Travel Industry Looks Ahead: Cruise Stocks and Airline Stocks Soar on Positive News

Wall Street remains optimistic about cruise stocks as the industry continues to enjoy a surge in demand following the pandemic. This trend is expected to persist, and it is projected that 35.7 million passengers will take a cruise in 2024, which represents a 6% increase from 2019 and a rise from the 31.5 million in 2023, according to the Cruise Lines International Association.

• The Oil Price Has Started to Fall:

Due to shutdowns and limitations, the cruise industry was the slowest in the travel sector to recover from the Covid-19 pandemic. This year, however, cruise stocks were performing well until late summer and fall. During that time, a combination of high oil prices, Maui wildfires disrupting Hawaiian travel, and the Israel-Hamas war led to share price declines.

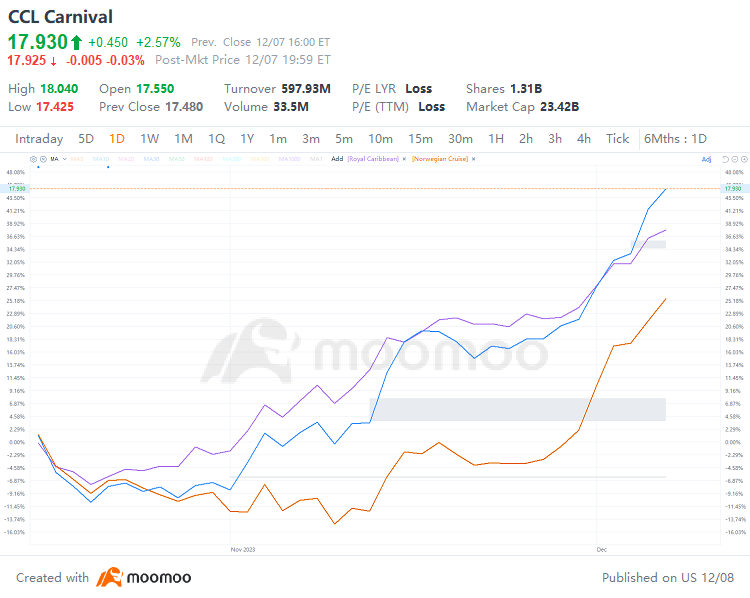

Currently, things have taken a turn for the better as oil prices have decreased, with U.S. crude falling below $70 a barrel on Wednesday. Additionally, Hawaiian cruises have resumed operations, while itineraries to Israel are currently canceled. Since the close of Oct. 31, $Carnival (CCL.US)$ shares have risen by 55%, $Royal Caribbean (RCL.US)$ has gained 40%, and $Norwegian Cruise (NCLH.US)$ has added 37%.

• Strong Demand Brought By Promotional Sales During Black Friday:

The results of Black Friday and Cyber Monday sales indicate that there is a positive trend in bookings, with promotional deals becoming more frequent as wave season approaches. This period starts after holidays and extends through the end of March. Carnival reported record bookings for its Princess, Holland America, and Cunard lines during the Black Friday period last week.

Royal Caribbean did not release any details regarding the success of its Black Friday and Cyber Monday sales since it does not provide updates within the quarter, according to Deutsche Bank analyst Chris Woronka.

• Wall Street Still Bullish On Cruise Stocks:

Royal Caribbean has an average analyst rating of overweight and average price target of $118.74, and Carnival has an average analyst rating of overweight, according to FactSet.

Analyst Conor Cunningham from Melius Research upgraded Carnival shares from "hold" to "buy." One of the reasons for this recommendation was the industry's growing momentum in booking trends. The availability of excess free cash flow was another factor cited by Cunningham to support the upgrade.

According to Seeking Alpha analyst Manika Premsingh, "A vastly improved operating environment for the travel sector is, of course, the driving factor behind investor bullishness on Carnival's stock."

• Airline Stocks Rebounded Due to Similar Factors:

Recently U.S. airline stocks perform exceedingly well on the bourses.

The notable performance on the stock markets was driven by Delta's optimistic statements during the Morgan Stanley Global Consumer & Retail Conference. Following an exceptional performance during the Thanksgiving holiday, Delta's management anticipates strong traffic during Christmas, concluding a prosperous year.

The upbeat air-traffic scenario apart, the decline in oil price from the 2023 highs reached in late September bodes well for airlines. This is because expenses on fuel represent significant input costs for airlines.

Source: CNBC, ZACKS, Seeking Alpha

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment