Toyota and Honda's financial results for fiscal year 23, which are booming with the highest profits, beat Tesla and BYD in terms of performance and lost in stock prices!? Ready to pursue with enhanced shareholder returns

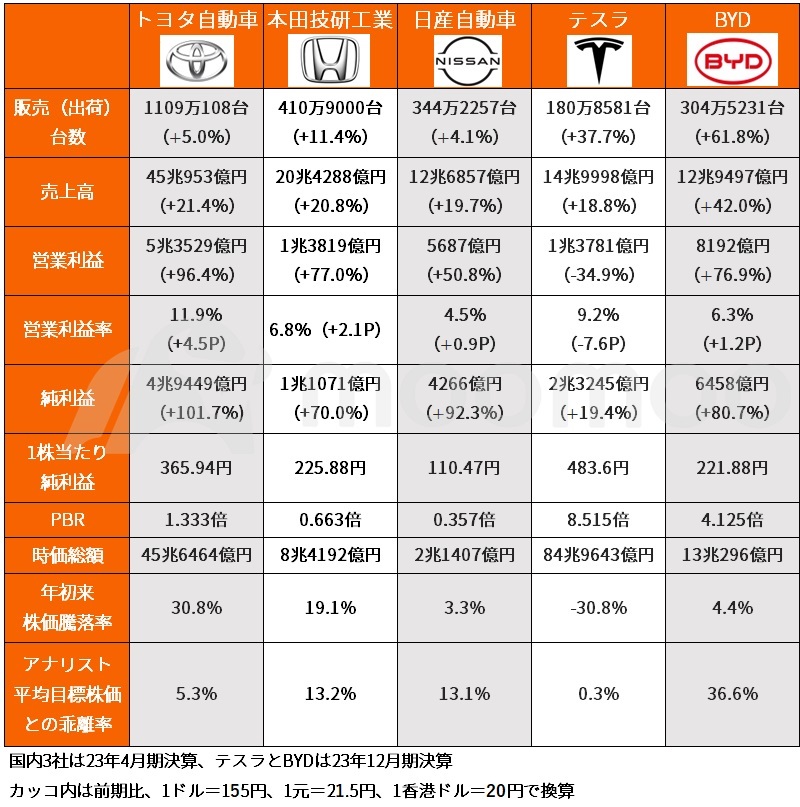

Financial results for the fiscal year 2023 (fiscal year ending 24/3) of the Big 3 domestic automobile manufacturers are ready. Due in part to the depreciation of the yen and the reevaluation of hybrid cars, each company had good financial results. particularly $Toyota Motor (7203.JP)$with $Honda Motor (7267.JP)$IsRecord profit updateI'm doing it,Toyota's operating profit was the first domestic company to be 5 trillion yenIt has reached.

The top 3 domestic markets in fiscal year 23 are rising rice $Tesla (TSLA.US)$or China $BYD COMPANY (01211.HK)$It can be said that they were more than equal in terms of performance against such emerging forces. Meanwhile, investor evaluations such as PBR have left a big gap in the two emerging companies,The sense that stock prices are undervalued stands out. Each company is working to enhance shareholder returns through dividend increases, share buybacks, etc., and they are also trying to chase down the 2 companies in terms of investor evaluations.From the fiscal year 24 earnings forecasts of the three domestic companies, we can also see points of view that should be paid attention to when considering investment。

The top 3 domestic markets in fiscal year 23 are rising rice $Tesla (TSLA.US)$or China $BYD COMPANY (01211.HK)$It can be said that they were more than equal in terms of performance against such emerging forces. Meanwhile, investor evaluations such as PBR have left a big gap in the two emerging companies,The sense that stock prices are undervalued stands out. Each company is working to enhance shareholder returns through dividend increases, share buybacks, etc., and they are also trying to chase down the 2 companies in terms of investor evaluations.From the fiscal year 24 earnings forecasts of the three domestic companies, we can also see points of view that should be paid attention to when considering investment。

All of the top 3 domestic sales increased, mainly in North America,Sales were about 20% higher than the previous fiscal yearHowever, what has grown even more than that is operating profit. The depreciation effect of the yen also boosted, and each company1.5 times or more compared to the previous fiscal yearIt became. FY23 can be said to be “earning power” itselfThe improvement in operating profit margins was evident, and Toyota reversed Tesla and Honda reversed BYD, respectivelyI did it.

The fact that the big 3 domestic companies have yet to catch up with the 2 emerging companies is evaluation from investors. Although the stock prices of Toyota and Honda have been rising steadily since the beginning of '24, the situation continues where Toyota falls short of Tesla and Honda of BYD in terms of total market value. particularlyIn PBR, Honda and Nissan have not yet been able to resolve the 1X split。

The domestic Big 3 are not content with this situation. Each company will coincide with the announcement of financial resultsProactive movement regarding shareholder returnsI'm showing you.

