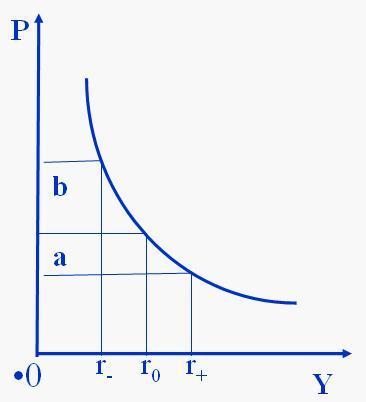

Interest rates play a central role in asset prices, profoundly impacting financial markets much like gravitational pull affects physical objects. The bond market, as an important component of the financial market, is particularly sensitive to changes in interest rates. When expectations for rate cuts intensify, investors typically adjust their investment strategies in advance to adapt to the upcoming interest rate environment. This adjustment is reflected in the fluctuations of bond prices. Due to the inverse relationship between bond prices and yields, expectations of rate cuts enhance the attractiveness of existing bonds, as they offer more favorable coupon rates compared to bonds that may be issued in the future.