Treasuries Dynamics: Fiscal Deficit Is Expected to Further Expand This Year. Will the U.S. Debt Storm Strike Again?

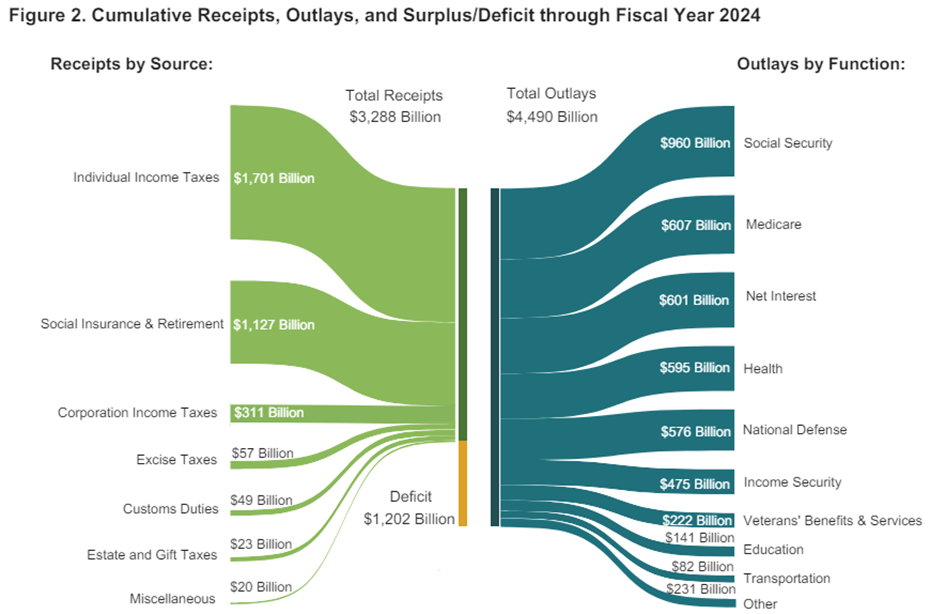

According to the Department of the Treasury, the federal deficit in May 2024 was $347 billion, an increase of $107 billion from the same period last year. The cumulative deficit in fiscal year 2024 was $1,202 billion, which is also higher than the $1,165 billion in the same period last year.

■ Deficits set to hit new highs. Will the market repeat the scenario from Q3 last year?

In Q3 last year, due to the upward revision of the deficit and the increase in the scale of interest-bearing Treasury auctions, bond interest rates rose to 5%.

As for this year, although the Treasury General Account (TGA) still has a substantial balance now, the deficit in Q3 could increase significantly due to base effect, since the cancellation of the student loan forgiveness policy in 2023 caused a fiscal surplus in September.

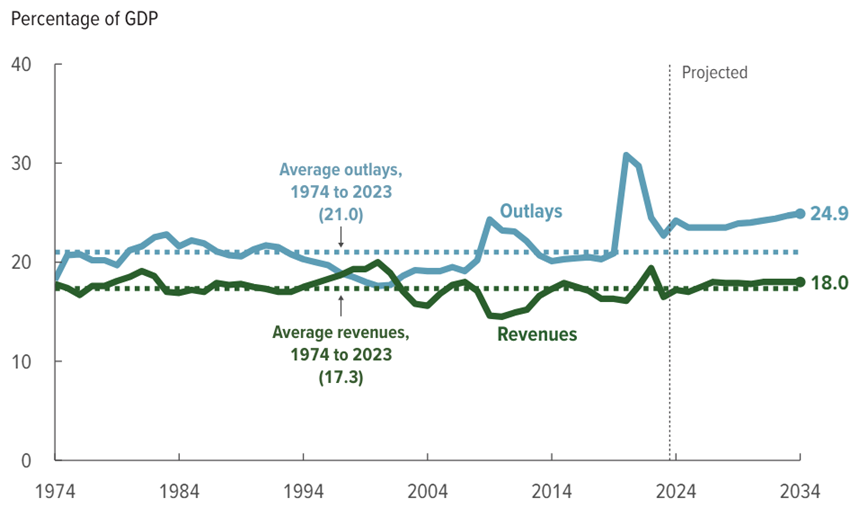

According to the Congressional Budget Office (CBO)'s announcement in June, the U.S. is projected to face a budget deficit of $1.915 trillion in fiscal 2024, surpassing the previous year's deficit of $1.695 trillion, marking it as the highest deficit since the period affected by the COVID-19 pandemic.

Considering a longer period of time, the CBO anticipates that by 2034, the total budget deficit will reach 6.9 percent of the GDP. These factors mean that the U.S. debt problem may not be over yet.

