expectations in its latest quarter. The database software maker posted adjusted earnings of 93 cents per share on revenue totaling $423.8 million for the second quarter. Those results topped expectations of 46 cents earnings per share and $393 million in revenue, according to a consensus estimate from Refinitiv.)

(Shares added 2.3% in premarket trading after the athletic apparel retailer reported an earnings beat. Earnings per share for its second fiscal quarter came in at $2.68, topping the Refinitiv consensus estimate of $2.54. Revenue was $2.21 billion, versus the $2.17 expected. Lululemon also upped its guidance for the year.)

(The drugstore chain rose by 0.4% in early trading. Walgreens said Friday that Roz Brewer had stepped down as the company’s chief executive and left the board.)

(The metals and mining stock rose nearly 2% after JP Morgan upgraded Vale to overweight from neutral, saying that shares look too cheap to ignore after recent pullback, valuation reset.)

Gapping down

(The cloud services company slid 1.9% before the bell. VMware gave a mixed second-quarter report on Thursday, beating expectations for earnings per share while missing on revenue. The company also said it entered a definitive agreement to be acquired from Broadcom.)

(Shares of the chipmaker fell 4% despite Broadcom’s fiscal third-quarter results beating expectations. The semiconductor company generated $10.54 in adjusted earnings per share on $8.88 billion of revenue. Analysts surveyed by Refinitiv were expecting $10.42 per share on $8.86 billion of revenue. Fourth-quarter revenue guidance of $9.27 billion was roughly in line with estimates.)

Source: CNBC

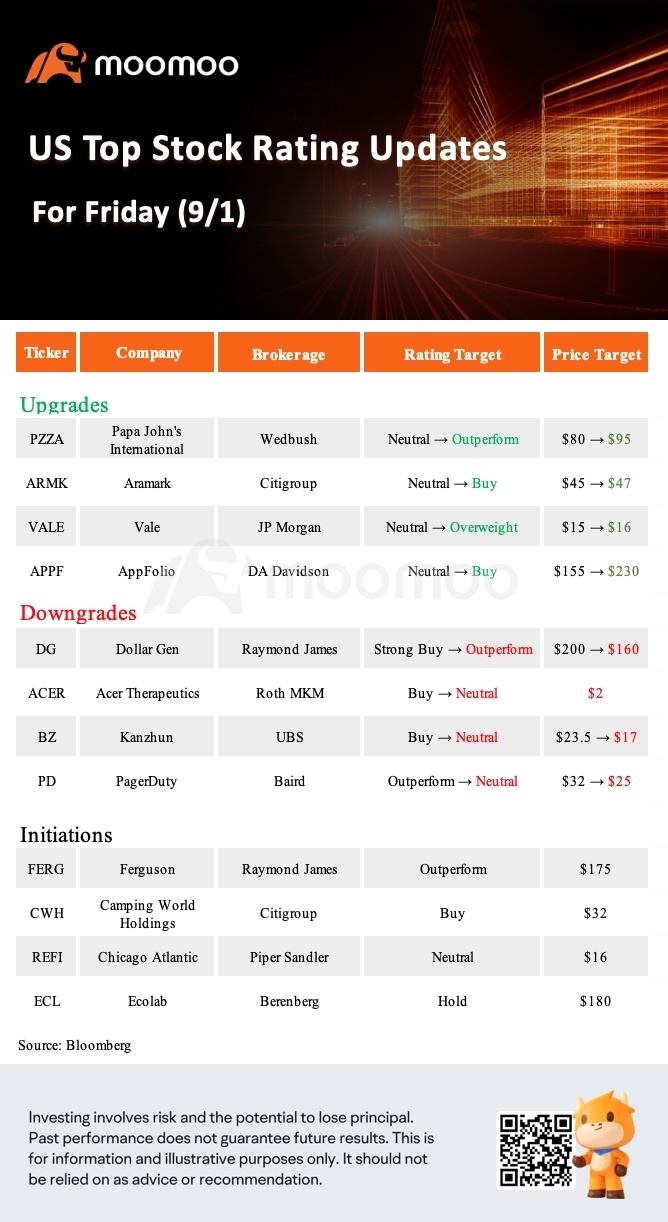

US Top Rating Updates on 9/1

$Vale SA (VALE.US)$ was upgraded by JP Morgan from Neutral to Overweight, increased target price from $15 to $16.

$Papa John's (PZZA.US)$ was upgraded by Wedbush from Neutral to Outperform, increased target price from $80 to $95.

$Dollar General (DG.US)$ was downgraded by Raymond James from Strong Buy to Outperform, decreased target price from $200 to $160.

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 22

22 1

1