Toyota increased its year-end dividend per share by 10 yen from the previous fiscal year to 75 yen, which is an increase of 15 yen compared to the previous fiscal year. At the same time, it was announced that a stock buyback with an upper limit of 1 trillion yen will be carried out.The maximum total return amount for fiscal year 23 is 2.1 trillion yenIt goes up to. It was also revealed that Toyota will write off 520 million shares or 2 trillion yen worth of company stock. The dividend forecast for fiscal year 24 has not been disclosed, but the company”Implement stable and continuous dividend increasesIt indicates a policy to do”, and if fiscal year 24 were 75 yen, the same as fiscal year 23, the dividend yield at the closing price on the 14th would be 2.21%.

Honda, which aims to achieve over 1 times PBR at an early stage, also announced efforts aimed at improving corporate value in line with financial results announcements. In terms of shareholder returns,Stock buybacks are 250 billion yen in fiscal 23 and 300 billion yen in fiscal 24The policy of implementation. Dividends were also increased from 40 yen per share in fiscal year 22 to 68 yen (both figures reflect the 3 stock split in 23/10). In fiscal year 24, we plan to pay a dividend of 68 yen, the same as fiscal year 23.

$Nissan Motor (7201.JP)$Is per share per yearDividends doubled from 10 yen in fiscal year 22 to 20 yen。We plan to further increase dividends to 25 yen or more in fiscal year 24It was also announced. Stock buybacks invested 120 billion yen in fiscal year 23.In fiscal year 24, 2.5% of net profit is expected to be used to buy company shares, etc., and the total shareholder return rate is expected to be 30% or moreIt was revealed.

As for earnings forecasts for fiscal year 24 (fiscal year ending 25/3), each company is forecasting in line with their respective issues for future growth.

Authentication fraud issues were discovered one after another at group companiesToyota positions fiscal year 24 as “gaining a foothold” for future growth, a policy of “using necessary money and time.” President Koji Sato said in the financial results announcement, “We will work hard to improve individual skills and develop human resources with the idea of creating a way of working 10 years from now,”380 billion yen for “investment in people”It is said that they will change the way they work by throwing in. Of this, 300 billion yen will be used for suppliers and dealers. For this reason, although sales are expected to exceed fiscal year 23, operating income and net profit are expected to decline.

Honda places importance on improving operating margins, and aims to achieve an operating margin of 7% in fiscal year 24 by moving the initial target 1 year ahead of schedule. While sales are expected to decline, operating profit is expected to exceed the record high for fiscal year 23.

With fiscal year 24 resultsNissan has the most bullish forecastthat's it. By introducing new models all over the world,Both unit sales volume and sales are expected to exceed 7% in fiscal year 23, and operating profit is also assumed to increase 5.5%I'll do it.

Note that the estimated exchange rate is 1 dollar = 145 yen for Toyota and Nissan, and 1 dollar = 140 yen for Honda.

Although the direction of earnings forecasts is different between the three companies, what they have in common isThe amount of development investment such as research and development and capital investment is increasingThat's it.

Of Toyota's development investment in fiscal year 24, capital investment was 1.1 trillion yen, and research and development was 0.6 trillion yenA total of 1.7 trillion yen is a growth area for EVs, AI, etc.So, the amount has increased by 0.5 trillion yen since fiscal year 23.

Honda, which will drastically increase development investment from fiscal year 23, has operating cash flow not including R&D increased by 1 trillion yen from the previous fiscal year to approximately 3 trillion yen in the 23-year financial results,“We have built a foundation to support our future growth years”It says so.

Nissan's research and development expenses for fiscal year 24 have not been disclosed, but it invested 609.9 billion yen in fiscal year 23, an increase of 16.8% compared to fiscal year 22.

Based on the current stock prices of each company and earnings forecasts for fiscal year 25, there is a strong sense of undervaluation from the point of view when investing, and the earnings forecast for fiscal year 24 is strongNissan has a short-term perspectiveSo, fiscal year 24 is “solidifying our foothold”Toyota has a mid-term perspectiveSo, hoNda is a short to medium term perspective in betweenIt can also be said that it is suitable for viewing.

However, it is necessary to keep a close eye on trends to see if business performance progresses as expected.

ー MooMoo News Mark

Source: each company's website, moomoo

Source: each company's website, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

182076928鬼平 : It's a terrible comment isn't it!

isn't it!

182985505 : Toyota continues to decline

182984552 : Should I buy a Toyota now?

のもぐー : Since they bought the company's stock at the bottom price and sold at a high price, it went back and forth between 3400 and 3600 yen.

よろぴこ : Whether the yen depreciates or the yen appreciates, it will fall.

I wonder what's going on.