Trump returns! What lies ahead for stocks and bitcoin?

In the early hours of November 6, U.S. local time, Republican presidential candidate Donald Trump announced his victory in the 2024 presidential election. In response to the election outcome, the "Trump Trade" swept across major asset classes, with S&P 500 index futures rising by 2%, the dollar and U.S. Treasury yields increasing, and Bitcoin briefly surpassing $75,000, hitting a historic high!

Trump's policy positions clearly reflect a conservative stance, emphasizing "America First." He intends to implement trade protectionism, strict immigration restrictions, tax cuts, and regulatory rollbacks, while advocating for the development of traditional energy sources and dismissing climate change as a "hoax."

Trump's return to the White House could benefit industries such as infrastructure, traditional energy, finance, and pharmaceuticals, but his policies may also lead to rising inflation, which could weigh on market performance.

Trump has committed to cutting corporate taxes and reducing regulations, and he may appoint a dovish Federal Reserve chairman. His victory is expected to be favorable for the financial sector, including banks and asset management companies, and could help boost the U.S. stock market in the short term.

Historically, presidential elections have had some impact on the monthly performance of U.S. stocks. As the election date approaches, market volatility typically increases, leading to weaker stock performance; however, after the election results are announced, the uncertainty dissipates, and volatility tends to decline, paving the way for a potential rebound in the stock market.

According to Bank of America, U.S. stocks usually decline in the months leading up to the election (September and October) and then rebound in November and December. In fact, many analysts have predicted that regardless of who wins the presidency, the bullish momentum in U.S. stocks is set to persist into late 2024. One week before the election, the S&P 500 index declined by 1.4%, which could signal a bullish outlook for the stock market in the following month. According to Jefferies' analysis, if the S&P 500 performs poorly before election day, it is likely to do well afterward, with an expected average increase of about 4% by year-end.

Large ETFs tracking the S&P 500 index include $Vanguard S&P 500 ETF (VOO.US)$ , $SPDR S&P 500 ETF (SPY.US)$ , and $iShares Core S&P 500 ETF (IVV.US)$ , which have good liquidity and low fees. Investing in the S&P 500 index can effectively diversify individual stock and sector risks, making it a powerful tool for outpacing inflation in the long run.

Trump is undoubtedly a supporter of cryptocurrencies, and the surge in Bitcoin is seen as a key aspect of the "Trump Trade." Trump has vowed that if he returns to the White House, he will make the U.S. the global capital of cryptocurrency, establish a strategic Bitcoin reserve, and appoint regulators who are friendly to digital assets, indicating that he is the most pro-crypto candidate.

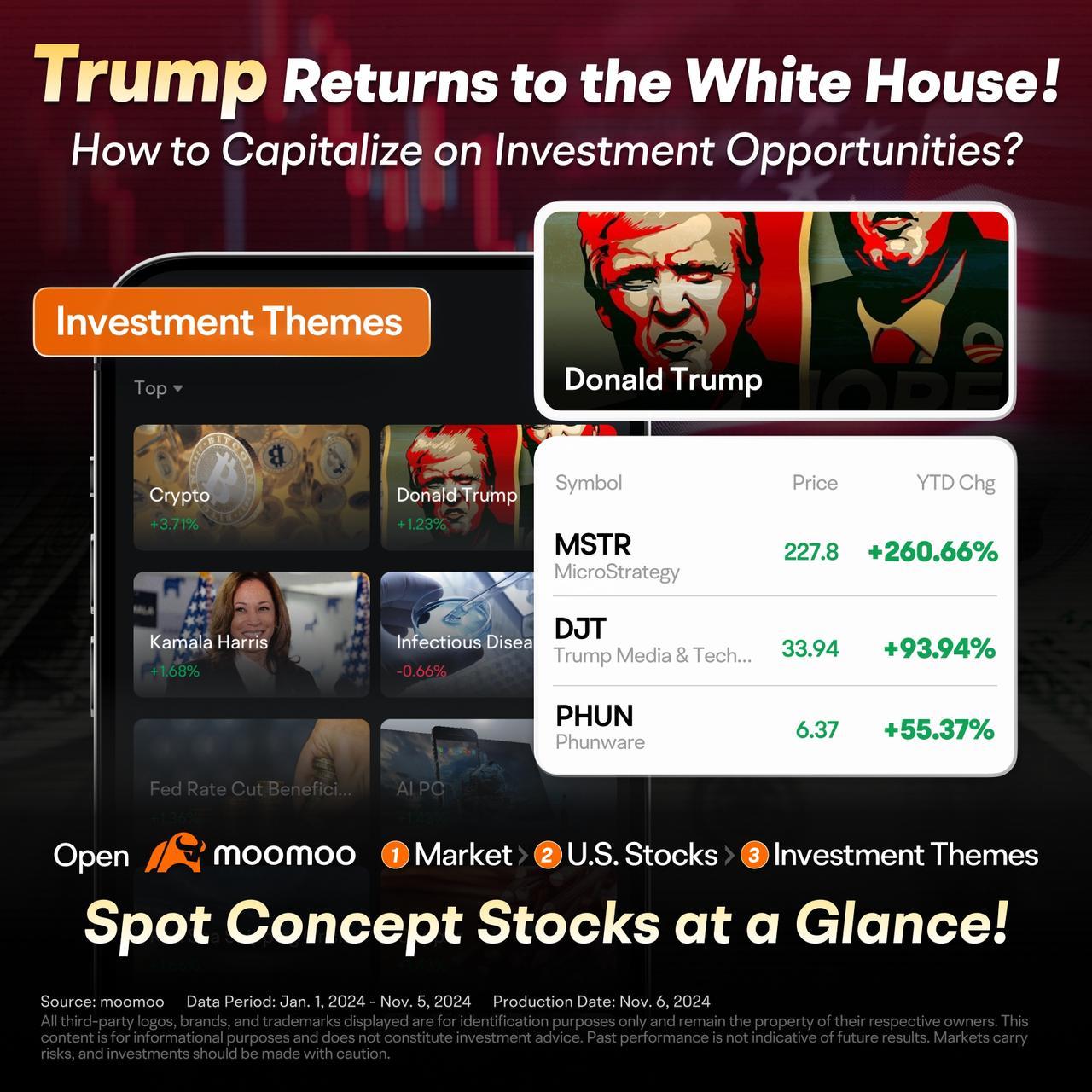

In response to the election outcome, Bitcoin's price briefly exceeded $75,000 on election day, with an increase of over 8%, reaching a new all-time high. In the U.S. stock market, key companies related to cryptocurrencies include Coinbase ( $Coinbase (COIN.US)$ ), the largest cryptocurrency exchange globally; MARA Holdings ( $MARA Holdings (MARA.US)$ ), the largest mining company; and MicroStrategy ( $MicroStrategy (MSTR.US)$ ), one of the publicly traded companies with the most Bitcoin holdings.

Additionally, investors can track the price movements of Bitcoin and other cryptocurrencies through cryptocurrency ETFs, which can be categorized into spot cryptocurrency ETFs, futures cryptocurrency ETFs, and ETFs related to cryptocurrency stocks.

The "Trump Trade" has been one of the major themes in market speculation this year. With Trump's election, related assets have the opportunity for a new round of speculation. Among them, Trump Media Technology Group ( $Trump Media & Technology (DJT.US)$ ) is widely regarded as the purest "Trump concept stock." DJT is the parent company of the well-known "Truth Social," and Trump holds nearly 60% of its shares. Whenever the probability of Trump's victory increases, DJT often sees a strong rise. Since the end of September, DJT has rebounded strongly, with its stock price soaring from under $12 to nearly $55, achieving a maximum increase of over 360%.

Among the "Magnificent Seven Stocks", $Tesla (TSLA.US)$ is a potential beneficiary of the "Trump Trade." Tesla's CEO Elon Musk is one of Trump's biggest supporters, having donated nearly $75 million to his campaign. Trump has also promised that if elected, he would appoint Musk as chairman of the government efficiency committee. As the election sentiment shifts in Trump's favor, Tesla's stock price rose by 12% in overnight trading!

Additionally, stocks closely related to Trump include Rumble ( $Rumble (RUM.US)$ ) and Phunware ( $Phunware (PHUN.US)$ ). Rumble is similar to DJT in nature, serving as a social platform for conservatives and providing video hosting and streaming services for DJT. Furthermore, Trump's campaign partner, Vice President Vance, is also a shareholder of RUM. PHUN provided mobile application development and data analysis services for Trump's 2020 presidential campaign.

According to Trump's policy philosophy, here are the sectors and associated stocks that investors can monitor in the "Trump Trade":

Trump's victory could mean that the market may experience a "strong dollar storm." Forex traders anticipate that Trump will implement trade protectionist policies, including raising import tariffs to support American manufacturing. Additionally, Trump’s emphasized tax cuts will likely stimulate inflation, reducing the Federal Reserve's capacity for potential rate cuts, thereby driving up the dollar and Treasury yields.

Morgan Stanley predicts that following a Republican victory, the dollar will strengthen, and the dollar's exchange rates against the euro, yuan, and other currencies that may be affected by tariffs will also rise.

Bond traders believe that a Republican landslide poses a "clear threat" to bond buyers. With the Republican Party unified with Congress, Trump will advance tax reduction and tariff plans, expand the fiscal deficit, and reignite the inflation era. This will likely push up the 10-year Treasury yield, with bond prices potentially falling further.

Among U.S. Treasury ETFs, larger funds such as $Vanguard Total Bond Market ETF (BND.US)$ , $iShares Core US Aggregate Bond ETF (AGG.US)$ , and $iShares 20+ Year Treasury Bond ETF (TLT.US)$ have all fallen to three-month lows, while the dollar index has once again surpassed 105 after four months.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

AL MALIK PAIZA : return back week according your our best time for serious

Patrick G Bynum : I d in an person for verification an updates Patrick G Bynum it's a phone scam Google account verification code

villan : this all the hack me and erase my fon memory

villan : pls adivece her to came and face

villan : don't alwiz judge people last time a few years we also human if voice out u can take all come for fake win,u hack me and now wat want throw

villan : I think there are team there one person hack..can't one do this

villan : but I am fight my rules and here if that is u must tell early kick out not now

villan : so you and me did right and u hack my phone,my mother phone,some camera exllant tv camera brilliant that's y I want that hack

villan : sorry for didn't know past and present

villan : many time I just shut my mouth and walk becoz see can't stop better put some think tat what I am to you

View more comments...