Trump 2.0: Will the market momentum last?

Last Wednesday, the 2024 US election concluded with Trump's sweeping victory. Also boosted by the Federal Reserve's expected 25 basis point rate cut, US stocks entered a rally, with banks rising 10% on the announcement of Trump's victory. The three major US Stock indices climbed nearly 5% over the week, while Bitcoin reached an all-time high, Tesla soared 29% and Nvidia gained 9%.However, the current strong bullish sentiment leading up to the election has added some uncertainty to the post-election market:

Can This Momentum be Sustained?

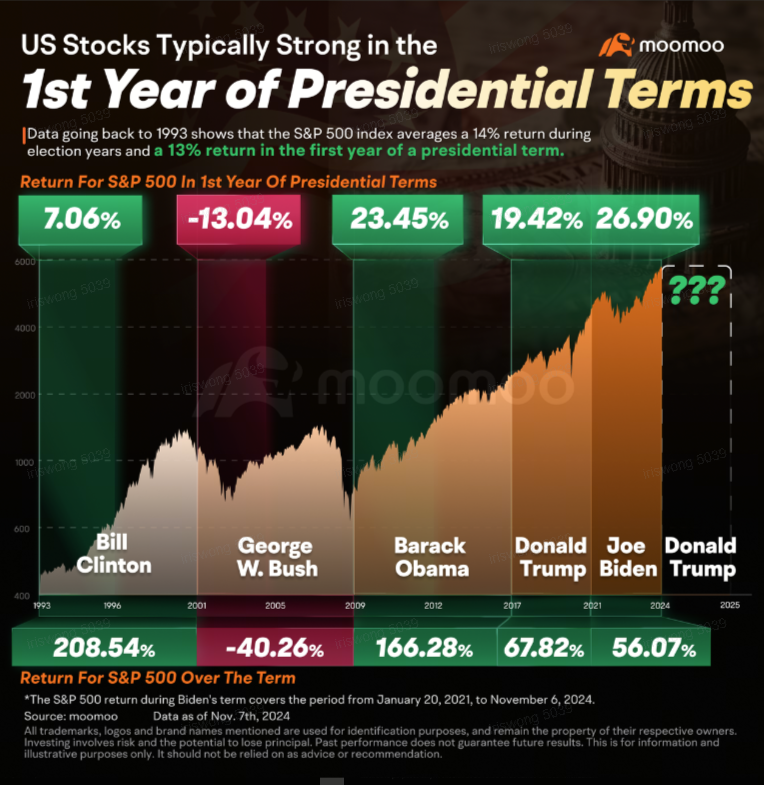

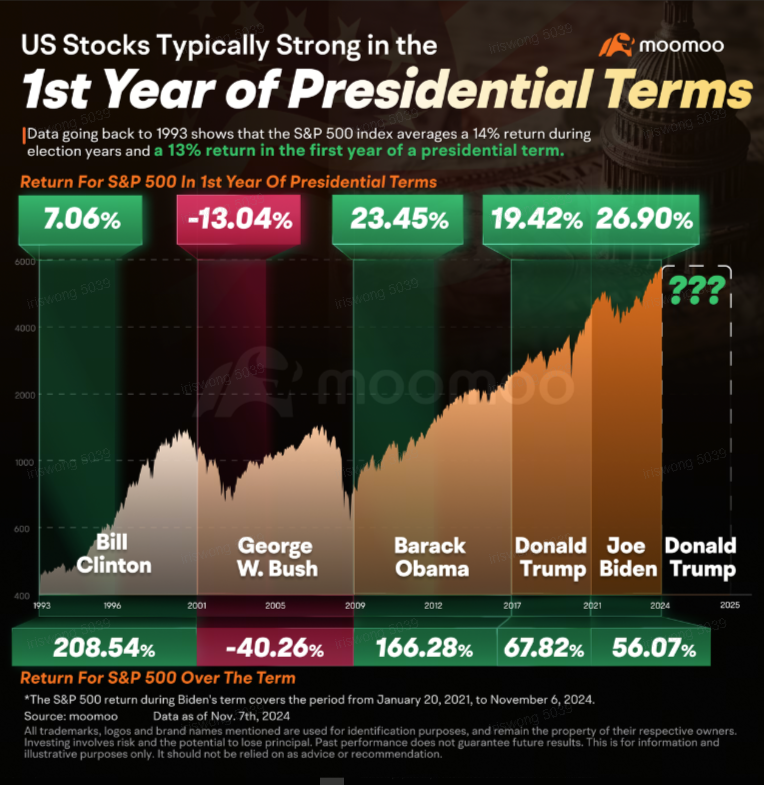

Historically, after US elections, once uncertainty dissipates, the stock market has experienced a rally. Since 1993, the S&P 500 index has averaged a 14% return during election years and a 13% return in the first year of a presidential term. For Trump, after his 2016 election victory, the upward trend continued until a significant correction at the end of 2017. During the first term of his presidency, the market rose nearly 20%.

The rise in stock markets is fundamentally driven by corporate earnings and robust economic growth, while monetary policy serves as a tool to adjust economic activity. However, Trump's policy on tariffs and immigration will ultimately affect the market.

Trump seeks to impose tariffs ranging from 10% to 20% on imports from other countries, with a proposed 60% tariff on Chinese goods. The US being the world's largest importer, such tariffs will inevitably put upward pressure on global prices. On the immigration front, curbing illegal immigration might boost the labour shortages, and could also lead to rising wage levels. The combined increase in prices and wages is likely to sustain a high-interest-rate environment, which is a current market concern. However, implementing policies such as massive deportations run into practical constraints, as the cost of deporting immigrants could prove extremely high. The average inflation went from 2.1% in 2017 to 2.4% in 2018, and dropped to 1.8% in 2019.

On the flip side, Trump’s tax cuts and deregulation have been significant positives for business growth. Markets expect the corporate tax rate to drop from 21% to 15% under his administration, which is projected to boost overall corporate earnings per share (EPS) by 4% to 6%. Goldman Sachs Research estimates that by 2025, $4 trillion in corporate spending will be roughly split between returning cash to shareholders (through buybacks and dividends) and investing in growth (such as capital expenditures, research and development, and mergers and acquisitions).

Under Trump's previous administration, domestic-facing and defensive industries such as utilities, telecom services, and real estate tended to outperform, while automobile, capital goods, and technology hardware stocks underperformed.

Additionally, deregulation in the financial sector and in artificial intelligence (AI) will likely create favorable conditions for AI growth. The ongoing rise in US stocks is largely driven by the transformative impact of AI on production and daily life, so further easing of regulations will expand the possibilities for growth in this sector.In summary, Trump's policies have generally had a positive impact on the US stock market. However, the outlook for the US economy remains uncertain and largely depends on the direction of his administration's future policies.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment