Today's Morning Movers and Top Ratings: NVDA, PG, UAL, MS and More

Morning Movers

Gapping up

Procter & Gamble exceeded market expectations for its quarterly sales and profit. The company's shares rose approximately 1% in premarket trading.

P&G has been consistently raising prices for several months, which combined with reduced input costs for some commodities and stabilized supply chain and other expenses have contributed to a steady increase in their margins. The company is recognized for a range of products, including Gillette razors, Oral-B toothbrushes, and Dawn dish soap. In the quarter ended September 30th, P&G reported an improvement of 460 basis points in their gross margin, reaching 52%.

The stock rose 0.1% despite the insurer reporting a 14% fall in quarterly profit, as severe wind and hail storms in parts of the United States drove up catastrophe losses for the insurer.

Gapping down

The shares have continued to move lower in response to the United States government's decision to restrict the export of advanced chips to China. Shares fell 1.5% in early Wednesday trade after previously losing 4.7% on Tuesday.

In response to the filing and yesterday's development, analysts at Citi and Morgan Stanley lowered their price targets on Nvidia stock. Citi analysts slashed their price target by $55 per share to $575.

The stock fell 3.8% after reporting third-quarter results, with brokerages reducing their price targets on the online broker, citing the company's lowered account growth targets.

The stock fell 2.9% after the banking giant reported a 9% drop in profit from a year ago, while revenue grew 2% to $13.27 billion, essentially matching expectations.

Wealth management net revenue came in at $6.4 billion, trailing the expected $6.58 billion. Moreover, the company's net interest income stood at $1.98 billion, slightly below the estimated $2.06 billion. Equities sales & trading revenue was $2.51 billion while FICC sales & trading revenue came in at $1.95 billion. Analysts were looking for $2.41 billion and $1.83 billion, respectively.

UAL reported third-quarter results that topped estimates, but Q4 guidance fell short of estimates as higher fuel costs and the suspension of Tel Aviv flights are expected to weigh.

United Airlines Holdings shares were down about 5% in pre-market Wednesday trading.

Source: CNBC

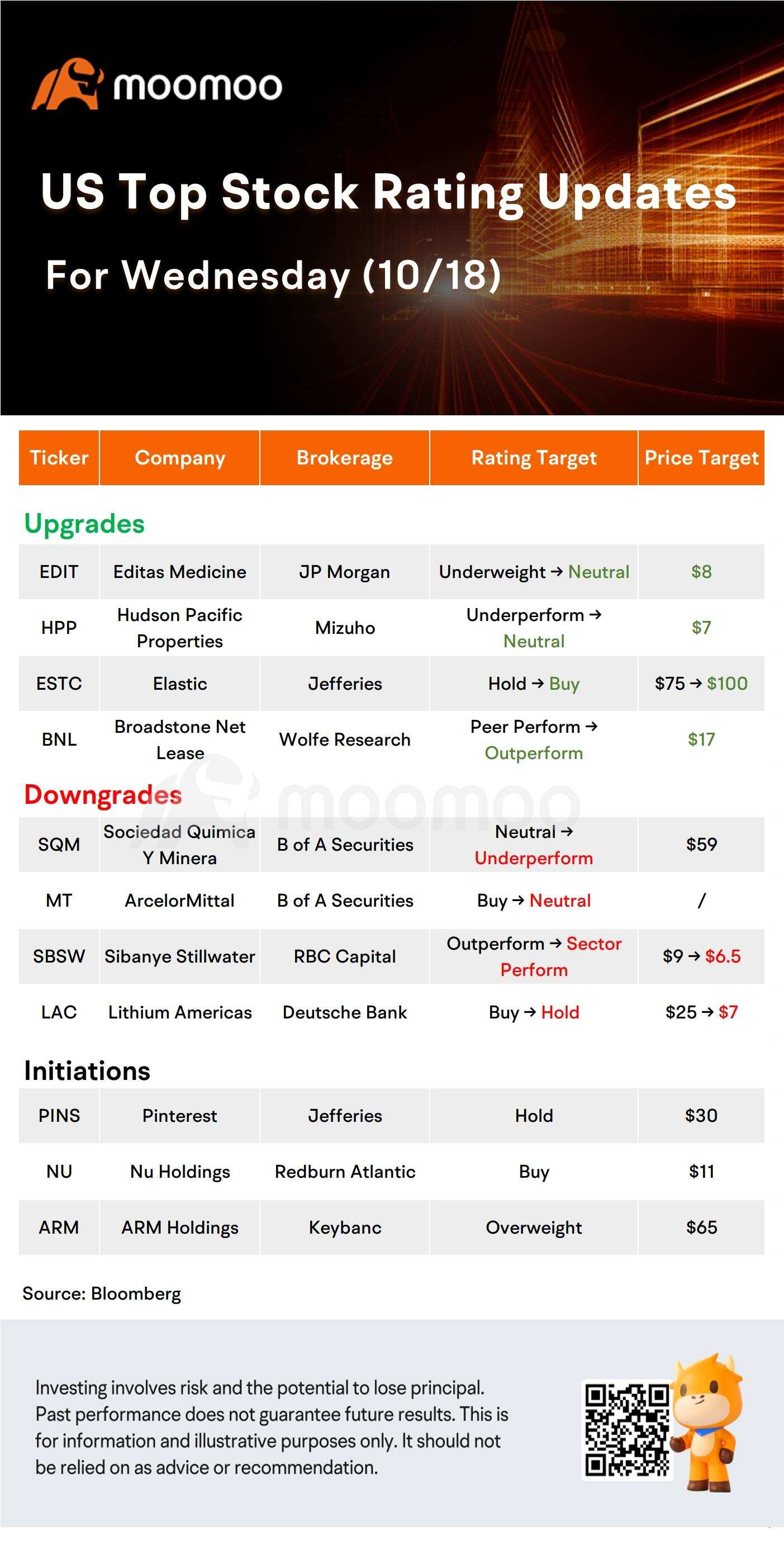

US Top Rating Updates on 10/18

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment