Traders to stay cautious after 10-year treasury yield hits new high since July

US Market Key Charts (S&P, US Dollar, Gold)

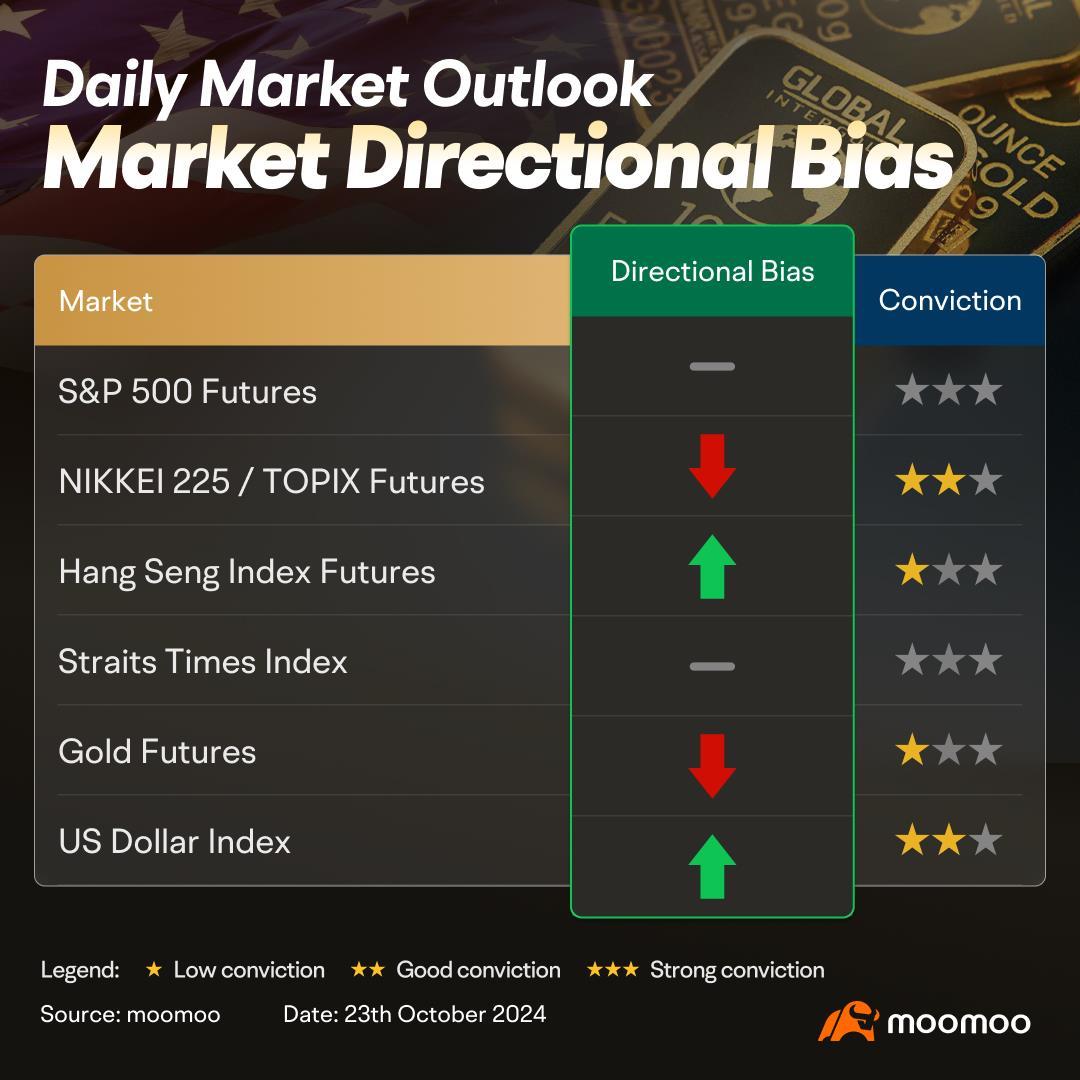

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral with a slight bullish bias as price hovers between 5850 support level and 5940 resistance level. A 4 hour candlestick closing above 5940 resistance level could open push towards 5990 resistance level. Technical indicators are mixed with MACD displaying a bullish momentum and price holding below 21-EMA.

