Today's Pre-Market Stock Movers And Top Ratings: WE, LYFT, DKNG, QCOM and More

Pre-Market Stock Movers

Gapping up

(Shares of the entertainment and casino company gained more than 15% in early morning trading after Disney’s ESPN announced a 10-year deal with Penn to create ESPN Bet, a sports betting site. As part of the deal, Penn will pay ESPN $1.5 billion in cash. Disney’s stock price gained more than 1.8% on news of the deal.)

(Shares of the military technology developer advanced 13.8% in premarket trading after reporting a beat on earnings and revenue for the second quarter. Axon posted earnings per share of $1.11, flying past analysts’ expectations of 62 cents, according to StreetAccount. Revenue came out at $374.6 million, while analysts expected $350.5 million. JPMorgan upgraded the stock to outperform and assigned a $235 price target, which suggests 34% upside.)

(Shares of the restaurant management software platform popped 14% after the company posted second-quarter earnings that topped expectations. Earnings per share of 19 cents surpassed a Street Account estimate of 1 cent per share. Toast reported $978 million in revenue, also exceeding expectations of $943.1 million.)

(Shares of the payments platform company jumped nearly 19% after Marqeta announced it struck a four-year deal to continue servicing Block’s CashApp. The company also reported a mixed second quarter. Marqeta lost 11 cents per share on $231 million of revenue. Analysts surveyed by Refinitiv were expecting a loss of 9 cents per share on $219 million of revenue.)

(The cybersecurity company gained 6.4% in premarket trading after it raised its full-year guidance and reported earnings for the second quarter that surpassed Wall Street’s expectations.)

Gapping down

(The stock plunged 25.7% after WeWork said in an SEC filing that there’s doubt about the company’s ability to keep operating amid by weaker-than-expected membership rates. WeWork warned of measures such as a potential bankruptcy or restructuring or refinancing its debt. Its share price, which was below $1 since early this year, dropped to $0.05 in premarket trading.)

(Shares lost almost 6% premarket after the ride-hailing company announced its second-quarter earnings. Lyft posted revenue of $1.02 billion, in line analyst estimates, according to Refinitiv. Meanwhile, adjusted per share earnings came in at 16 cents, beating estimates of a loss of 1 cent per share.)

(Dating platform Bumble slid 2.8% even after the company beat expectations for its second quarter on both lines. But Bumble offered weak expectations for adjusted EBITDA in the current quarter.)

(The sports betting company saw its shares fall about 4.6% after Disney-owned ESPN announced a partnership with its rival Penn Entertainment on a gambling sportsbook.)

Source: CNBC

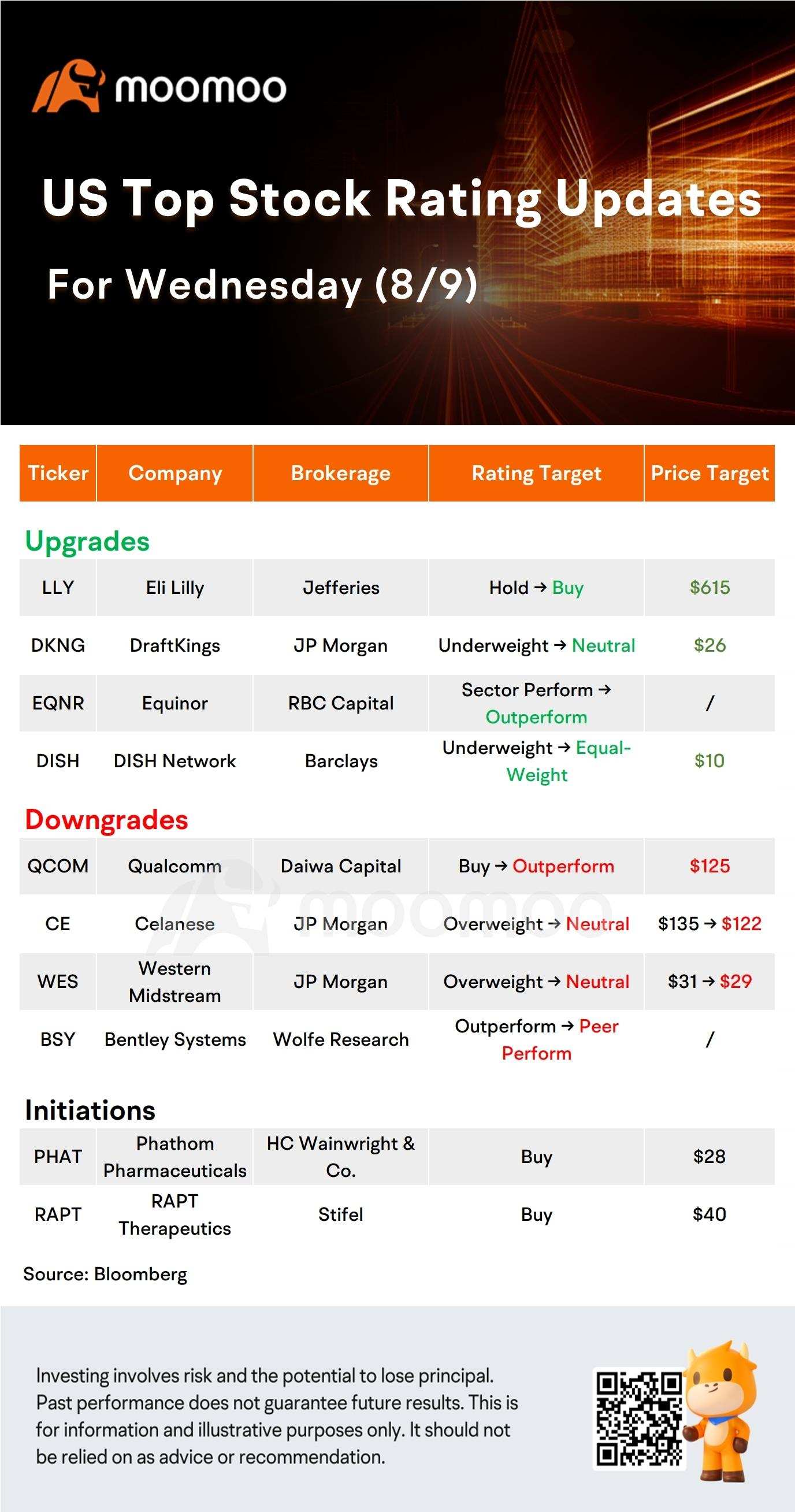

US Top Rating Updates on 8/9

$Eli Lilly and Co (LLY.US)$ was upgraded by Jefferies from Hold to Buy, increased target price to $615.

$Equinor (EQNR.US)$ was upgraded by RBC Capitals from Sector Perform to Outperform.

$Qualcomm (QCOM.US)$ was downgraded by Daiwa Capital from Buy to Outperform, decreased target price to $125.

$Celanese Corp (CE.US)$ was downgraded by JP Morgan from Overweight to Neutral, decreased target price from $135 to $122.

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102152793 : wow