TF := 13;{PERIOD OF 13}

UP := EMA(H, TF);

DW := EMA(L, TF);

F1 := C > O AND (O > UP OR C < DW); F2 := C < O AND (O < DW OR C > UP); COND := F1 OR F2;

COND1 := UP > REF(UP, 1) AND DW > REF(DW, 1);

COND2 := UP < REF(UP, 1) AND DW < REF(DW, 1);

COND3 := NOT(COND1 OR COND2);

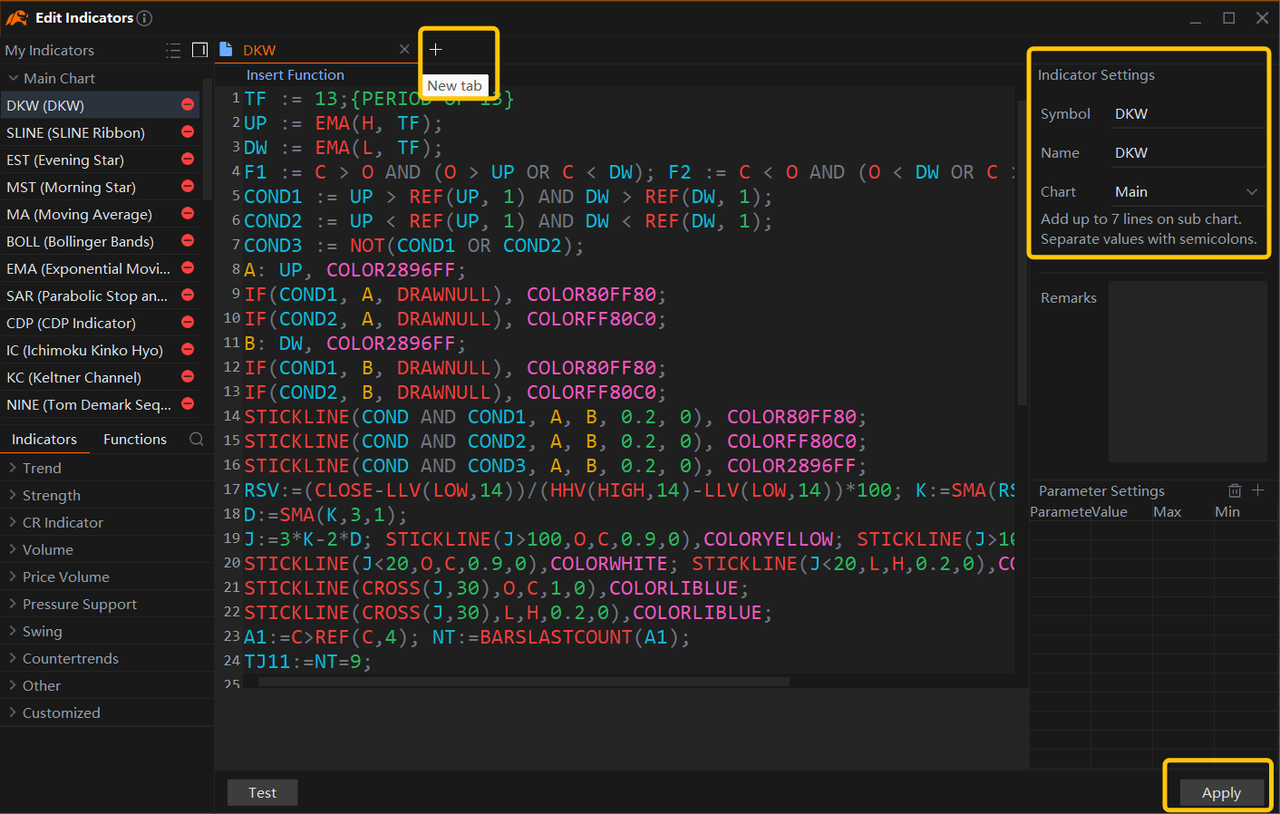

A: UP, COLOR2896FF;