Alternatively: A 4 hour candlestick closing below 5850 support couldopennext drop towards 5810 support level.

$USD (USDindex.FX)$ (4 Hour Chart) -[BULLISH↗ **]We stay bullish as price has pushed above 103.991 resistance-turn-support level. We expect price to push towards 104.437 resistance level. A 4 hour candlestick closing above 104.437 resistance level would open the next push toward 104.475 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 103.991 support level would open next drop towards 103.656 support level.

$Gold Futures(DEC4) (GCmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn slightly bearish as price is nearing 2765 resistance level. As long as price holds below 2765 resistance level, we expect price to drift lower towards 2730 support level. Technical indicators have yet to display a bearish momentum.

Alternatively: A 4 hour candlestick closing above 2765 resistance level would open push towards next resistance at 2780.

NIKKEI 225 / TOPIX IndexFutures

$Nikkei 225 (.N225.JP)$ (4 Hour Chart) -[BEARISH ↘ **]We maintain our bearish directional bias as long as price holds below 38900 resistance level. We expect price to continue dropping towards 37770 support level. Technical indicators are leaning towards a bearish directional bias as well.

Alternatively: A 4 hour candlestick closing above 38900 resistance level would open push towards 39500 resistance level.

HSI IndexFutures

$HSI Futures(NOV4) (HSImain.HK)$ (4 Hour Chart) -[BULLISH↗ *]We turn slightly bullish as long as price holds above 19870 support level. We expect price to drift towards 21630 resistance level. Technical indicators are currently mixed, with prices holding above 21-EMA period.

Alternatively: A 4 hour candlestick closing below 19870 support level would open next drop towards 19220 support level.

SG Market - STI

$FTSE Singapore Straits Time Index (.STI.SG)$ (4 Hour Chart) -[NEUTRAL]We maintain a neutral directional bias with a slight bullish bias as there is no good risk-to-reward ratio. Price is currently hovering between 3570 support and 3640 resistance level. A 4 hour candlestick closing above 3640 resistance level would open push towards next resistance at 3700.

Alternatively: A 4 hour candlestick closing below 3570 support level would open next drop towards 3510 support level.

Summary - What Is Happening In The Markets

US markets closed mixed last night, with $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ drifting marginally lower by 0.06% and $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ edging higher by 0.11%. There is currently mixed sentiments among traders after earning reports, US 10-year yield rising above 4.2% and uncertainty ahead of the US elections. Markets are currently pricing in a quarter-point cut at Fed's next meeting in November. Existing home sales data, earning reports from $Tesla (TSLA.US)$ and $Coca-Cola (KO.US)$ would be out, and traders could look to observe it.

Asian markets opened mixed this morning. $Nikkei 225 (.N225.JP)$ dipped by 0.16%. There is risk-off sentiment among traders as IMF reduced Japan's projected economic growth to slow to 0.3% in 2024. However, traders should also note that IMF believe that the economy will bounce back in 2025. Traders should keep an eye out for au Jibun Bank Japan manufacturing and services PMI. $HSI Futures(NOV4) (HSImain.HK)$ climbed higher by 1.48%. This comes after PBoC cutting key lending rates by quarter basis points on Monday and launching first operation of new swap facility transaction on Tuesday. $FTSE Singapore Straits Time Index (.STI.SG)$ edged higher by 0.59%, with the finance and producer manufacturing sector advancing. $DBS Group Holdings (D05.SG)$, $OCBC Bank (O39.SG)$ and $UOB (U11.SG)$ climbed higher by 0.62%, 1.05% and 0.90% respectively. Among other stocks, $HongkongLand USD (H78.SG)$ pushed the most by 1.78%. Traders should look out for CPI data released later.

Prepared by:

Moomoo Singapore

Isaac Lim CMT, CFTe

Chief Market Strategist

Chief Market Strategist

This report is provided for informational and general circulation purposes only and should not be construed as an offer, solicitation, or recommendation for the purchase or sale of securities, futures, or other investment products. It does not take into consideration any particular needs of any person. This advertisement has not been reviewed by the Monetary Authority of Singapore.

For full disclaimers, please visit https://www.moomoo.com/sg/support/topic5_935.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Les Lim : there no stocks to buy in SG

钱爱我我爱钱 Les Lim : buy reits

JaydenTan : Will just comtinue to go higher these few days![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)