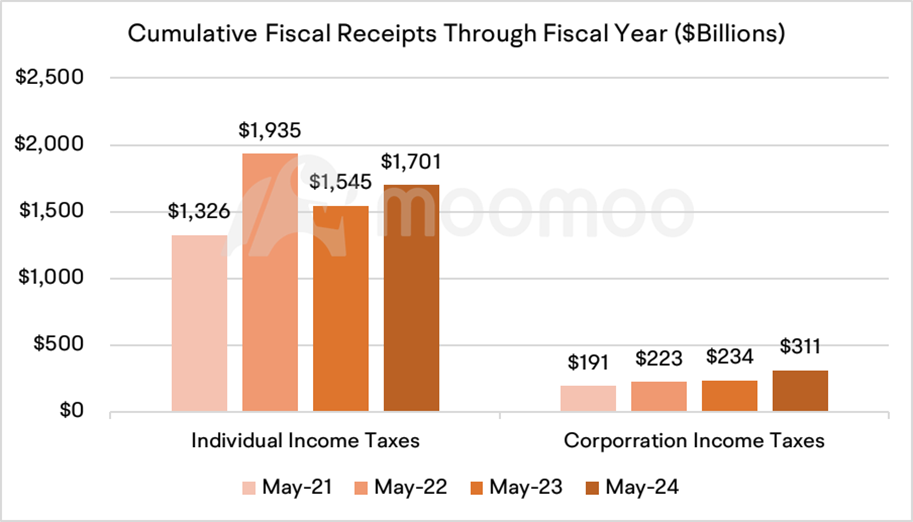

■ Annual tax payments are strong, but uncertainty exists after 2025

Personal income tax and corporate income tax collections increased by $79 billion and $77 billion in May, respectively, representing growth of 12.5% and 33%. Cumulative fiscal income through fiscal 2024 was also stronger than last year. Due to the stock market recovery in 2023, with the S&P 500 rising by 24%, revenues from capital gains tax and other sources have significantly increased in 2024.

However, the "sunset provisions" of the "Tax Cuts and Jobs Act" are set to expire on December 31, 2025. Currently, the CBO has not included the extension of the tax cut policies in its projections, so the future fiscal receipts may be overestimated, and the actual deficit could be higher.

President Biden has already indicated his opposition to these "sunset provisions." On April 24, Biden wrote on the X website: "Donald Trump is very proud of his $2 trillion tax cut initiative, which greatly benefited the wealthy and large corporations and increased the federal debt. Most of these tax cut policies are about to expire. If I am re-elected, I will not extend these policies." On the contrary, if Trump wins the election, it is highly likely that the tax cuts will be extended.

During last week's presidential debate, Biden and Trump attacked each other over the issue of high deficits. Although Trump's approval rating on economic issues is significantly higher than Biden's, the former president did not provide a clear solution on how to reduce the deficit.

■ Fiscal outlays: national defense and interest expenditures increased significantly

So far in the fiscal year 2024, overall U.S. government spending has maintained a high growth rate of around 8%. There was a sharp decrease in the growth rate of spending last year in the third quarter, mainly due to the temporary pause of student loan forgiveness. However, based on the trend of monthly expenditure and last year's baseline, the year-over-year growth rate in Q3 this year is expected to continue rising.

1) Regular mandatory expenditures such as Social Security and Medicare reached a growth rate of about 10% in May. Excluding end-of-month disturbances, the growth rate is also above 6%.

2) Interest expenditures increased by over $180 billion, nearly a 50% increase, which is a major part exceeding expectations. By 2034, net interest payments are expected to rise to 4.1 percent of GDP, making up approximately one-sixth of all federal government expenditures, according to CBO.

3) Military-related spending also increased by nearly $40 billion, an increase of 8%. The Biden administration has added a number of additional military aids this year, with an additional increase of about 10 billion in April and May.

4) The main decreases were in education and COVID-19-related subsidies. However, these reductions are not enough to lower overall spending.

The outcome of the election will also affect future fiscal spending. A White House under Biden's leadership may continue to increase funding for infrastructure projects. Still, both candidates have the potential to widen the deficit in different ways.

■ What are the implications?

For monetary policy, as the interest burden continues to increase, the discussion on the sustainability of fiscal expansion will continue. If the inflation data is close to the target range, there might be increased calls for the Fed to cut interest rates, and there is a chance that the interest rate cut expectations may become earlier.

For capital markets, the economy driven by fiscal stimulus may lead to the continued situation of a strong stock market and weak bond performance.

However, economists warn that the financial burden of national debt has the potential to divert money away from private investment.“The exploding debt could cause as much as a 10% reduction in real wage income within 30 years,” stated Kent Smetters, who is a professor at the University of Pennsylvania's Wharton School and also serves as the faculty director for the Penn Wharton Budget Model.

Source: United States Department of the Treasury, Congressional Budget Office, FRED

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Clement Lemons : ok