IF(COND1, A, DRAWNULL), COLOR80FF80;

IF(COND2, A, DRAWNULL), COLORFF80C0;

B: DW, COLOR2896FF;

IF(COND1, B, DRAWNULL), COLOR80FF80;

IF(COND2, B, DRAWNULL), COLORFF80C0;

STICKLINE(COND AND COND1, A, B, 0.2, 0), COLOR80FF80;

STICKLINE(COND AND COND2, A, B, 0.2, 0), COLORFF80C0;

STICKLINE(COND AND COND3, A, B, 0.2, 0), COLOR2896FF;

RSV:=(CLOSE-LLV(LOW,14))/(HHV(HIGH,14)-LLV(LOW,14))*100; K:=SMA(RSV,3,1);

D:=SMA(K,3,1);

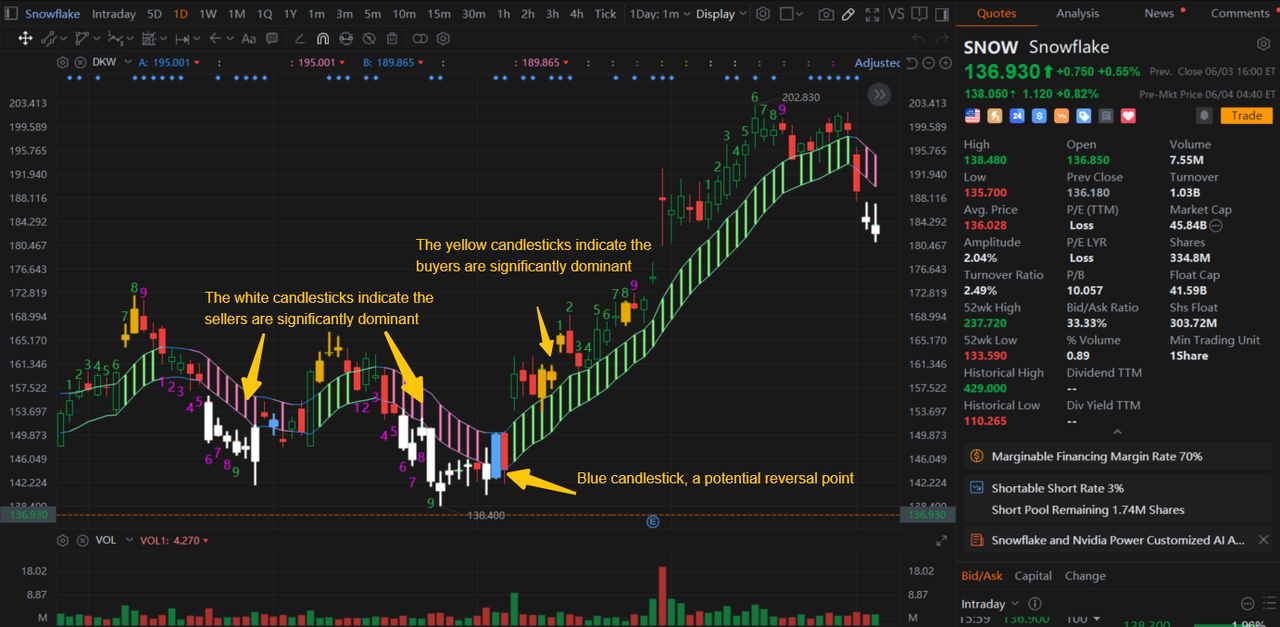

J:=3*K-2*D; STICKLINE(J>100,O,C,0.9,0),COLORYELLOW; STICKLINE(J>100,L,H,0.2,0),COLORYELLOW;

STICKLINE(J<20,O,C,0.9,0),COLORWHITE; STICKLINE(J<20,L,H,0.2,0),COLORWHITE;

STICKLINE(CROSS(J,30),O,C,1,0),COLORLIBLUE;

STICKLINE(CROSS(J,30),L,H,0.2,0),COLORLIBLUE;

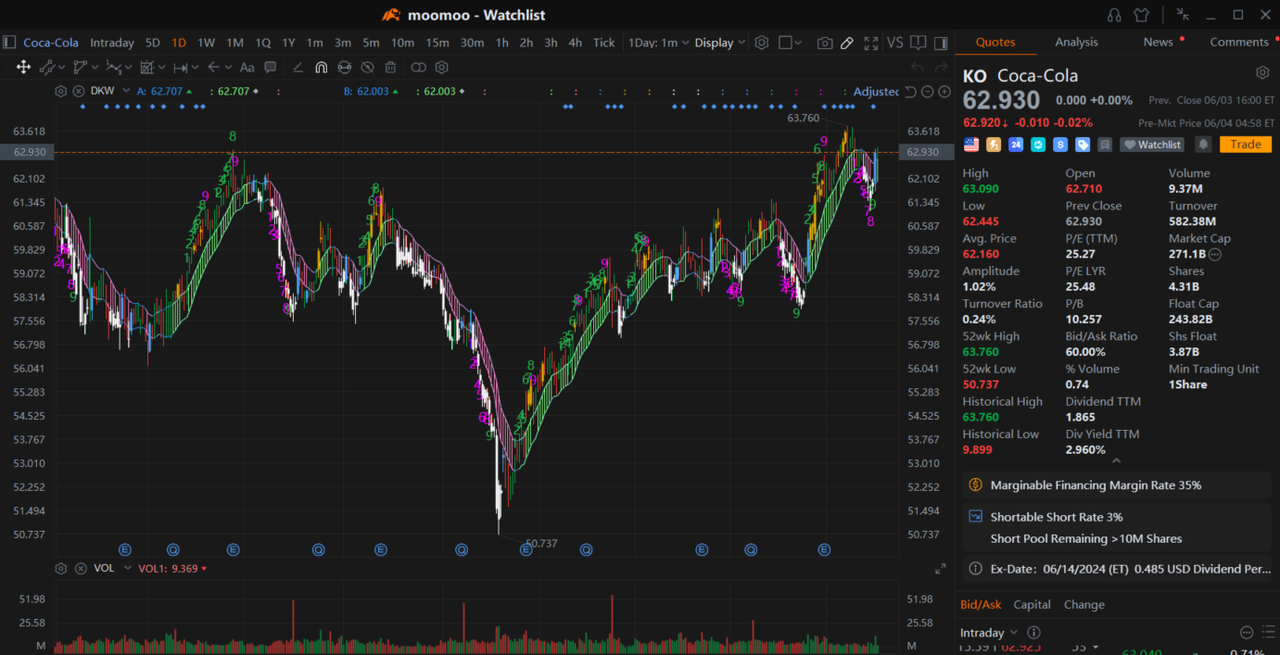

A1:=C>REF(C,4); NT:=BARSLASTCOUNT(A1);

TJ11:=NT=9;

TJ13:=ISLASTBAR AND BETWEEN(NT,5,8);

AY:=(BACKSET(TJ11>0,9) OR BACKSET(TJ13>0,NT)) * NT;

DRAWNUMBER((AY > 0 AND AY < 9), H * 1.007, AY ), COLORGREEN;

DRAWNUMBER(NT = 9, H * 1.007, 9 ), COLORFF00FF;

B1:=C<REF(C,4);

NT0:=BARSLASTCOUNT(B1);

TJ21:=NT0=9 ;

TJ23:=ISLASTBAR AND BETWEEN(NT0,0,8);

AY1:=(BACKSET(TJ21>0,9) OR BACKSET(TJ23>0,NT0))*NT0;

DRAWNUMBER((AY1 > 0 AND AY1 < 9), L, AY1, 0, -1*15), COLORFF00FF;

DRAWNUMBER(NT0 = 9, L, 9, 0, -1*15), COLORGREEN;

HLAFENTITY:=ABS(O-C)/2+MIN(O,C);

AA:=BARSLAST(NT0=9);

DOWNGAP:=H<REF(L,1);

BB:=AA>=0 AND AA<=15 AND DOWNGAP; STICKLINE(BB,REF(L,1),H,0.75,1),COLORWHITE;

CC:=BARSLAST(BB);

DD:=CC>=1 AND CC<=3 AND H>REF(L,CC+1) AND C>O;

DRAWICON(DD AND NOT(REF(DD,1)) AND NOT(REF(DD,2)),L*0.975,5);

STICKLINE(DD AND NOT(REF(DD,1)) AND NOT(REF(DD,2)),O,C,0.75,0),COLORMAGENTA;

DRAWTEXT(DD AND NOT(REF(DD,1)) AND NOT(REF(DD,2)),L,' -------------'),COLORLIGRAY;

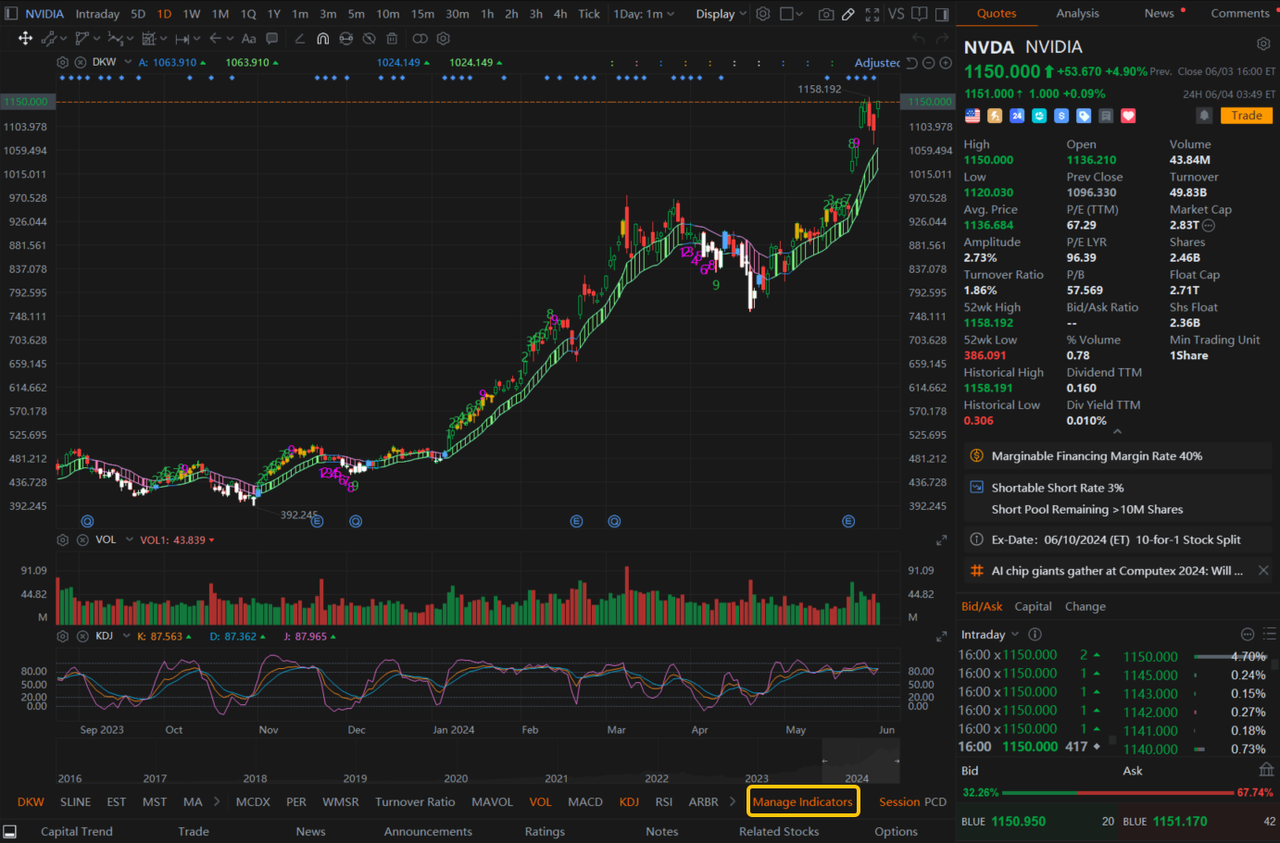

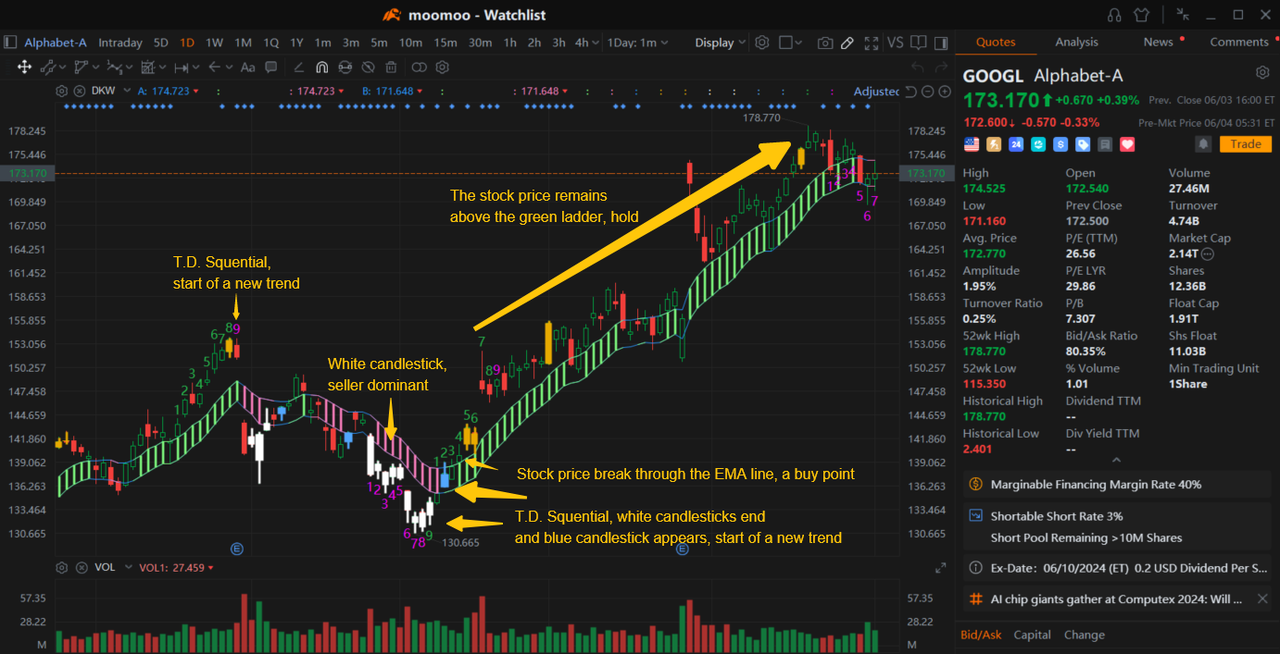

Takias : Fantastic article.

ZmjjkK OP Takias : Give it a try!!

Takias ZmjjkK OP : I’m on it already mate :) analyzing your indicator onsome of the stocks from my current portfolio

ZmjjkK OP Takias : Great to hear that! Let me know if you have any questions

Edwar Dli : seems like it works wow

Revana : so based on this indicator, ARM will go up right?

BlueGoo : mara is on an upward trend

Maniac Fool : Wow nice pictorial indicators

Terrence Tan CK : Do you also have this type of indicators for Trading View?

sulin : Thanks so much for sharing! Im new to trading and find this very useful.

View more comments...